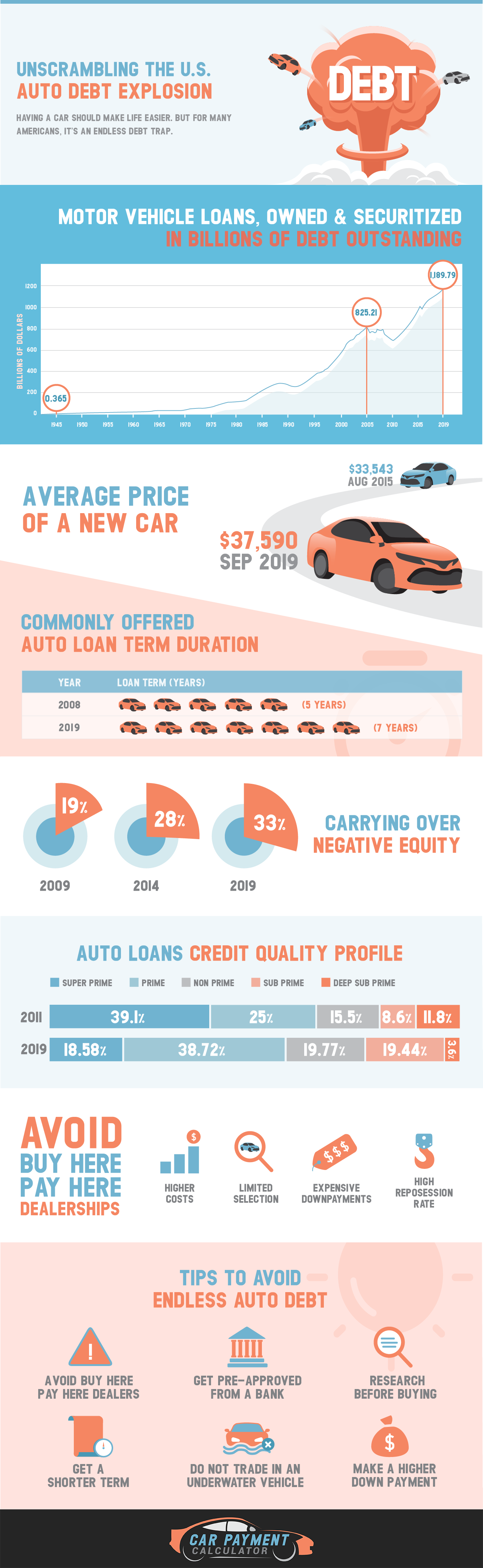

In Deep Debt How Americans Fall Prey to Neverending Auto Loans

Embed This Infographic

Use the following code to syndicate this infographic on your website.

Infographic Research Guide

The following guide shares background research & reference links for the above infographic.

Owning a car should make life much easier. But while automobiles have become a modern necessity, for others, it's a costly amenity.

As vehicles grow more expensive, U.S. buyers have a hard time keeping up with payments. And beyond the rising costs, issues like having bad credit scores and stringent loan stipulations from Buy Here Pay Here (BHPH) dealerships don't help.

How do car owners fall into the endless loan trap? In this feature, we'll rundown auto loan debt statistics and factors that make it harder to own cars. We'll also tackle how some dealers take advantage of subprime auto loans and what you can do to avoid going underwater.

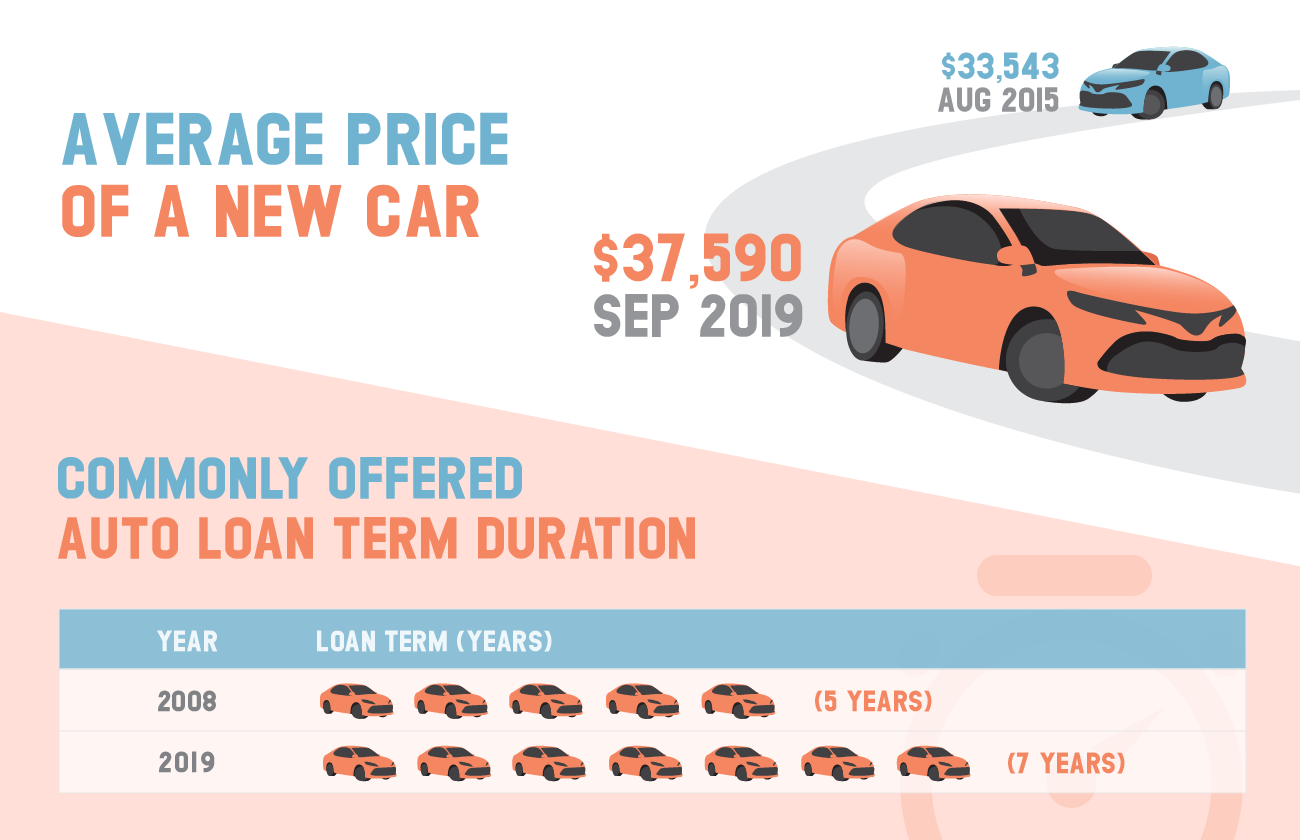

Rising Car Prices and Longer Auto Loan Terms

Average Price of a New Car

| August 2015 | September 2019 | Price Difference |

|---|---|---|

| $33,543 | $37,590 | $4,000 |

Commonly Offered Auto Loan Term Duration

| Year | Loan Term (months) | Loan Term (years) |

|---|---|---|

| 2008 | 60 months | 5 years |

| 2019 | 72 to 84 months | 6 to 7 years |

In September 2019, valuation specialist Kelley Blue Book estimates that the average price of a light vehicle is around $37,590. That's $4,000 more compared to August 2015, with car prices around $33,543. On top of this, modern features and ‘add-ons' easily drive up a car's cost.

Consequently, the increasing prices push auto dealerships to impose longer loan terms. In an October 2019 report by the Wall Street Journal (WSJ), most dealerships now offer auto loans as long as 7 years (84 months).

In the first half of 2019, credit-reporting firm Experian states that around a third of auto loans for new cars had terms over 6 years (72 months). But ten years ago, less than 10% of auto deals had terms beyond 6 years. A related article by Edmunds.com states that ten years ago, the most common new car loan term was 5 years (60 months), followed by 6 years.

Longer Loan Terms and False Affordability

Longer terms, or stretched out debt, impose higher costs.

However, WSJ reports that many Americans equate long loan terms with the illusion of affordability. They believe the prolonged payment duration helps them purchase very expensive vehicles, which are otherwise unaffordable under a 5-year loan.

In response, Edmunds recommends sticking to a shorter 5-year loan. The lower monthly payment for a longer term might look attractive, but it is easily unfavorable for several reasons.

First, cars depreciate at a rapid rate. The longer the loan, the more you pay for a car that has significantly less value.

Second, you spend more in interest by the end of the term. Let's compare the total interest cost for a new vehicle with the same price, down payment and interest rate. The first loan runs for 5 years, while the second loan runs for 7 years. See the table below.

| Comparison | 5-Year Auto Loan Term | 7-Year Auto Loan Term | Difference |

|---|---|---|---|

| Car price | $37,590 | $37,590 | |

| Down payment | $4,000 | $4,000 | |

| Loan Amount | $33,590 | $33,590 | |

| Interest | 5% | 5% | |

| Loan term, months | 60 months | 84 months | |

| Monthly payment | $633.88 | $474.76 | $159.12 |

| Total interest cost | $4,443.08 | $6,289.67 | $1,846.59 |

In this example, you'll pay $159.12 more monthly in the 5-year term than in the 7-year term. However, by the end of the 5-year term, you'll save $1,846.59 more on interest compared to a 7-year auto loan. Please take note: Interest rates on longer loan terms are usually higher, which means the overall interest cost can be higher. For comparison purposes, we used a 5% interest rate.

In addition, you might not need the car that long. For instance, if you take out a 7-year auto loan, but need a new car by 5 years, you'd be forced to pay for 24 more months on top of the new or used vehicle you need. In which case, many consumers opt to roll over their car debt to a new loan.

You can use the following calculator to estimate your loan payments for various scenarios.

|

Calculate Your Loan Payments With or Without an Upside Down Trade-inCalculate your monthly auto loan payments with dealer financing on a loan including a negative equity trade-in vehicle. |

|

| Automobile Price ($): | |

| Down Payment ($): | |

| Trade-in Value ($): | |

| Amount Still Owed on Trade-in ($): | |

| Sales Tax (%): | |

| Include Sales Taxes In Loan?: | |

| Dealer Interest Rate (APR %): | |

| Competitive Interest Rate (APR %): | |

| Loan Term (years): | |

Breaking Down Your Auto Loan |

|

| Monthly Payment: | |

| Loan Amount: | |

| Sales Tax: | |

| Downpay + Trade-in, less owed on Trade-in: | |

| Total Interest Cost: | |

| All In Cost: | |

Trade-in Debt Roll Over Costs |

|

| Monthly Payment Would Be Without Trade In: | |

| Amount Added to Each Monthly Payment Due to Trade In: | |

| Extra Interest Paid Using Dealer Financing w Trade-in: | |

| Trade-in Sales Tax Savings: | |

| Net Rollover Cost (Extra Interest Paid, Less Sales Tax Savings): | |

According to Edmunds, a third of new car-buyers who trade in old vehicles roll their previous car debt into new loans. Increasingly more people won't pay off existing debt before they trade in their cars for new ones, leaving many consumers underwater.

Eric Janszen, economic commentator and founder of financial advisory firm iTulip, aptly explains why it's crucial to invest only in assets that will increase in value, instead of things that will surely depreciate.

“A debt is a lien on future labor; and you derive most of your income from your labor. So, you never, ever want to put a lien on your future labor except for the purpose of investing in an asset that is likely to increase in value over the life of the loan, that is, to exceed to total cost of the principle plus interest on the loan. To do otherwise is to discount the value of your labor.”

– Eric Janszen

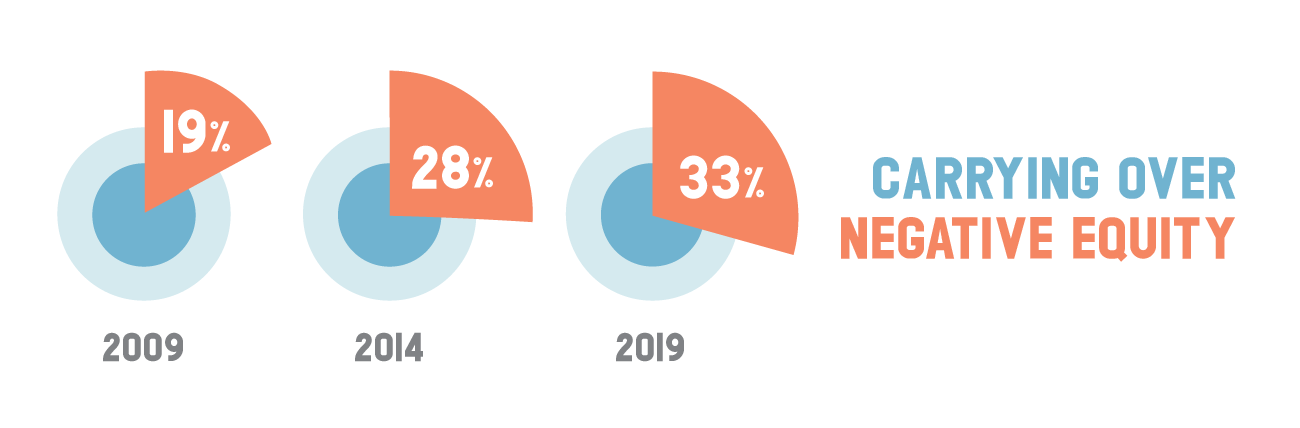

Carrying Over Negative Equity

| Year | % of Buyers with Negative Equity |

|---|---|

| 2009 | 19% |

| 2014 | 28% |

| 2019 | 33% |

In November 2019, WSJ reported that many lenders and consumers are piling on previous debt to new loans, which often exceeds the car's value. This market behavior is reminiscent of how consumers treated houses during the 2008 financial crisis, compounding debt instead of eliminating it.

Contrary to what some lenders say, rolling over existing debt does not solve the problem. This financial trend, known as negative equity, makes car owners highly vulnerable to endless debt.

Over the years, this phenomenon has become more frequent. According to WSJ, 10 years ago, buyers who traded in their cars with negative equity comprised 19% of the market. In the next 5 years, this rate increased to 28%, and by 2019 around 33% of consumers rolled in previous debt to new loans. Most of these buyers today owe at least $5,000 in negative equity from their old cars before taking a new loan.

Furthermore, borrowers with negative equity are often given longer loan terms with higher monthly payments and interest rates. The elevated rates and longer repayment duration indicate a smaller fraction of the monthly payments goes towards paying the principal in the first years of the loan. This leaves borrowers with even greater risk of default (failure to repay debt including interest on a principal).

The Impact of Credit Score on Auto Loan Interest Rates

Credit bureau Experian classifies credit score in 5 levels. Super Prime is the highest level with credit scores between 781-850. The lowest is called Deep Subprime with scores between 300-500. Borrowers with Subprime status (scores between 501-600) and below are at risk of going underwater.

Experian releases the State of the Automotive Finance Market report every quarter. For Q2 of 2019, below are the credit scores with their corresponding interest rates.

Average Car Loan Interest Rates

| Credit Quality | Credit Score | New Car Interest Rates | Used Car Interest Rates |

|---|---|---|---|

| Super Prime | 781-850 | 4.23% | 4.77% |

| Prime | 661-780 | 5.17% | 6.54% |

| Nonprime |

601-660 | 8.12% | 11.38% |

| Subprime |

501-600 | 12.20% | 17.36% |

| Deep Subprime |

300-500 | 14.70% | 20.09% |

Bad credit makes borrowers pay far more in the long run. As evidenced by the data, there is a major interest difference from a Nonprime status at 11.38%, to a Subprime status at 17.36%. Higher interest rates basically mean larger monthly payments, longer terms and more costly financing.

To show how negative equity with subprime standing can drive people into debt, let's compare a regular trade-in with a consumer who is buying a used car with $3,000 on a previous loan. See the table below.

Car Trade-in, Positive Equity vs. Negative Equity

| Loan Details | Positive Equity (Prime credit score) | Negative Equity (Subprime credit score) | Difference |

|---|---|---|---|

| Automobile Price | $37,590 | $37,590 | |

| Down payment | $4,000 | $4,000 | |

| Trade-in Value | $5,000 | $5,000 | |

| Amount still owed on trade-in | 0 | $3000 | |

| Interest Rate | 6.54% | 17.36% | |

| Loan Term | 5 years | 6 years | |

| Monthly payment | $579.52 | $731.56 | $152.04 |

| Loan amount | $29,590 | $32,590 | $3,000 |

| Total interest | $5,181.01 | $20,082.57 | $14,901.56 |

For this subprime loan, the buyer pays $152.04 more in monthly fees and spends $14,901.56 more in interest over the life of the loan. That's almost four times what they could spend on interest without rolling over existing auto debt.

Sunken car loans are more common among subprime borrowers because they often do not have the financial capability to pay off an old loan before buying the next car. Worse, after a few months, other subprime buyers miss their monthly payments.

When borrowers default, lenders repossess vehicles and try to sell them again to cover the unpaid balance. However, it's usually not enough to pay off the remaining balance. Ultimately, borrowers struggle to pay for a car they no longer have.

Subprime Auto Loans and Buy Here Pay Here Dealerships

Where do you go if most banks do not approve your loan?

Bad credit scores leave people susceptible to Buy Here Pay Here (BHPH) dealerships that take advantage of high default-risk borrowers. With nearly one out of three trade-ins that go underwater, Bloomberg reports that BHPH lenders are capitalizing on ‘less creditworthy' debtors.

BHPH car dealerships do their own lending. They finance with their own money and lend to buyers without checking their credit scores.

Theoretically, it's good if certain dealerships can lend money to buyers who are not eligible for regular financing. However, in reality, BHPH dealerships trap buyers with little options, forcing them to pay far greater expenses than a car is worth.

Experian states the following cons of getting an auto loan from Buy Here Pay Here dealers if you have poor credit:

- Higher costs – They typically charge higher rates than traditional car lenders. You may pay the maximum interest rate allowed in your state. There may even be hidden costs not offered upfront in your contract.

- Limited Selection – You are only eligible for certain cars when you have poor credit.

- Expensive down payments – Since borrowers with bad credit carry an amount of risk, BHPH lenders alleviate that risk by charging a larger upfront payment. If you don't have enough cash, you won't be able to afford the deal.

- Higher possibility of repossession – Certain dealers can repossess your car right away if you miss even just a few days of payments. This leaves you vulnerable during emergency situations that require you to use your car.

Furthermore, some lenders can automatically disable your vehicle if you are unable to pay fees on time. A New York Times report chronicles this penalty measure, which is potentially dangerous especially if you are driving your car.

“Some borrowers say their cars were disabled when they were only a few days behind on their payments, leaving them stranded in dangerous neighborhoods. Others said their cars were shut down while idling at stoplights. Some described how they could not take their children to school or to doctor's appointments. One woman in Nevada said her car was shut down while she was driving on the freeway.”

– Michael Corkery and Jessica Silver-Greenberg, The New York Times

However, note that not all dealerships instantly disable cars. Many usually call borrowers about the late payment, giving them at least 30 days before shutting down the vehicle. In some instances, dealerships still allow people to use their car especially during emergencies. They inform people ahead of time when the car will be disabled.

In 2019 PointPredictive estimated over 20% of auto loans have inflated income statements. If a dealership offers a loan where they need to show false income statistics for you to qualify for financing that loan will likely destroy your credit. If they talk about a chance to refinance later it is almost certainly a lie:

When Mirna López bought a used 2018 Nissan Pathfinder in May, she got a car loan with a monthly payment of $809. Her monthly earnings were about $660. Normally, lenders wouldn’t approve that. But an employee at Mac Mitsubishi, a dealership in West Hartford, Conn., filled out her loan application and stated she made $7,833 a month, according to Ms. López and a copy reviewed by The Wall Street Journal. ... Some borrowers, including Ms. López, said their dealership told them they could return in a few months and refinance into a lower-interest loan, only to tell them later it wasn’t an option.

Shifting Profit from Auto Sales to Arranging Loans

In an April 2019 article, WSJ reported that financing in auto dealerships has displaced sales as the profit center. As profit margins on new-car sales diminish, dealerships depend on arranging loans, selling add-on services, extended warranties, as well as paint protection plans to earn more.

Car dealers earn a markup for organizing auto loans, an aspect of the business that generates lucrative income. Salespeople depend on earning from these arrangements as they are faced with the difficult challenge of upselling expensive vehicles. According to the report:

“Dealerships made an average of $908 per new vehicle last year on their finance and insurance business, far more than the $420 they earned off the actual vehicle sale, according to research firm J.D. Power.”

– Adrienne Roberts, The Wall Street Journal

In another related article from Digiday, British e-commerce site Dennis Publishing states that many car dealers make more profit from selling financing and insurance than they do from actual car sales.

“[T]he margin on a car bought on finance is around $1,400 (£1,000), while it's $482 (£350) for one bought outright.”

– Jessica Davies, Digiday

As a buyer, avoid purchasing extended warranties and unnecessary features especially if you do not need them. Arranging financing before going to a dealer can save you a lot of money, particularly if you have a poor credit score or in need of a used car.

Kicking The Trade

Sme auto dealerships recommend vehicle buyers purchase a new vehicle and then default on their old vehicle loan, in a process which is called kicking the trade. This absolutely trashes the credit score of the borrower & in some cases gets them billed by the prior lender for any remaining balance due after the car has been sold at auction.

A more extreme version of the above is when a dealership promises to take a trade in, gets the consumer to sign a loan on a new vehicle, and then backs out of taking the trade in:

When Whitney Davis’s Hyundai Sonata was having mechanical problems in 2016, she returned to the Connecticut dealership where she bought it used. The dealership told her it would take the car and sell her another one, she said. But after she signed a loan for a used Nissan Altima, she was told she couldn’t trade in the Sonata, she said. When she explained she couldn’t afford two car loans, an employee told her to have the Sonata’s lender take it back, she said.

PointPredictive data shows the value of loans impacted by auto fraud or misrepresentation has grown around 250% from 2010, jumping from $2 billion to just under $7 billion in 2019.

The U.S. Auto Loan Debt Explosion

Early this year, AP News reported that the rising auto debt threatens to disrupt consumer finances and the broader economy. Many borrowers are missing auto loan payments at rates not seen since the increase of auto loan delinquencies in 2010.

Data from the Federal Reserve Bank of New York revealed that 7 million Americans were around 90 or more days late in car payments by the end of 2018. Compared to 2010, about 1 million more consumers were behind in payments in 2018.

In a related report sharing the same data, CNBC states that delinquency rates rose from 12.4% in 2015, to 16.3% in mid-2018. These figures represented subprime auto loan borrowers with credit scores below 620.

Both news outlets attribute the growing auto loan debt in part to the consumer's shifting preference. They said that more people are choosing larger, more expensive cars like SUVs and trucks instead of compact cars.

Auto loan debt accounts for about 9% of borrowed money monitored by the N.Y. Fed. Still, mortgages and student loans are larger categories than car debt.

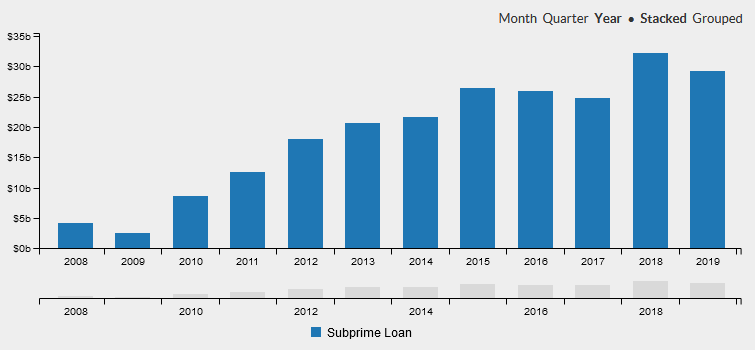

To give you an idea how much auto loan debt has increased, see the graph and table below.

Below shows auto loan debt from 2005-2019:

| Year End | Billions in Motor Vehicle Loans Owned and Securitized, Outstanding (MVLOAS) |

|---|---|

| 2005 | $823.0973 |

| 2006 | $784.97512 |

| 2007 | $801.15951 |

| 2008 | $777.27561 |

| 2009 | $719.08399 |

| 2010 | $713.49627 |

| 2011 | $751.07592 |

| 2012 | $809.31837 |

| 2013 | $878.30248 |

| 2014 | $957.21079 |

| 2015 | $999.89794 |

| 2016 | $1,063.94949 |

| 2017 | $1,112.69483 |

| 2018 | $1,152.73938 |

| 2019* | $1,193.77559 |

* at the end of Q3

In the third quarter of 2010, outstanding auto loans owed was estimated at about $698 billion. By the third quarter of 2019, auto loan debt vastly increased up to $1,194 billion.

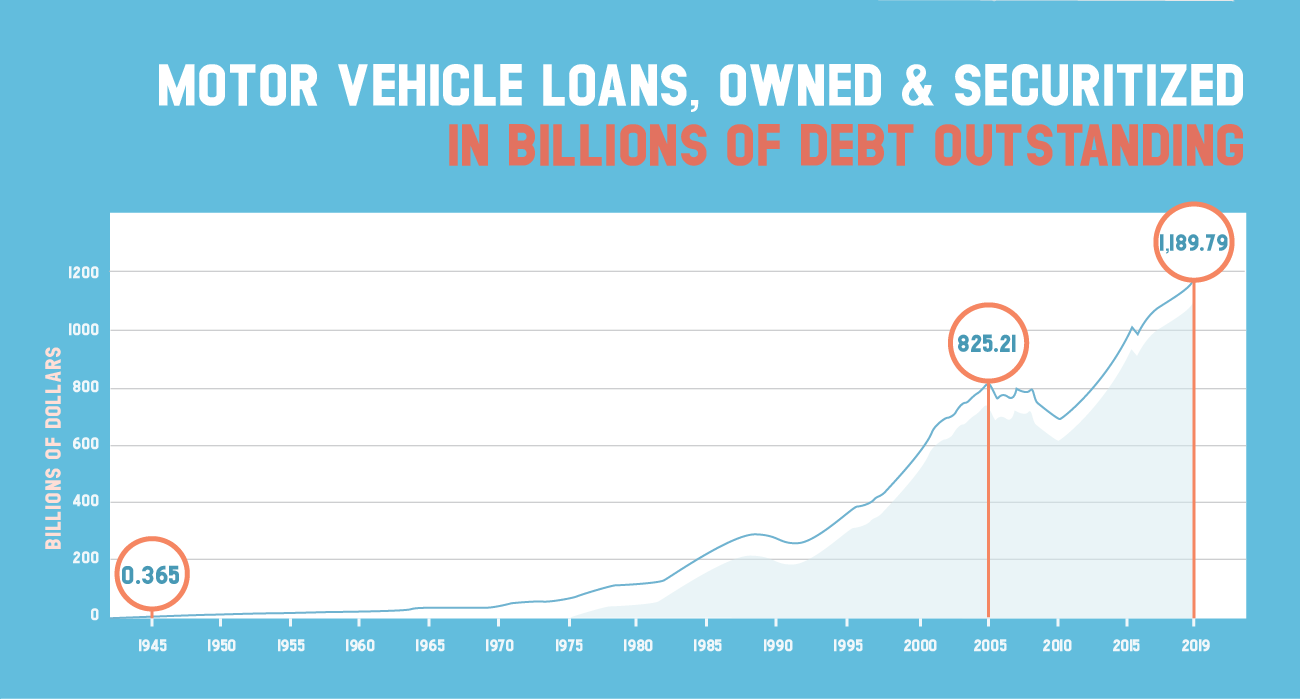

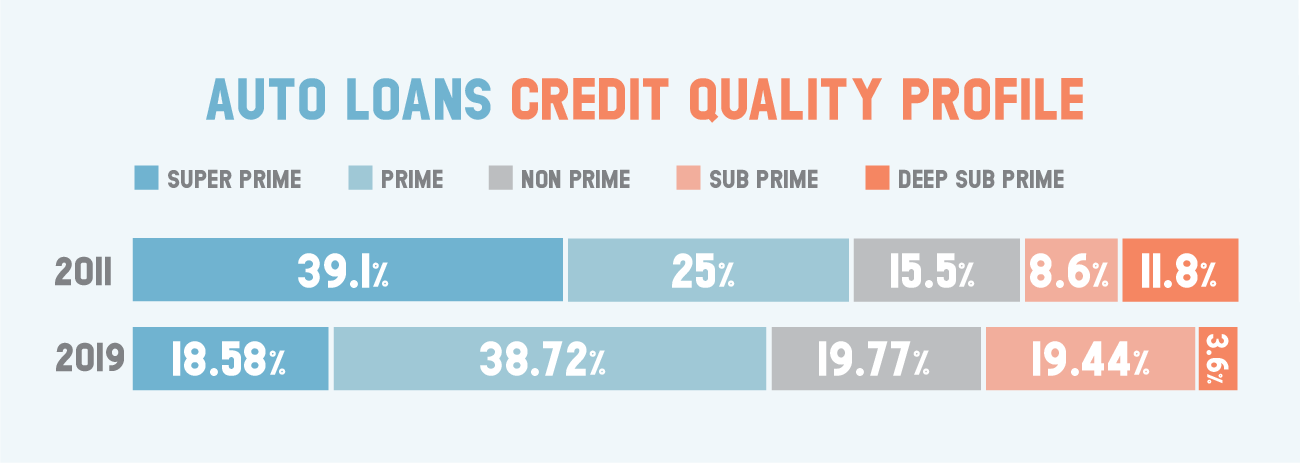

When it comes to the risk distribution of auto loans, there is a noticeable percentage increase in subprime loans between Q1 of 2011 and Q2 of 2019, based on data from Experian.

In 2011, around 8.6% of loans were classified as subprime, with 11.8% under deep subprime. That's a total of 20.4% auto loans at greater risk of default. 25% are prime loans, while 39.1% are super prime loans.

In 2019, an estimated 19.33% of loans were classified as subprime, with 3.61% under deep subprime. That means almost 23% of auto loans have a higher risk of default.

Between 2011 and 2019, it is evident that a growing number of subprime auto loans take part of the risk distribution, despite the increasing percentage of prime auto loans over the years. Super prime auto loans have also dramatically dwindled down to 18.58% in 2019.

Santander, the Top Sponsor of Subprime Auto Loans

According to technology research company Finsight, Santander Consumer USA Holdings, Inc. has been the largest packager of subprime auto loan securities since 2010. The company is an arm of the Spanish bank Banco Santander SA that went public in 2014.

The table below shows the top subprime auto loan sponsors with their corresponding sponsorship amounts through the first 11 months of 2019 compared through 2015. Lenders with the most volume in the most recent year are published at the top of the table while lenders from prior years that were not in the current data set were included as new rows at the bottom of the table. If a lender did not package subprime loans in that particular year the field is left blank.

| Lender | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|

| Total in millions | $29,220.2 | $32,152.6 | $24,690.1 | $25,833.8 | $26,485.0 |

| Santander Consumer USA Holdings Inc | $8,316.1m | $11,198.9m | $8,011.5m | $6,825.8m | $9,054.7m |

| Westlake Financial Services | $3,500.0m | $3,100.0m | $1,500.0m | $1,625.0m | $1,195.6m |

| Exeter Finance | $2,950.0m | $2,200.0m | $1,400.0m | $1,100.0m | $1,350.0m |

| General Motors Company | $2,790.5m | $3,351.1m | $4,730.2m | $4,900.0m | $4,297.0m |

| DriveTime Automotive Group Inc | $1,718.5m | $1,537.9m | $1,885.4m | $1,513.5m | $990.2m |

| Carvana Group LLC | $1,379.1m | ||||

| Flagship Credit Acceptance | $1,331.7m | $1,017.7m | $982.9m | $1,626.6m | $1,180.7m |

| Global Lending Services LLC | $1,322.4m | $854.1m | $208.7m | $191.8m | $117.4m |

| American Credit Acceptance | $1,151.9m | $988.6m | $863.2m | $850.3m | $652.3m |

| Consumer Portfolio Services Inc | $1,000.5m | $856.8m | $852.6m | $1,187.0m | $795.0m |

| Credit Acceptance Corporation | $754.2m | $1,348.3m | $1,150.0m | $700.2m | $600.8m |

| World Omni Financial Corp | $671.8m | $551.2m | |||

| First Investors Financial Services | $407.9m | $359.8m | $618.8m | $428.8m | $434.2m |

| Prestige Financial Services Inc | $365.3m | $407.8m | $335.2m | $655.7m | $400.0m |

| United Auto Credit | $285.0m | $357.7m | $147.5m | $312.2m | $188.2m |

| U.S. Auto Finance | $270.0m | ||||

| Foursight Capital LLC | $218.9m | $528.2m | $172.0m | $219.9m | $106.4m |

| Avid Acceptance | $179.1m | $114.0m | |||

| Arivo Acceptance | $166.0m | ||||

| CIG Financial | $161.9m | $172.5m | |||

| Skopos Financial Group | $144.8m | $147.0m | $294.6m | ||

| JD Byrider | $134.6m | $121.2m | $126.3m | $109.8m | $131.2m |

| Ally Financial Inc | $1,756.5m | $526.3m | $2,495.9m | $4,086.1m | |

| OneMain Financial | $900.0m | $856.9m | $700.0m | ||

| Veros Credit LLC | $183.1m | $150.1m | |||

| Tidewater Finance Company | $170.8m | $156.4m | |||

| Ganas Holdings | $101.8m | ||||

| Sierra Auto Receivables Funding LLC | $135.0m | ||||

| Honor Finance LLC | $100.0m | ||||

| Go Financial | $344.7m | ||||

| CarFinder Capital | $265.9m |

A Reuters March 2017 report details how Santander knew that some dealerships had high default rates, largely due to erroneous data on loan applications. The company still bought the loans and even pointed to a group of dealers it referred to as “fraud dealers,” which they continued to fund.

At the time of the report, Santander agreed to pay $25.9 million to settle investigations on subprime auto loans in Massachusetts and Delaware. Massachusetts Attorney General Maura Healey said the bank's ‘predatory practices' was an occurrence also seen in the 2008 financial crisis when banks run-up subprime mortgages.

In an October 2019 report by Bloomberg, Santander is said to have sold many of the sunken loans to bond investors. As soon as the debt ‘sours' after the securities are sold, the company is compelled to repurchase the loans, therefore shifting the loan's potential losses away from bond investors and back its original lenders.

Bloomberg interviewed Matt Scully of Moody's Investors Service to comment on Santander's financing practices:

“The situation is somewhat perverse in that bondholders are actually benefiting from high early-payment defaults through the repurchases.”

Below is data from Finsight listing the number of subprime auto loan asset backed securities from 2008 to 2019 with their corresponding amount in millions.

| Year | Subprime Auto Loan ABS | Amount in Millions |

|---|---|---|

| 2019 | 55 | $29,220 M |

| 2018 | 58 | $32,153 M |

| 2017 | 49 | $24,690 M |

| 2016 | 52 | $25,834 M |

| 2015 | 49 | $21,676 M |

| 2014 | 42 | $21,676 M |

| 2013 | 38 | $18,033 M |

| 2012 | 35 | $18,033 M |

| 2011 | 24 | $12,622 M |

| 2010 | 16 | $8,639 M |

| 2009 | 6 | $2,577 M |

| 2008 | 6 | $4,187 M |

Avoiding the Endless Car Loan Debt

Arranging financing is a good move only if you obtain fair terms within your income. Before buying a car, make sure you have gathered enough funds for the purchase. Otherwise, it would be better to save a little more if you find that your budget might not be enough.

Moreover, improve your credit score by paying monthly bills on time. A better credit score makes you eligible for favorable auto loan rates. It also reduces your risk of missing payments and completely defaulting on a loan.

Finally, steer clear of deals that will make you pay more than you should. Here's a brief guide to help you avoid auto loan debt:

Stay Away from Questionable Buy Here Pay Here Dealerships

These days, it's common to see car ads offering ‘great deals,' especially online. If it's too good to be true, then it must be a scam. Car dealers that promise ‘low down payments' and financing when you have a bad credit score are debt traps. Do not visit these sellers.

Get Pre-Approved at Your Bank or Credit Union

Only secure financing from reputable sources. Ed Mierzwinski, senior director of the Public Interest Research Group's (PIRG) federal consumer program, gives this advice:

“[T]he most important way consumers can keep the cost of their purchase down is to secure financing before heading to a dealership. If not, you'll be presented with options that could cost you more in interest, whether through the dealer's own financing arm or another lender that it works with.”

Research Before Going on a Test Drive

Once you know what car you need, it's always a good idea to know your options and compare rates. Calculate how much it would cost so you know if a sales agent is giving you a fair deal.

To compare auto loan rates and terms, you can use this car loan calculator.

Choose a Shorter Loan Term

While shorter terms require higher monthly payments, you'll be able to pay off the principal and interest of the loan in the first few years. Your debt does not drag on longer and you won't pay more in interest compared to 6 or 7-year loan term.

Do Not Trade In an Underwater Vehicle

You incur more debt when you trade-in a car with unpaid balance that’s worth more than its value. This is the surest way to fall into the neverending loan trap. Pay off the balance first, then make sure you can afford the next vehicle at reasonable terms.

Pay a Larger Down Payment

Prepare cash funds before going to a car dealer. The goal is to pay at least 20% of the vehicle's price. Paying more upfront can help you reduce monthly fees and the overall cost of financing.

The Bottom Line

Increasing car prices in the U.S. has made it more challenging to purchase cars. This is especially a struggle for consumers with poor credit scores, easily falling for dubious Buy Here Pay Here dealerships.

Carrying over previous car debt to new loans is a huge part of why consumers go under. Having a bad credit score and negative equity leaves buyers in far greater debt. Longer loan terms may also give the impression of affordability, but consumers often spend more in the long-term.

To avoid auto loan debt, save up and improve your credit score. Stay away from Buy Here Pay Here dealerships with shady offers. Finally, obtain proper financing from your credit union or bank and make sure to pay bills on time.