Reach Your Savings Goals Estimate Your Required Monthly Deposit

Make a Smart Emergency Fund

Published September 23, 2019 by Benjie Sambas

There are unexpected expenses that needs to be addressed as soon as possible. Some people have built decent savings to cover for these unintended expenditures. However, most are still living from paycheck to paycheck and only get through emergencies with minimal savings. At worst, they will also plunge themselves into debt to cover their unplanned spending.

How can one build a decent emergency fund and make it work to cover for every unintended expenses?

A savings crisis

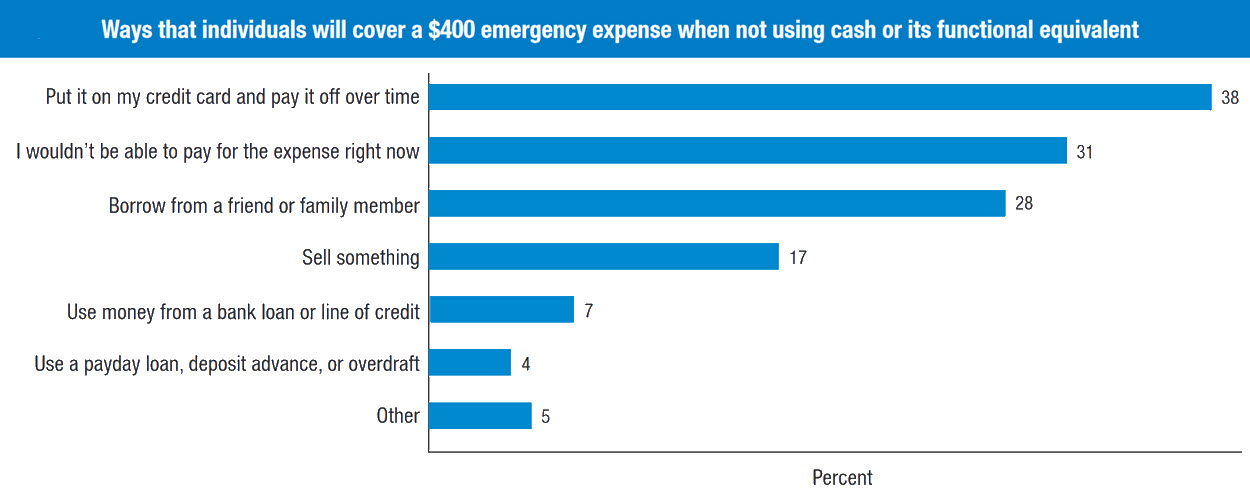

In their yearly household financial health report, the Federal Reserve mentioned that four out of 10 adults will find it hard to cover a sudden expense of $400. Supposedly, they would have to borrow from someone, or sell something to cover for the emergency. The agency said that this is a marked improvement over emergency spending habits in previous years. However, having less than half of total households in the US prepared for minimal emergency spending is still alarming.

How individuals cover minimal emergencies

Most people don't have minimal emergency savings for small expenses, and are more likely to go into debt covering small amounts. (Federal Reserve)

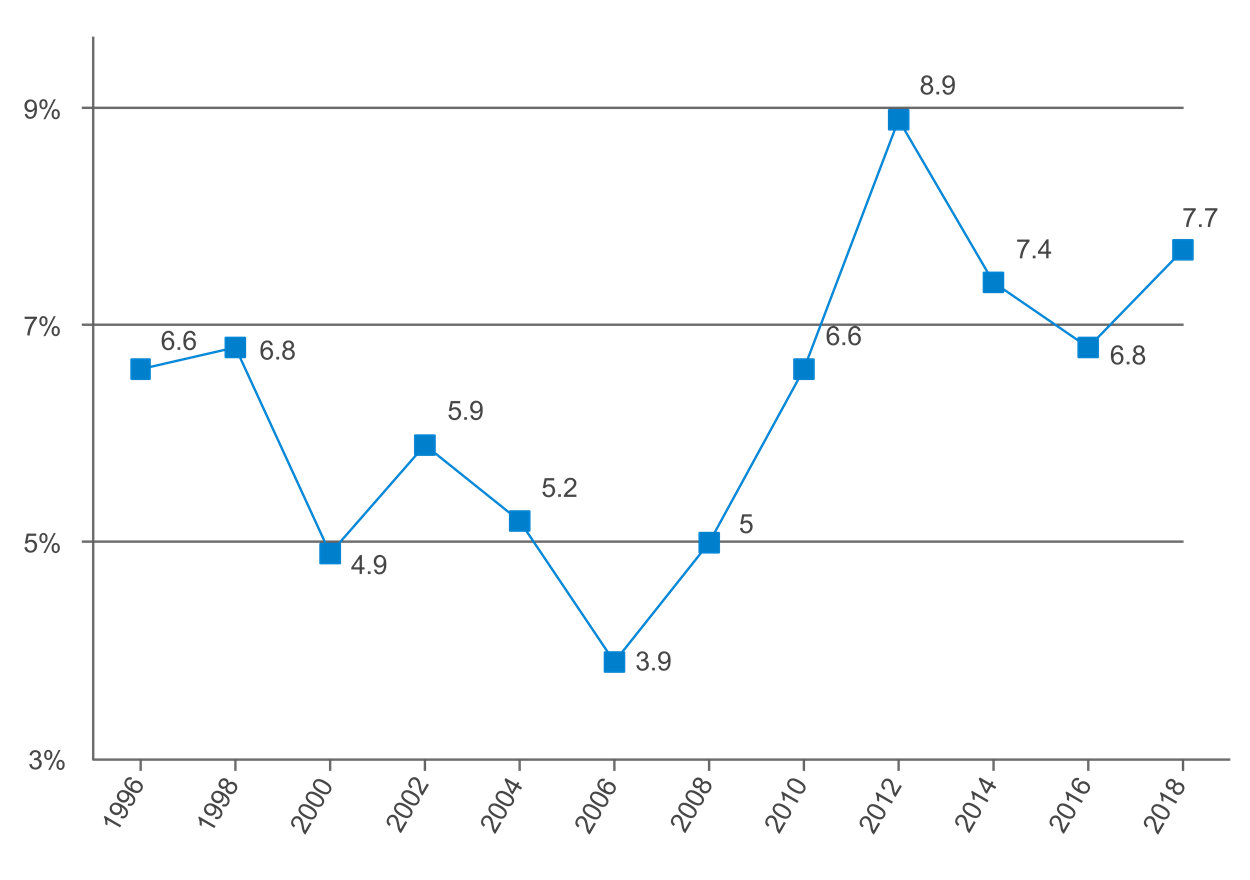

Most people don't have minimal emergency savings for small expenses, and are more likely to go into debt covering small amounts. (Federal Reserve)Aside from household savings, sound personal saving habits are also becoming vague. Different factors like household expenses, debt, and other expenditures take out much of the income, so most individuals focus on them. According to the US Bureau of Labor Statistics, people are becoming less focused on saving that the personal savings rate continues its 60-year decline trend.

Personal saving as percent of disposable income

While some people continue to allot part of their disposable income as savings, it has yet to breach 1/10 of their income. (FRED)

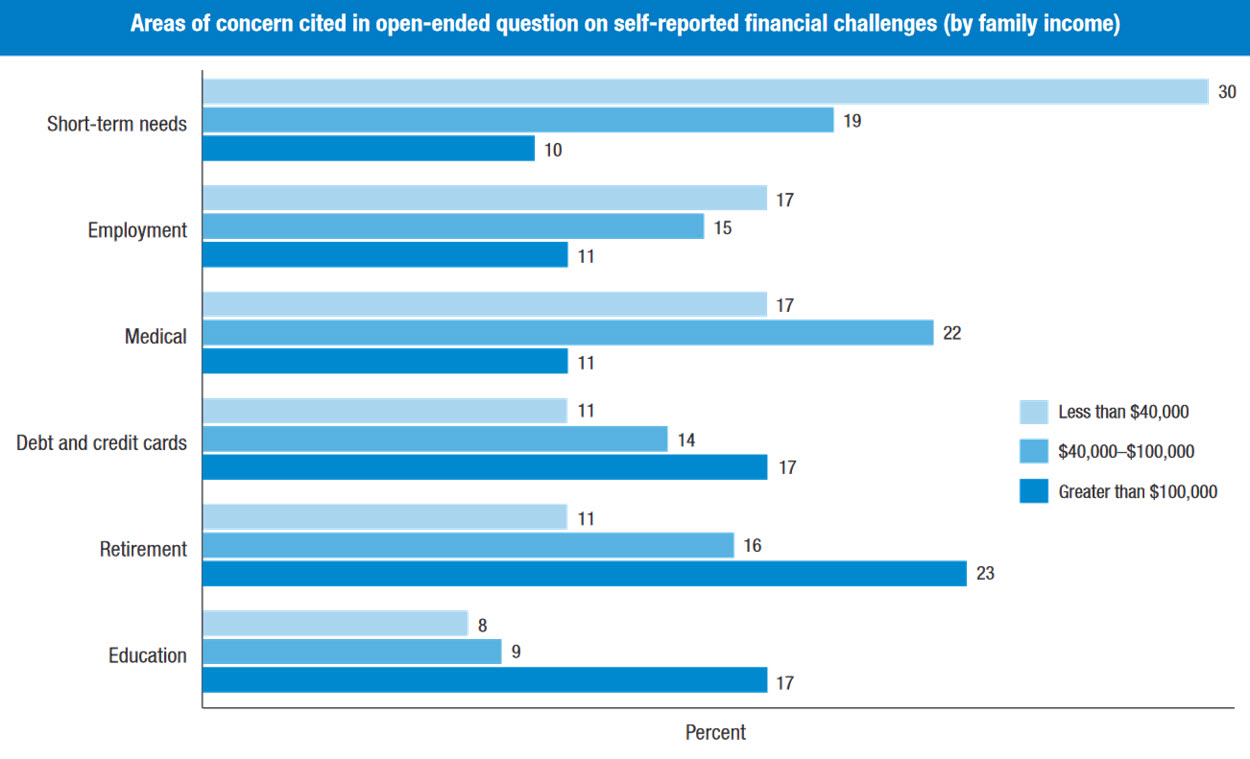

While some people continue to allot part of their disposable income as savings, it has yet to breach 1/10 of their income. (FRED)Spending habits aside, financial obligations are the biggest obstacles why people find it hard to save. The Federal Reserve reported that among households, those earning less than $40,000 live from paycheck to paycheck and are thinking more of short-term needs than saving. Only 30% have long-term financial goals that include building an emergency fund. Meanwhile, most households don't have a formal budget, as only 1 out of 3 maintain household allocations for their income and expenses.

Financial challenges by income bracket

Among different financial brackets, those earning less than $40,000 are likely to prioritize short-term needs than save. (Federal Reserve)

Among different financial brackets, those earning less than $40,000 are likely to prioritize short-term needs than save. (Federal Reserve)This crisis is taking its toll on both household and personal finances. America Saves, a nonprofit campaign by the Consumer Federation of America, believes that a reversal should be made as soon as possible since the crisis endangers future financial security.

“This savings crisis is putting Americans' future financial security at risk. We know stagnating wages and increasing costs make it hard for many Americans to make it from one paycheck to the next, let alone save for the future.”

George Barany, Director of America Saves

An emergency fund is a bad idea

Traditionally, people build their emergency funds by having a go-to cash reserve for sudden expenses. Most likely, these they've saved and tucked away in a corner. There are also those that have saved at least 1-3 month's worth of income “for the rainy days.”

This type of saving is already outdated. Emergency funds that stay dormant work against the saver, instead of the other way around. People's spending and saving habits have become more complex that the idea of money within arm's reach is not actually saving up, but just having “spare change.”

Zero percent interest

The concept of interest works both ways. While there is negative connotation about high rates on credit cards, debt, and others, earning compound interests can be an advantage. Setting aside money that don't earn at all is not a smart way to build emergency funds as inflation is constantly working against you. If you are saving up funds just by setting aside a minimum part of income here and there, with cash “always ready” to be spent on emergencies, it's a wrong way to save.

Easy access means temptation

Most people save cash because it's a ready expense for emergencies. However, it also works negatively. If there are no emergencies to spend on, you'll be tempted to spend your cash on impulse buys and just “return it.” However, with bad spending habits, you are likely to spend more and replace less than the amount you've originally taken. It will have an opposite effect on your savings plan, as it will drain your emergency funds in no time.

A question of priorities

From simple car trouble to complex medical and health issues, most people likely associate unexpected spending as emergency, and will likely dip into their savings. However, your $2,500 in “emergency funds” will not cover more serious cases, and the most likely path you'll take is go into debt.

Meanwhile, those who have already built decent funds are likely saving it for “true” emergencies. Instead of withdrawing from their savings to cover unintended expenses, they think these “emergencies” can wait and will just borrow, or don't think of these expenses as priorities and settle them at leisure. This adds to the original expense since there are penalties and additional fees.

Either way, not knowing how to smartly prioritize emergencies work against you and your savings.

Make a “smart” fund instead

While people still save by having cash on hand, most financial experts agree that making money work for you is the best course of action towards building a decent-sized emergency fund. Smart saving will also allow you to build adequate finances in as little time as possible.

Building a smart emergency fund is two-fold. There should be a smaller emergency fund, with ready cash to deal with surprise expenses. This way, you can spend on unintended expenditure without dipping into your main emergency savings. With a median cost for little emergencies at $2,000, having at least this amount readily available is a good way to prepare against some common financial shocks. Having a mini emergency fund also prepares you in case of other expenditures. For example, a small emergency fund can be a backstop for payments that otherwise will put you into debt. High-interest card bills can be settled in full so you won't incur penalties. Just make sure to replace the amount taken from the fund at the soonest.

Aside from a mini emergency fund, start building decent-sized savings as your main emergency fund. This will cover unexpected situations like decreased income from losing jobs, serious medical emergencies, and other considerable expenses. Experts say that to cover large emergencies, at least three- to six-months' worth of income is enough to cover for large expenses. These include essential expenses like mortgage or rent, utilities, and personal expenditure.

There's a big difference between these two savings goals. Although being over-prepared and targeting six-months' worth is ideal, it is best to check your finances first. The ultimate goal is to build adequate funds in as little time as possible. With debt and other expenses, trying to save for a larger amount is impractical.

There may be conditions when one needs large emergency funds to cover surprise expenses. For example, sole breadwinners, those who don't have stable work, or people with recurring medical conditions need to have substantial funds. They would have a hard time dealing with financial difficulties when something significant happens. Having good-sized savings is a great help in these situations.

Saving for an ideal emergency fund

Aside from making a two-fold emergency fund, where one builds these funds is also important. A mini emergency fund is practical if it is built on liquid savings. This means that the fund should be in cash, or at least in a savings account. This way, the funds will be readily accessible when needed.

How about the main emergency fund? One good advantage of having different financial instruments available is the variety of return rates. Traditional funds can still be deposited in a savings account, where it can be accessible and also return some gains. However, there are other savings tools that can make the funds accessible for their intended purpose as well, with much better returns.

Health Savings Accounts (HSAs)

If you are building an emergency fund in preparation for a recurring medical condition, open a health savings account. HSAs are tax-advantage accounts for those who have high-deductible health plans (HDHP) and pays for emergencies not covered under the plan. If you are already covered because of a medical condition, an HSA is a good fund-building account to have. Since the account is also an employer-matching instrument, both you and your employer can contribute and likely double the expected fund amount.

Online savings accounts

Savvy savers open savings accounts with online banks instead of traditional banks. These web-present establishments offer some advantages over regular, brick-and-mortar institutions. One distinct upside that online banks has is they offer higher interest rates. Emergency funds in onlne banks can earn an APY above 2%. This is significantly higher compared with the average of 0.09% for savings at regular banks. For accessibility, most online banks partner with third-party ATM providers so account holders can withdraw their cash whenever they need it.

Certificates of Deposit (CDs)

If you are ready to sacrifice flexibility for added interest, invest in CDs. This is an ideal account for individuals who are anticipating emergencies long-term. It is not as accessible as a savings account since CDs works as term deposit. Regular CDs mature at a minimum of three years. However, there are some institutions who offer 1-year CDs on a lower rate of return.

Roth IRA

Some associate individual retirement accounts as something they can take advantage of when they retire. However, IRAs have evolved and there is a new account called Roth IRA. In this specialized account, holders can withdraw contributions any time without incurring early distribution fees, unlike in other retirement plans. This means that your emergency fund will still be accessible even if it's in a retirement account.

Money market accounts

These type of accounts also work like regular savings. However, money market accounts are high-yield ones, and some also combine savings with check writing features. Most money market accounts also have easy-to-understand processes that usually come as penalty-free features.

Build funds faster

Aside from switching to savings instruments with better returns, you can also build your emergency funds faster in as little time as possible with a number of personal saving concepts.

Get extra work.

Having another source of income is definitely a big plus towards funding emergency savings quicker. From odd jobs and side hustles to a stable second job, additional earning will add flexibility to your budget and get more savings out of your income.

Cut back on expenses.

It helps in saving more money for a decent-sized emergency fund. Meanwhile, it will also improve your spending habits. Having the good sense of what to spend on and when may also make your emergency fund irrelevant. With much finances on hand due to smart spending, you can easily pay for unexpected expenses direct from your cash flow.

Make a formal budget.

Poor spending habits are usually the result of having no budget. For both household and personal expenditure, list your recurring expenses like necessities, credit card payments, rent or mortgage, and others. Keep track of expenses and make sure to always stick to your budget.

Automate your savings.

Making your savings automatic cuts on some processing fees that you spend on for traditional transfers. Automatic transfers also make sure that you have already allotted some of the income to savings or on critical expenses.

Be financially literate.

Gain new insights on how to build saving plans faster or how to get better at spending. Aside from personal coaching, take advantage of company-sponsored seminars. According to the Employee Benefit Research Institute, more employers are now looking into the financial health and wellness of their employees.

Use your tax refund.

Most earners treat their tax refunds as form of reward, and use it mostly for personal expenses. The IRS reported that 2019 tax refunds averaged $2,725. This is a good amount to start building an emergency fund. With refunds being an annual undertaking, you will have a steady source for additional savings.

Make your funds work for you

Accessible funds in a regular saving account is convenient. However, there are other tools and instruments to build your emergency funds quickly and efficiently. Meanwhile, combined with good outlook on spending and expenses, a decent-sized emergency fund can be built in as little time as possible.