Compare 10, 15, 20 & 30-year Fixed-rate Mortgages Side-by-side

Get the Best Mortgage for Your First Home

Published September 12, 2019 by Benjie Sambas

Buying your first home is one of the biggest decisions an individual can make. There are different factors involved in deciding to buy a house, and one of these is choosing the right type of housing loan. Going for the lender with the best type of loan for your finances is important. With the right type of loan, your home can be your biggest investment and works as an asset. Meanwhile, an inappropriate one will make your mortgage the largest debt you have and will likely push you into a financial spiral.

Mortgage facts

Real estate is expensive. However, there are people who buy their homes with full payments, though cash transactions in the industry are rare occurrences. Most individuals decide to purchase their homes through housing loans.

Why are financing options the most popular approach when purchasing a home?

The goal is more realistic.

Getting a housing loan makes it possible to own your home. While you can save enough to purchase a house, it is an impractical approach. Economic factors like inflation, rising cost of living, and others will decrease buying power. In addition, these factors also contribute to the average price trends of houses over the years.

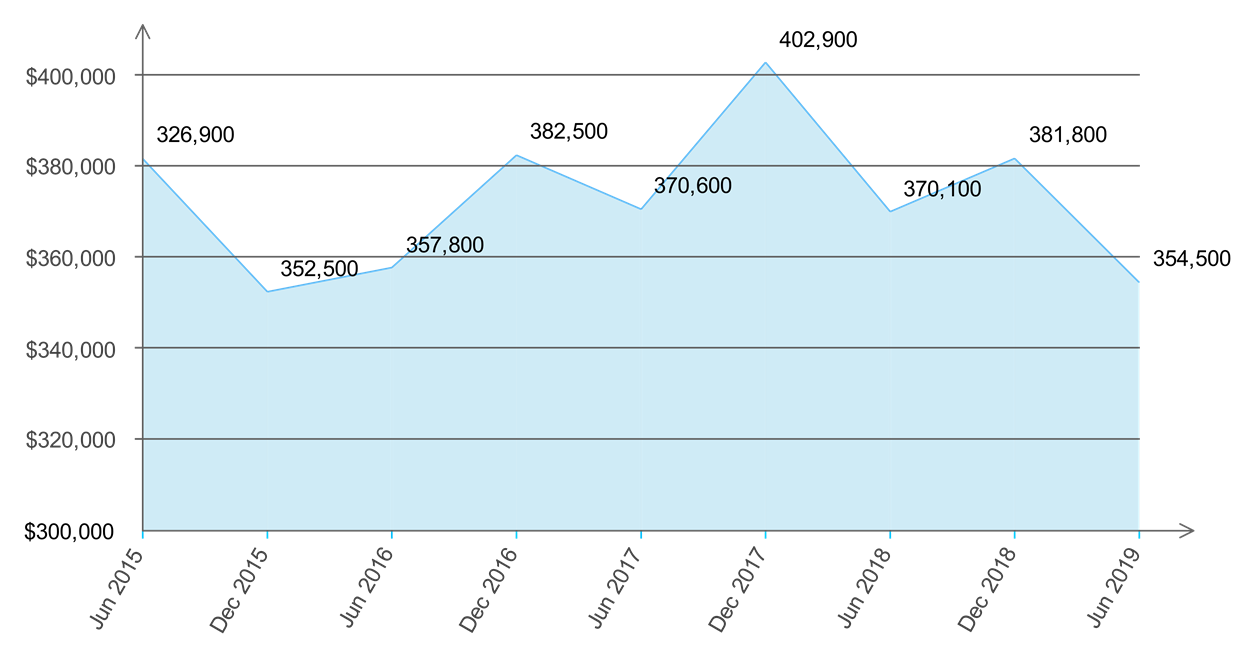

Average sales price for new homes sold

Loans diversify finances.

Mortgages are paid in installments, often on a monthly basis. As long as you meet your loan obligations, you can be flexible with your finances and make room in the budget for other expenses.

Builds credit reputation.

One major advantage of borrowing is its connection with credit and payment histories, metrics that are part of credit scores and reputation. As long as monthly payments are made on time, you will surely build a positive credit rating. Positive scores open new avenues for your finances such as taking out new loans, higher chances of credit card approval, and others.

How big is the market?

Housing loans is a big industry. While there are upward and downward trends particularly after the housing crisis started in 2007, the mortgage industry has since remained stable and is now showing signs of recovery.

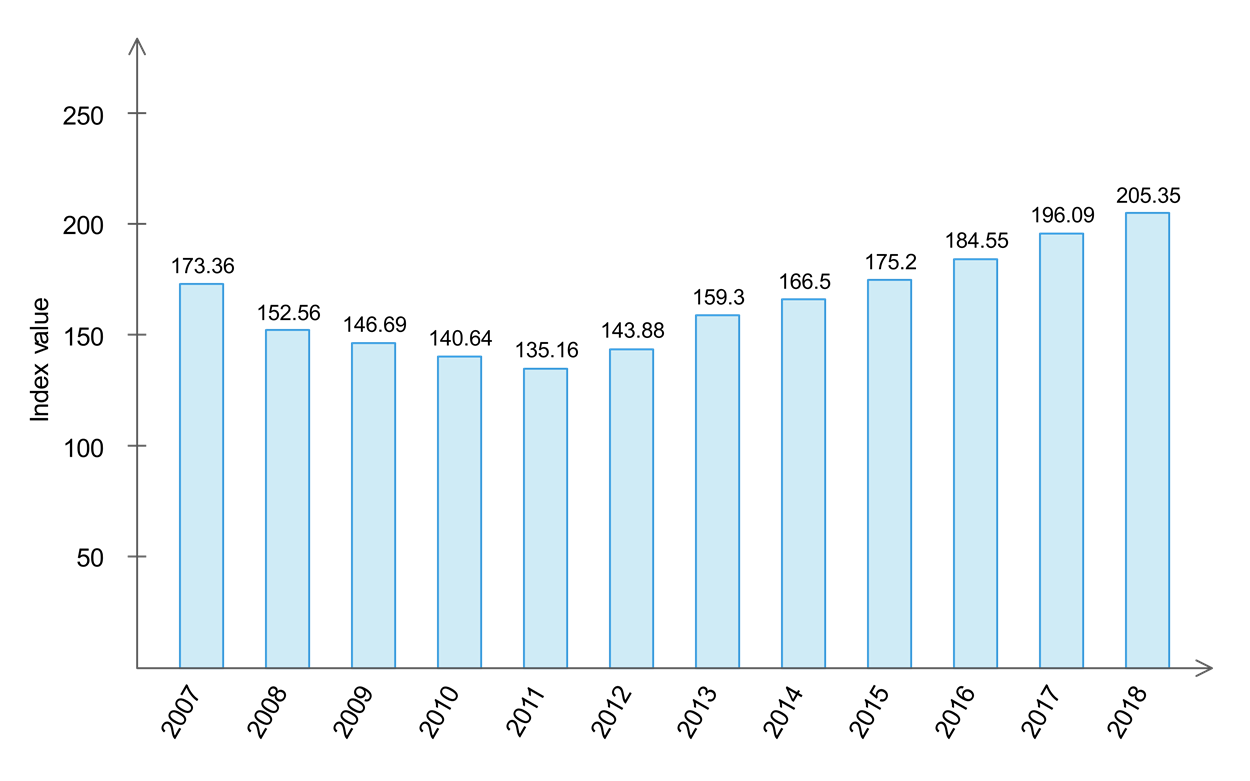

S&P/Case Shiller U.S. National Home Price Index

Almost all financial institutions offer housing loans, which shows the breadth and scope of the industry. Both public and private agencies list many financial loan instruments targeted at first-home purchasers.

Mortgage debt outstanding in millions of dollars

| Type of holder | 2015 | 2016 | 2017 | 2018 Q2 | 2019 Q1 |

|---|---|---|---|---|---|

| Depository institutions | 4,373,548 | 4,631,191 | 4,801,328 | 4,868,304 | 4,936,589 |

| Life insurance companies | 430,675 | 465,461 | 506,666 | 536,366 | 580,558 |

| Federal and related agencies | 5,036,576 | 5,146,884 | 5,314,929 | 5,369,802 | 5,481,561 |

| Mortgage pools or trusts | 2,791,613 | 2,827,611 | 2,973,229 | 3,067,754 | 3,156,521 |

Historical data on outstanding debts by institutions indicate recovery in recent years. (Federal Reserve)

Even with upward and downward trends, the mortgage industry will keep on expanding. Housing loans are the most preferred financing option for first-time home buyers, and since the rate of home ownership in the US increases, so will the housing loan trade.

This growing demand for housing is a key indicator of mortgage industry expansion. People from different age groups are preferring home ownership to renting. In a study, the Mortgage Bankers Association projected additional 13.9 and 15.9 million households by 2024, with millennials as the main driving force. Jamie Woodwell, MBA’s Vice President of Commercial Real Estate Research, says that the projected growth rate will be a big factor in recovering from the crisis.

“As millennials age and create more housing demand, these long-term social trends will mix with demographic changes and the waning hang-over from the Great Recession with a net outcome of increased demand for housing.”

Jamie Woodwell, MBA’s Vice President of Commercial Real Estate Research

Mortgage and additional expenses associated with homeownership

Even if mortgage is a widely-used financial instrument, some people have an unclear understanding on its details. As a first-time homebuyer, you need to be familiar with how mortgages work, especially with the cost and payment structures.

One detail where most people get confused is with the cost, as they get surprised with the difference in the mortgage term price and monthly amortizations.

The monthly amortization is composed of the mortgage term and other expenses. Commonly known as PITI, these costs and charges are always a part of the loan terms, and the monthly amortizations can either increase or decrease (especially with adjustable rates).

PITI is composed of the principal, interest, taxes, and insurance.

Principal

This is what first-time home buyers often mistake to be the total cost for purchasing a home. The principal is the amount that the institution is willing to lend a borrower without incurring additional risks. For example, for a $200-thousand home loan, a bank or a housing loan agency may let you borrow up to $180,000 if you pay the remaining $20,000 as down payment for the house. Financial experts recommend extra payments toward the principal to pay off the loan faster.

Interest

This is the amount that the lender charges the borrower for lending the money. The amount of the interest depends on factors like the loan term and the interest rate. For example, for a $180,000 loan, at 5% fixed APR for 30 years, with a regular amortization schedule, the total interest is $167,860. This amount will be spread over the 30-year term and added to the monthly payments. Usually, those who are unfamiliar with mortgage payments mistake the monthly amount to only include the principal and interest.

Taxes

This is a variable component on mortgage payments, since taxes depend on factors like location, the area’s tax rates, and the amount of the property. Each county and state have its own taxation system, so tax charges may vary. For a $200,000 home, if real estate tax is 2 percent, there will be $4,000 in yearly taxes, which means an additional $333 per month.

First-time home buyers should also be aware that most taxes are based on annual property assessment, not on the original purchase price. This means that any renovation or additions done over the course of the loan will either increase or decrease the assessed value of the house. Any amendments in the tax system in the area will also change the taxes due on the loan.

Insurance

Both lender and borrower need protection against less-than-ideal situations like defaulting or sudden income cuts. This is where insurance comes in, and there are different types of protection depending on the loan. Insurance is often a requirement for housing loans.

Private mortgage insurance

PMI is usually included in the monthly payments when the down payment for a house is less than 20 percent. This is also required for conventional loans. Paid-for mortgage insurance added to the monthly premiums is also known as BPMI. This is because some mortgage insurers also offer protection paid for by the lenders, of LPMI. Lenders usually recover LPMI by charging slightly higher interest rates on the loan.

PMI serves as protection for the lender, in case the borrower defaults. This covers the risk the lender took for the loan. This is important, since delinquency rates for housing loans have increased over the years. Borrowers are having a hard time meeting their obligations, which can lead to defaulting on the loan.

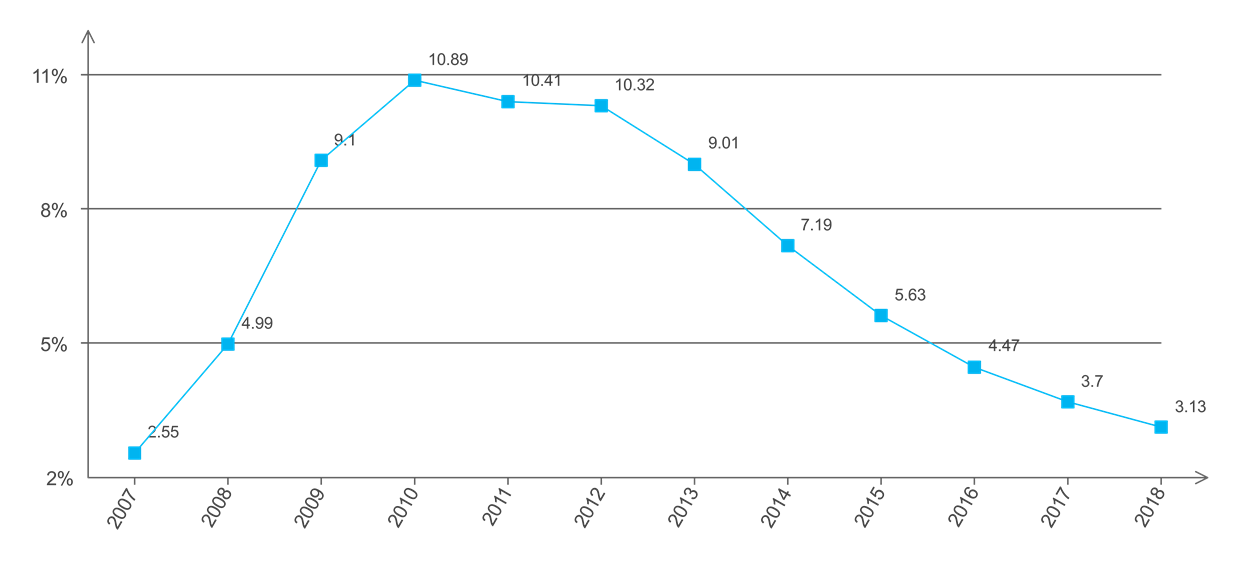

Delinquency rate on single-family residential mortgages

Mortgage insurance may take up to 2% of the loan amount. Other than this, PMI is also based on credit scores, as high ratings mean less insurance; the amount of down payment; and the type of loan.

You can have the PMI cancelled when the principal balance reaches 80% of the home’s original cost. Meanwhile, as per the Homeowner’s Protection Act, it is also automatically cancelled when the principal balance reaches 78 percent. There is also the option of final PMI termination, applied for borrowers who keep current on their payments. Mortgage insurance is taken off the month after the halfway point of the amortization schedule is done. Final PMI termination is applied even if your payments don’t reach 78% of the original cost.

When is PMI negligible?

While insurance is required as a mortgage add-on, there are instances when the PMI costs are almost nil. For example, there is no PMI if you make a 20-percent down payment for the house.

Where the loan originates also matters. Aside from having a 20% down payment, there is also no PMI for VA loans. Instead of down payment and mortgage insurance, VA loans have an upfront funding fee. The amount depends on the type of service or disability status, loan, and down payment amount (for those who wants to pay it). First-time borrowers also have different costing than those who have already availed of the loan.

However, the funding fee for VA loans can be waived under special conditions. There may also be changes to the over-all structure of loan take-outs and refinancing for VA loans, as the Protecting Affordable Mortgages for Veterans Act of 2019 has been signed into a law.

Meanwhile, for mortgages guaranteed by the Federal Housing Administration, the PMI is usually fixed, and a requirement for the loan. PMI amount only changes if the down payment is below 5%, but if not paid upfront, it can be rolled over to the mortgage.

Although a loan through the US Department of Agriculture is almost the same, PMI rates for borrowers are typically lower. Aside from paying it monthly, the amount is also carried over as part of closing costs. Again, the insurance can be rolled over into the mortgage, but it will result in higher loan amounts and fees.

Homeowners and hazard insurance

Some financing options like loans for single-family homes usually require homeowners insurance. Meanwhile, although homeowners’ association has general insurance for properties, it is best to get your own coverage especially for items inside the house. Costs for this type of insurance can vary depending on the property location.

Additional fees

Aside from PITI, there extra costs and charges added to the mortgage payments which increase the monthly amortizations.

HOA and Co-op fees

These are fees on top of the monthly mortgage, if the property is in an area with a homeowner’s association, a condo, or a co-op term. The fees serve as maintenance costs for the upkeep of the complex, building-wide improvements, and other expenses.

Closing costs

These are charges on top of the monthly payments. Most first-time buyers also get surprised about the additional fees that they have to pay before moving into their first home. These closing costs are mostly lender and third-party fees that are not included in PITI. These fees are often accounted for in the Loan Estimate and Closing Disclosure documents before taking out a loan. There are some lenders who offer the option of rolling over closing costs into the loan.

Utilities and maintenance

Another surprising add-on to the monthly amortizations is the extra payment for utilities and maintenance. It comes as a surprise especially for those who have been singly renting for a long time, or upgraded their home. There’s a big difference between maintenance and utilities costs in a bigger house.

Types of Mortgage

Financial experts recommend that one important thing first-time homebuyers need to do is be familiar with loan options, since the best type of financing depends on a variety of factors.

FRM versus ARM

Loans can be categorized based on their interest rates.

Fixed-rate mortgages (FRM) allow for more stable monthly amortizations, since the principal and interests have fixed amounts divided over the entire loan term. However, the final monthly payments can still change since other adjustable fees may apply.

- Pros: Lower risk with manageable surprises on payment changes (minimal); stable monthly amortization

- Cons: Interest rates are usually higher; lock-in periods are longer to take advantage of low monthly payments

- Best for: People looking for security and stability in amortization schedules; with expansive household expenditure and needs low-payment options; purchasing home for long-term occupancy

Adjustable-rate mortgages (ARM) have two interest payment structure. Low interest rates are set for initial years, and the rest of the interest amount spread over the remaining months with higher rates. While the introductory period is set with low rates, the succeeding interests are tied to the index. This means that when the index goes up, the payment will also likely increase. However, there are ARMs who have caps on how high or how low interests get adjusted.

- Pros: Lower interest rates than FRM, especially for the introductory period, means you get low monthly payments; low payments mean more flexible budget, savings, more purchase options

- Cons: Adjustable rates can go up once introductory period is over; higher risks of default if borrower cannot afford to pay the remaining balance, possible property foreclosure

- Best for: People who wants more purchase options on tight budget; only planning to live in the home for a few years; proficiently familiar with how interests work to take advantage of adjustments

Mortgage terms

Loan options are also classified according to their terms, the number of years to pay off the loan. There are different terms available depending on the institution, with the most common being a 15- or 30-year term. There are also longer terms for 50 years, or an in-between option like a 20-year one.

Choosing the best term for your housing loan means you’ve decided based on a different factors, like how the interest rates work, if there are adjustments, how much will the total payments be per month, and how long you will pay off the loan. Borrowers need to take these into account so they’d know if they can handle paying off the loan for the duration of the term.

Meanwhile, even if the borrower and lender have already agreed on a loan term, there are still ways to pay off the loan earlier and save, like making extra payments on the principal. However, be careful when deciding to pay off faster, since there are terms that are bounded with prepayment penalties.

| PROS | CONS | |

|---|---|---|

| Shorter term | lower total costs low interest rates compared with longer terms full property ownership achieved in shorter years | higher monthly payments |

| Longer term | lower monthly payments | higher total costs property ownership takes longer higher interest rates |

Before deciding to borrow, it is best to talk with an expert to explore your options. There are also helpful apps and websites like online calculators to help you choose the right type of loan.

| 10-Year APR | 15-Year APR | 20-Year APR | 25-Year APR | 30-Year APR | |

|---|---|---|---|---|---|

| Interest rate | 4.8 | 5.1 | 5.8 | 6.0 | 6.4 |

| Monthly payments | $2,102 | $1,592 | $1,410 | $1,289 | $1,251 |

| Total interests | $52,217 | $86,565 | $138,372 | $186,581 | $250,364 |

| Total payment | $252,217 | $286,565 | $338,372 | $386,581 | $450,364 |

An example of how to compare terms from an online calculator, for a $200,000-loan. These digital apps and online support are helpful in checking out which term is the right fit for your timeframe and budget.

Loan types

There are different types of loans available based on the terms and details set by lenders and institutions. Some of these are more popular than others because of convenience, easier requirements to accomplish, and other reasons.

FHA loans

After the Great Depression of 1934, the Federal Housing Administration was created to help people get approved for loans easier. With the most barest of conditions, these loans are the most popular especially for first-time home buyers. A FICO score of 500 and a 10% down payment are the basic requirements for this loan. However, higher credit scores can lower the down payment to 3.5% and also help lower the interest rates. One downside of an FHA loan is the Mortgage Insurance Premium (MIP), which is a requirement by Housing and Urban Development.

VA-guaranteed loans

For military personnel on active duty and even veterans, the VA guarantees home loans with a number of benefits like zero down payment and cost-effective interest rates. VA loans don’t require mortgage insurance which means a sizable portion of savings. Borrowers just need to meet the requirements and be eligible for the loan.

USDA loans

Another government-backed program is the USDA loan, which is an advantage especially for properties in rural areas. There are eligibility requirements for both borrowers and property. The USDA loan also offers 100% financing, so no down payment is required. The agency offers direct loans, guarantees, and home improvement grants.

Conventional loans

These types are not insured by the government, and backed by private lenders. Usually, these loans need to meet the guidelines of Freddie Mac and Fannie Mae, government-sponsored enterprises (GSEs). As quasi-private agencies, GSE-backed loans have stricter requirements than full government-backed terms. One popular upside of conventional loans is PMI removal for a 20% down payment.

Non-conforming loans

Borrowers who need large amounts often go for unconventional types like jumbo and super jumbo loans. Loan amounts can go as high as 3 million dollars for super jumbo. However, since borrowers need a larger amount, requirements are notches higher than conventional loans.

Lender reputation

Aside from the agreement details, experts have also studied what common, personal metrics borrowers think of to get the best loan type. Supposedly, whatever loan they go for, lender reputation is an important requirement, with the best ones featuring competitive costs as well as good customer service.

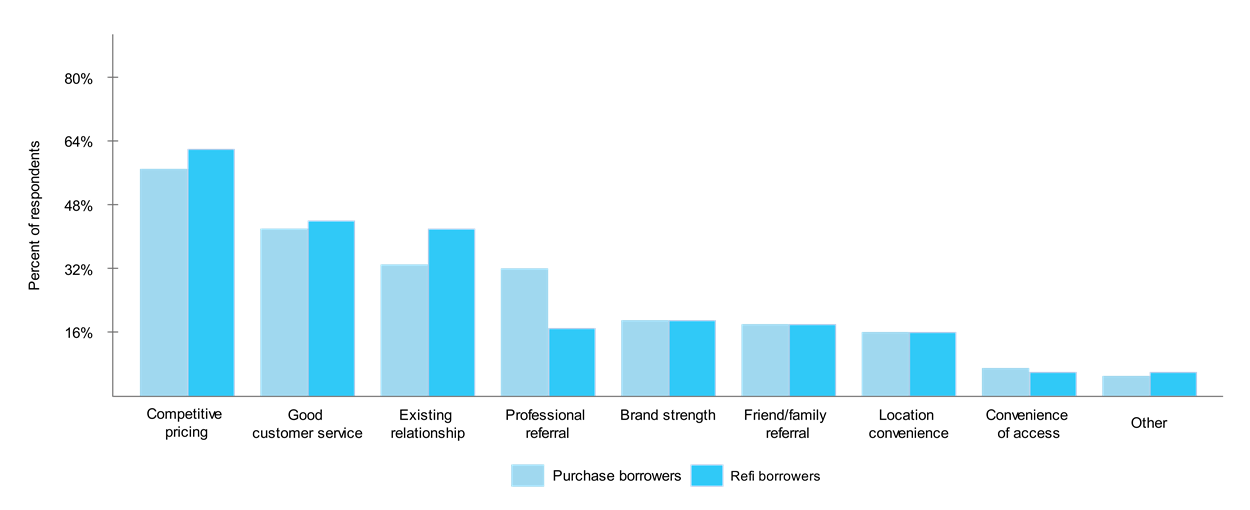

Important factors in choosing mortgage lender

Summing up

Since coming off a recession, the housing industry is slowly recovering and has made updates to its structure, especially on loans and mortgages. With improving interest rates and borrower-friendly requirements, even first-time home buyers can accrue a number of advantages on getting a housing loan.

About the Author

Benjie has been a bookwork for decades. He believes that writing is a form of expression, and that connecting with readers means you’ve expressed yourself correctly. Writing mostly on tech and social media topics, he continues to win over readers across other areas, too – both to inform and engage. His works have appeared in news publications like Christian Today & on business sites like Freelancer.com.

When taking a break from writing, you’ll most likely come across Benjie in a quiet corner of a room browsing an eBook by Robert Kiyosaki or Napoleon Hill, or reading the latest from Tom Clancy or WEB Griffin. In his spare time he enjoys urban trekking & photography.