What Those Numbers in Mortgage Requirements Mean

Published August 30, 2019 by Benjie Sambas

As first-time home buyers, most people get encouraged over the prospect of a new house that they would call their own. There are at least two major options to do this; either home buyers have already put up a capital to satisfy a full-payment contract for their home, or purchase the property through a mortgage.

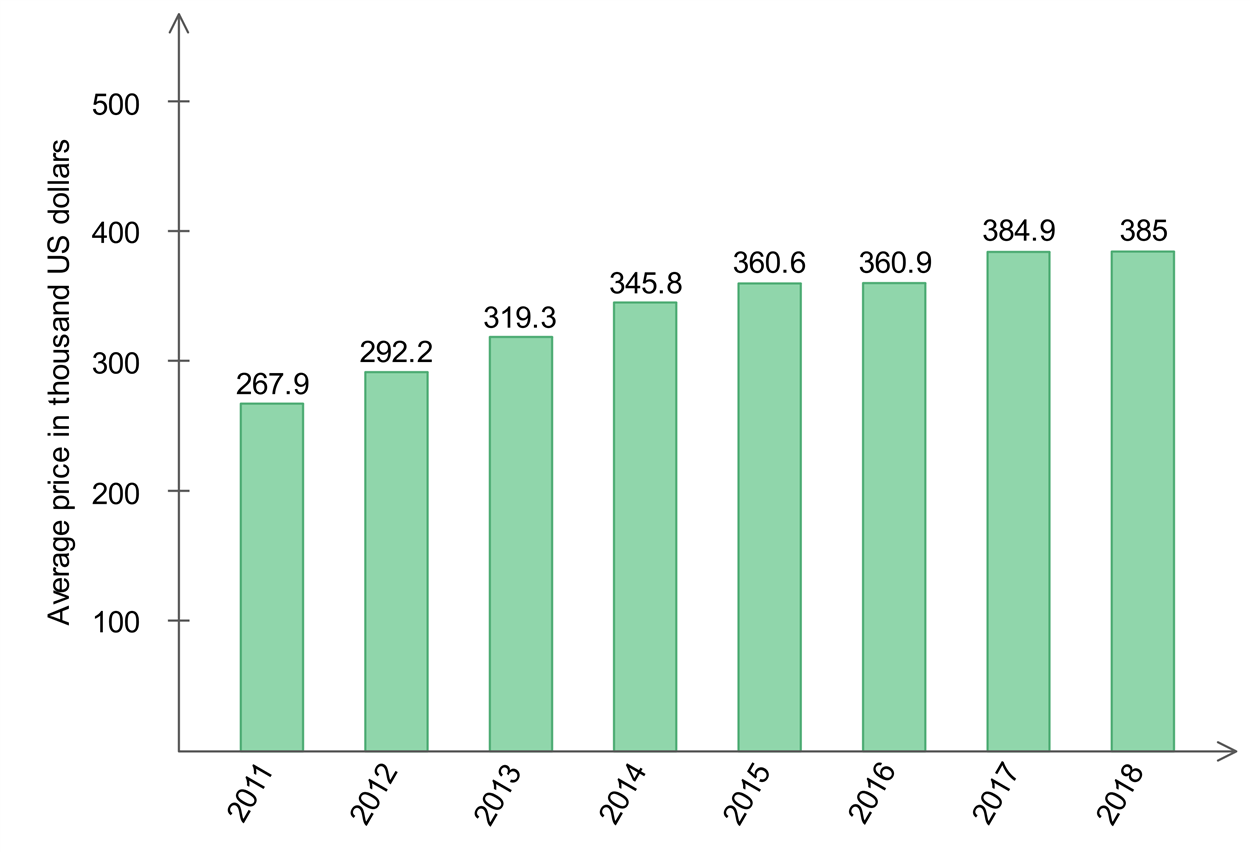

Often, securing a house through loans is the more common. With increasing prices of expenses and commodities, few people have enough savings or funds to enable them to purchase a house outright. Meanwhile, the rising cost of houses, plus additional expenses, have made securing homes through loans a much preferred alternative.

Average purchase price of new homes in the US

Mortgage is A loan, not THE loan

As first-time home buyers, some people get confused over loans and mortgages. Simply put, the former is a general term when lenders offer an amount to borrowers. When that agreement is in exchange of something, or a “collateral,” then it becomes a specific type of loan. A mortgage for a housing loan is one where the borrower secures the principal (the original amount) by making the property a collateral. The borrower and lender enters into an agreement with the house to be purchased as the collateral, and the agreement lays out the interests, the end date of the loan, the installment periods and amount, and other details.

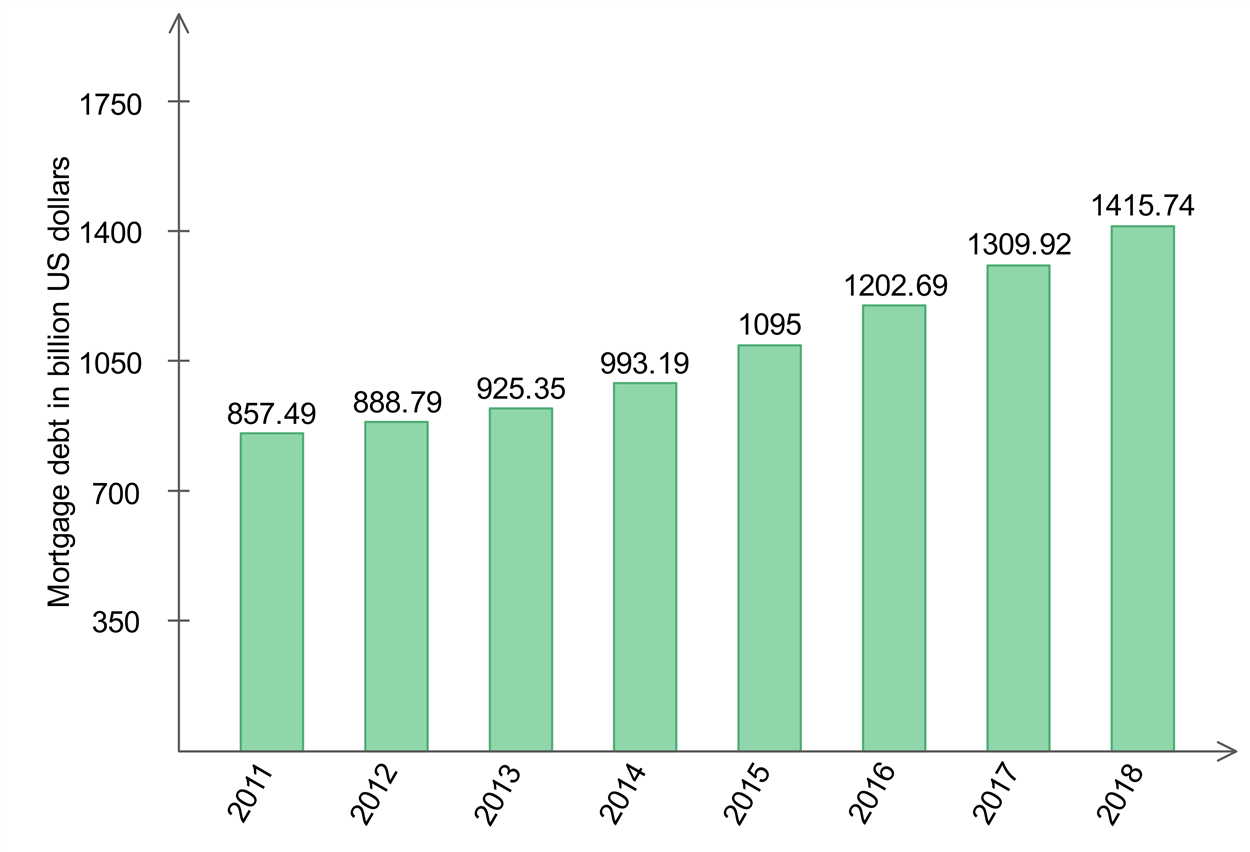

Mortgages have become common options in house-buying. Instead of paying for the full amount outright, properties like multi-family homes have been purchased through loans. The amount of outstanding balance for mortgages on multi-family residences have risen over the years.

Mortgage debt outstanding on multifamily residences in the US

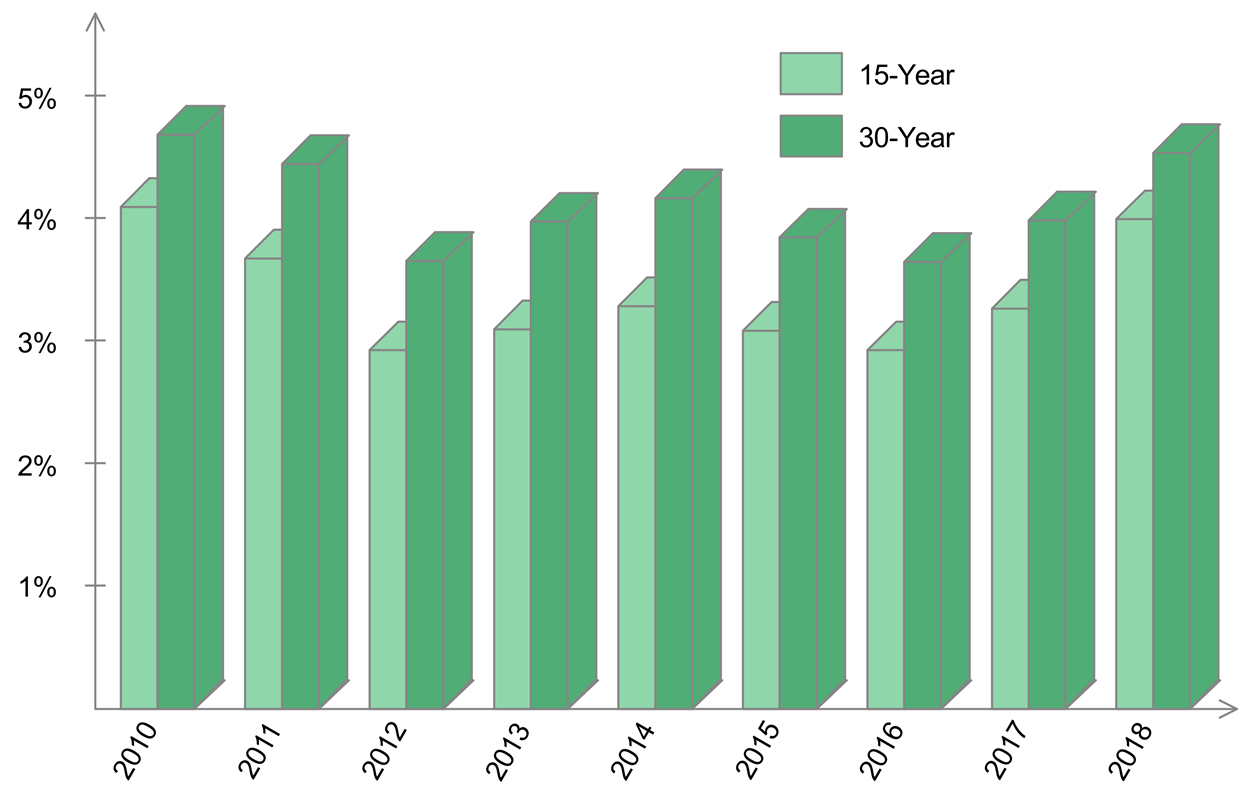

Meanwhile, with interests over the years being on stable ranges, with about 4.0% max for fixed rates, mortgages are becoming a dependable and affordable instrument for purchasing homes. Mortgages are much preferred by both lenders and borrowers. Since this is a secured loan with the house as collateral, institutions are protected to some extent even if the loan is defaulted. With payment periods that can be extended to at least 30 years max, borrowers can have their dream houses while remitting easy-to-pay monthly installments.

Average fixed rates for 15- and 30-year mortgages

Common qualifications items

Since mortgages are loan agreements, institutions have laid out requirements for people to qualify for a loan. These requirements serve at least two purposes. From the lender’s point of view, it protects them from default, since screening applications determine the borrower’s ability to pay the loan over the years, not just on the starting months. Meanwhile, borrowers are also protected since the guidelines determine their financial health. An assessment of their status helps them make decisions not just in taking out the loan, but in other financial matters as well.

Borrowers are ALWAYS protected when securing mortgages because of the “ability to repay” rule. This makes lenders examine borrower finances in detail and guarantee loan repayment through “reasonable, good faith determination of a consumer’s ability to repay any consumer credit transaction secured by a dwelling.”

National Credit Union Administration

Income

Of course, your ability to pay the loan is one of the basis for the mortgage to be approved. Lending institutions check out your income and the details associated with it – the amount, where it comes from, other sources, and such. Income is how lenders determine the amount for the loan, and borrowers also need to determine their total income to see whether they can pay off the loan comfortably.

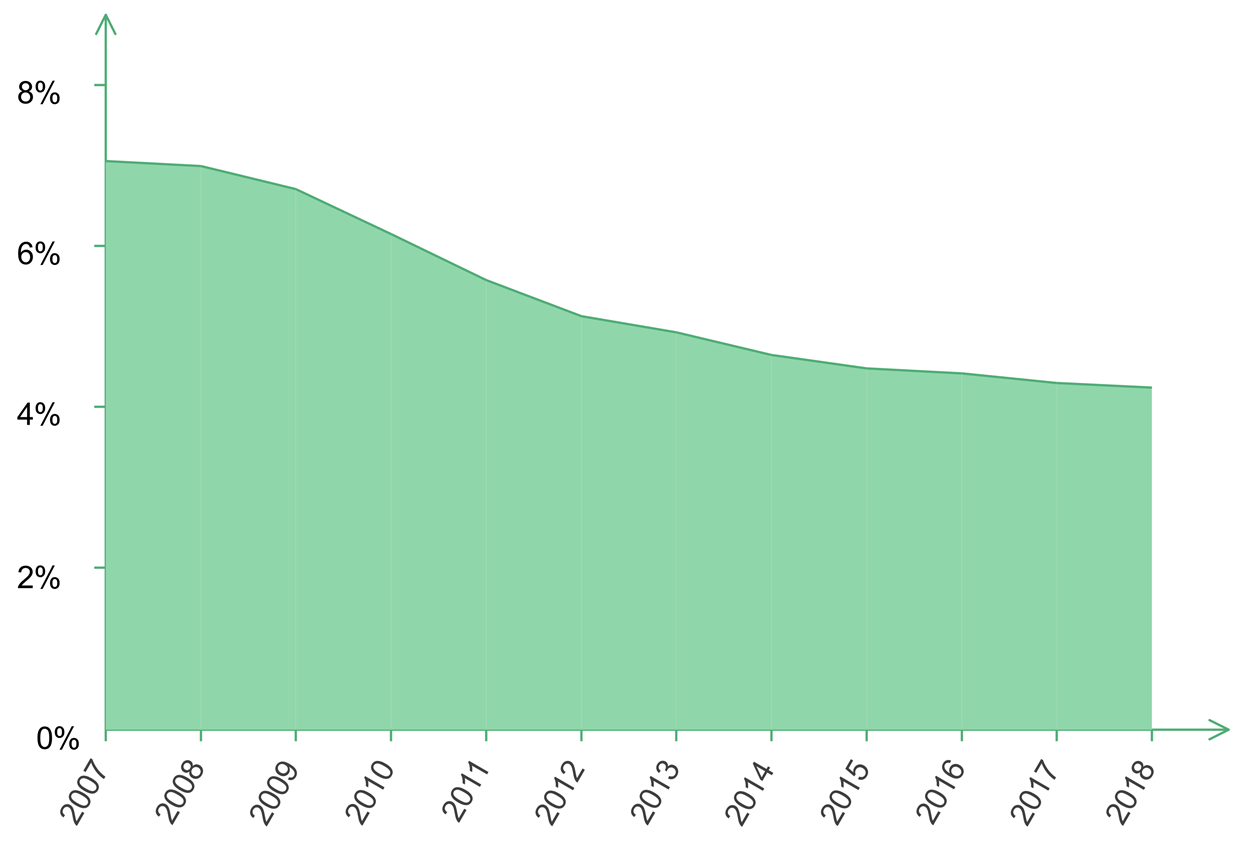

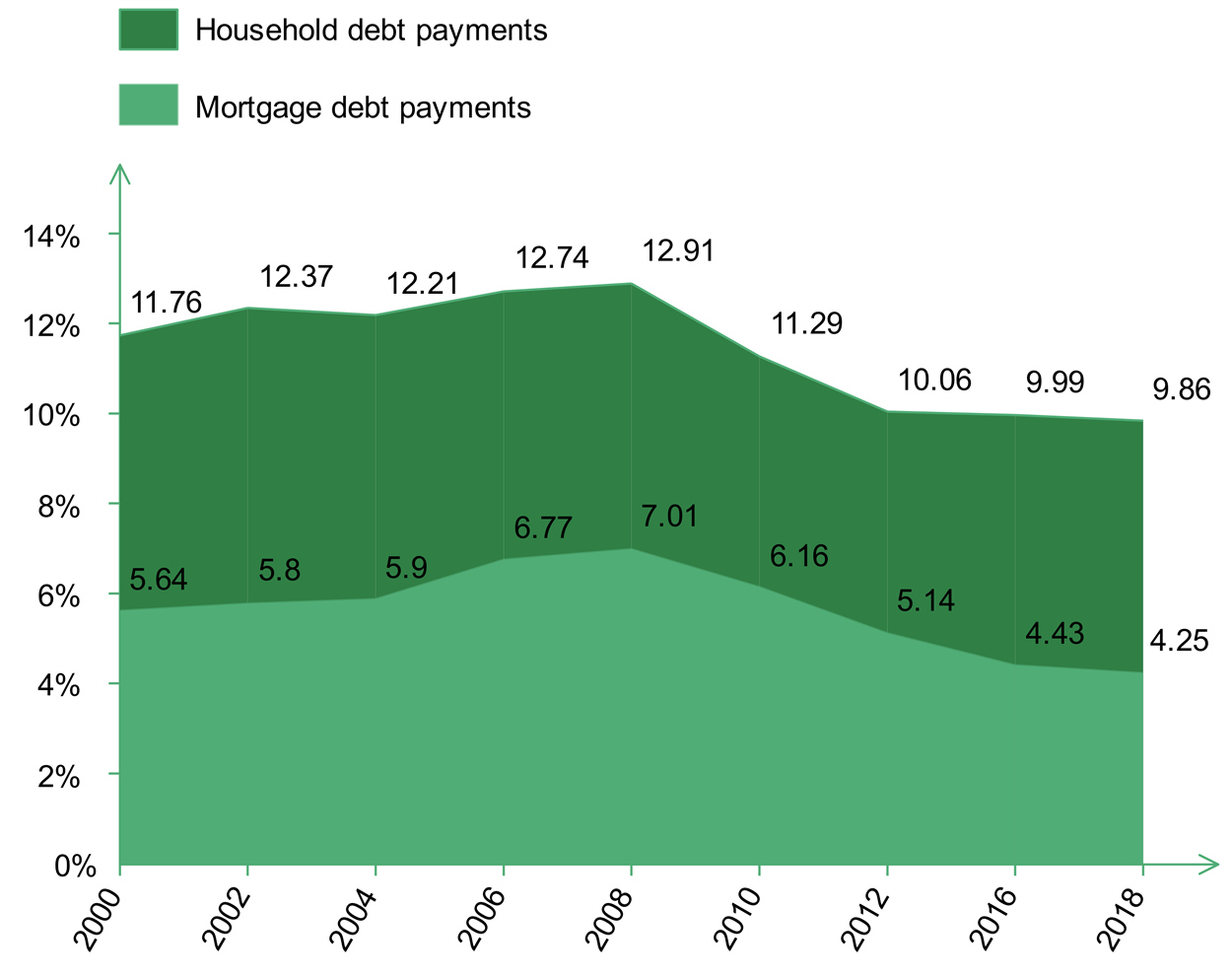

Mortgage debt payments as percent of disposable income

However, while you may generate high income, lending institutions also take into account the income stream, and there may be income that works against your qualifications. For example, alimony and child support, while they can be considered as earnings, usually don’t count as qualifying ones. There are also specific conditions for other gains like bonuses and commissions, self-employment income, or types of benefits. Generally, lenders take a look at “full, regular, and timely” income to be made for at least two years prior to the mortgage application. Taxable incomes are also generally counted as qualified sources.

How about spousal income?

When applying for mortgage as a two-person borrower, most people think that adding another income counts positively. This is not always the case. For example, if your spouse is made to be a co-borrower for the loan, both your earnings will be added and will count towards qualification. However, with a co-borrower, all negative aspects will also be taken into account. If the spouse has a low credit score, or even a derogatory credit event, it’s possible that the application will not push through. Even if you qualify, the low credit score may also reflect towards higher mortgage rates.

Down payment

There are multiple types of lending institutions where you can qualify for a mortgage. However, most of them require a down payment to be made, and each lender may have certain requisites. In most cases though, conventional home loans require at least 3% of the appraised value or purchase price as down payment.

The most accommodating mortgage is through VA loans for military members and veterans. VA-backed loans are usually at 100%, which means a down payment is not required. Meanwhile, the Federal Housing Authority, while making changes to how a down payment can be obtained, still retains the 3.5% Minimum Required Investment (MRI) of a home’s purchase price as requirement for qualified borrowers. Other institutions like banks and credit unions may have their own guidelines on mortgage down payments.

Documents

As a loan agreement, you’d need to convince the lender that you are qualified to take out the mortgage, and complete documents solidly support your position. While there may be additional documentation needed depending on the institution, most lenders commonly require the following:

- Signed purchase agreement with the seller

- Tax returns going back at least two years

- Proof of homeowner’s insurance

- W-2s for all employments going back two years

- Recent bank statements for at least 3 months

- Pay stubs for at least 30 days

- Other documents supporting other sources of income

- 1099s form for self-employed

- Document dividends or stock earnings for other sources

- Proof of bonus

- Pension statements

- Securities documents for other income like bonds and insurance

These documents are needed to facilitate processing of the application. Meanwhile, different stages of the process may also require additional documents like written verification of salaries. Some institutions may also require that their own forms be used in official documentation, especially when verifying employment through your HR department.

Financial Solvency

As mentioned, a high income doesn’t mean that you would be automatically qualified for a mortgage. Lenders definitely take into account financial solvency – your ability to handle financial obligations. While institutions may have different metrics when it comes to checking out capacity to pay mortgage, they definitely check two important measures before guaranteeing your loan – the DTI and credit score.

Debt-to-income ratio

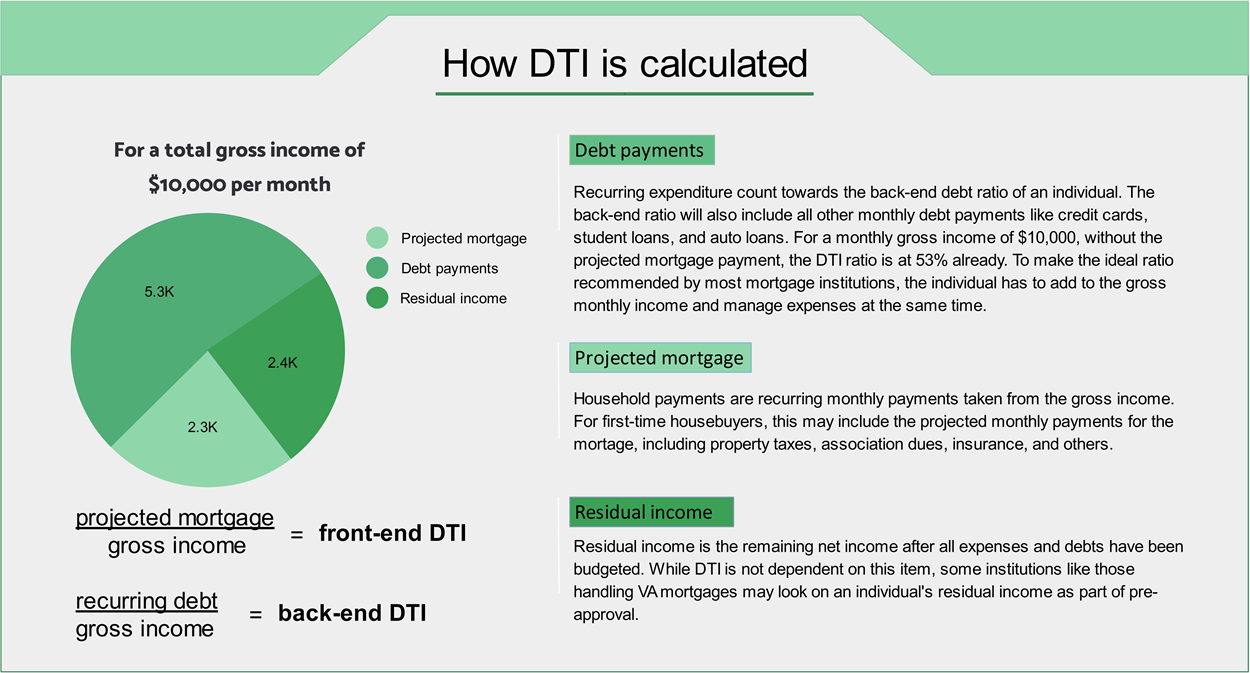

The DTI, or debt-to-income ratio, is an important part of your mortgage requirements. It compares the amount you spend on all your expenses against your income. Usually, institutions require a 43% DTI or lower to at least guarantee that an application passes the pre-approval stage.

The DTI is also an indicator how much of a risk your mortgage will be to lenders. Although this ratio uses income amount as a factor, listing a high income is not entirely a measure of guaranteed loan approval. While you may have high income from multiple streams, your DTI may still come out above the recommended 40% if you have high monthly expenses like debt payments.

Household versus mortgage debt payments as percent of disposable income

Front-end versus back-end DTI

The DTI ratio for an individual can be qualified as two separate metrics, the front-end and back-end DTI. Both of these ratios play significant roles in qualifying for mortgage, though the back-end DTI has more influence on good DTI ratio.

The front-end ratio is also known as the mortgage expense ratio, where a comparison is made between the individual’s gross monthly earnings and total projected mortgage that includes monthly housing expenses like PITI (principal, interest, taxes, and insurance). Lenders use this metric to gauge how well your income can carry additional expenses like mortgage payments. For example, if you have a monthly income of $10,000 and your projected monthly mortgage payments come in at $1,834, you have an 18.34% feont-end ratio.

Meanwhile, the back-end debt ratio is the total debt ratio for the loan borrower, where the gross monthly income is compared against all recurring monthly expenses. Aside from housing expenses, the back-end ratio is also computed using other outgoing-funds items like recurring payments, credit card fees, other loan debt payments, and the like. If you have a total of $4,300 debt payments on a $15,000 monthly income, your back-end ratio is at 28.67 percent.

For lenders, knowing an applicant’s back-end ratio is much preferred, since it gives the institution an idea of how the income will handle all outgoing financials in a firmer sense, not just on projected numbers. Moreover, both numbers are used to measure an applicant’s paying ability. Conventional loans typically set their standards at 28/36. This means that front-end should be at or below 28% and total debt ratio should not exceed 36%. However, there are institutions that set their own requirements. For example, FHA qualifications on debt ratios put them as 31/43, a higher limit than the usual.

Using these metrics, some lenders have made other types of loans available to applicants, with their qualifications depending on debt to income ratios.

| Loan Type | Front End | Back End | Hard Limit | Loan Notes |

|---|---|---|---|---|

| underwritten by Fannie Marie, conventional | n/a | 36% | 45% | manual underwriting |

| Underwritten by Fannie Marie, DU | n/a | 36% | 50% | automated program, Desktop Underwriter |

| Home Possible, Freddie Mac | 35% | 43% | n/a | |

| FHA conventional | 31% | 43% | n/a | exceptions can be made |

| FHA, EEH | 33% | 45% | n/a | depending on different factors |

| VA loans | n/a | 41% | n/a | residual income may be checked |

Improve DTI

A high debt-to-income ratio is detrimental to qualifying for a loan, but these numbers can be improved. With a number of adjustments to both income and expense details, DTI ratios can be brought to manageable ranges to get higher chances of loan approval.

- As some loans like VA mortgages take a look at residual income, it is best if there are additional sources of income. Multiple income streams are already becoming a common occurrence these days, especially for those who are adding income with online and part-time jobs.

- Check spending habits. As most lenders consider back-end ratio to be a significant factor, minimizing all monthly expenses can lower the DTI faster. Make sure to spend only on basic necessities, and as much as possible, do not splurge on items especially if you are already planning on applying for a loan.

- Pay off debts with high bill-to-balance ratio. This is especially true for credit card payments, as charges can have as much as 20% interest, plus late payment fees. For example, if you have two credit card balances, pay the $25 fee for the $50-bill, rather than just $15 on the card with a $75 balance. This will make the higher impact on decreasing over-all debt, which can lower the DTI.

- Pay off loans faster. If you have outstanding loans, paying them off quicker may seem to be a burden. DTI-wise, your debt ratio will increase if you decide to pay extra to the minimum. However, once you’ve covered your 2-year loan in just 15 months, your DTI will also decrease earlier than the projected period.

Credit scores

Another metric that mortgage borrowers should be familiar with is credit scores. Aside from DTI ratio, these numbers also play an integral part in qualifying for a home loan. However, this metric is inverse – higher credit scores mean higher chances of loan approval.

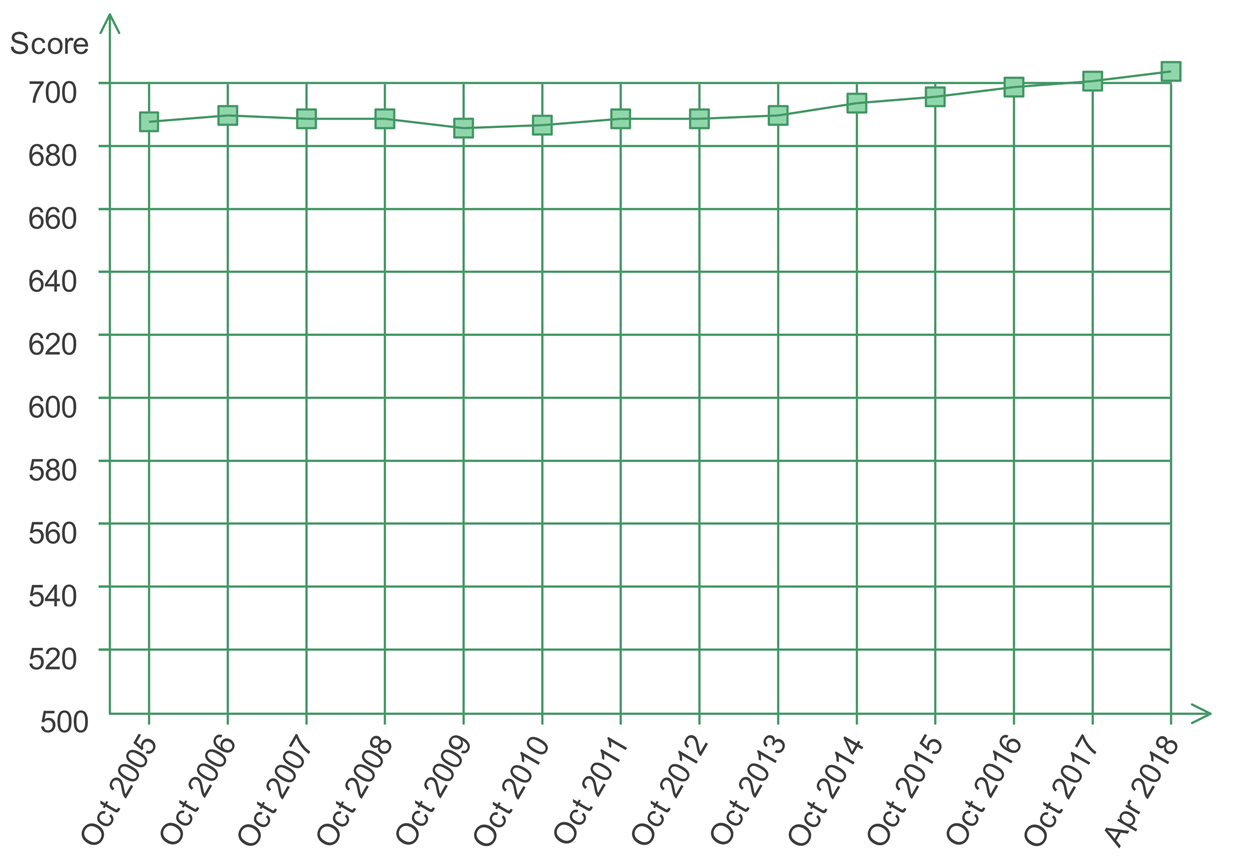

FICO average scores in recent years

Typically, two institutions gather credit scores used by lenders. The scoring range used by FICO and VantageScore are generally the same, with minor differences. These scoring agencies use 300-850 as general range for their scores. However, a 700-point score in FICO, which indicates “good credit, is only reflecting “good verging on fair” to VantageScore because of their different models.

The fact that the national average FICO Score has reached 700 speaks to how US consumers are, on average, managing their credit behaviors.

Ethan Dornhelm, Vice President, FICO Scores and Predictive Analytics

Since FICO is generally used as a model, here are the credit scores and what they mean to lenders and borrowers:

| FICO Score Range | Model | Approval Rating? |

|---|---|---|

| 800 to 850 | Exceptional | People with these scores often get approved easily. Aside from quick and convenient approval, these applications also get the best available lending terms, including the lowest interest rates and fees. |

| 740 to 799 | Very good | Individuals with scores in this range may qualify for better interest rates from lenders. |

| 670 to 739 | Good | This range includes the average US credit score, and lenders view applicants in this range as “acceptable” borrowers. They are also likely to qualify for other types of loans and credit cards but are likely to be charged above-normal interest rates. |

| 580 to 669 | Fair | Lenders will likely disqualify applicants with these scores if they apply for conventional loans. They are also likely to be eligible only for loans with interest rates significantly higher than the best available. |

| 300 to 579 | Poor | Many lenders decline credit applications from people with these scores in this range. Aside from loans, credit card applicants with scores in this range may only qualify for secured cards that require a cash deposit as spending limit. |

Good credit = loan approval?

While your mortgage will not be automatically approved if you get high scores, credit ratings also play an important part for lenders to grant approval. Since most credit score metrics take into account payment history, length and credit standing, total debt and credit, and credit usage, scores will show how reliable you are in paying the agreed amount on the agreed period.

Credit scores give institutions an idea of how worthy you are of the loan – high scores mean less risk of defaulting, while low credit ratings make an individual a high-risk borrower. With a bad credit reputation, loan applications are likely to get rejected. In addition, even if the loan pushes through because of other factors, the mortgage will have higher chances of reflecting high interest rates when compared against loan applications in the same range, but with the borrower having higher credit scores.

DIY credit score checking

While lenders give periodic reports to three major credit bureaus – Experian, Equifax, and TransUnion – you can do a credit check for through an Annual Credit Report. Aside from being free, federal laws ensure that your credit report is given every 12 months with updated information. However, you can also purchase a more custom, in-depth report directly from the three agencies.

Credit Repair

Improving credit scores is possible, though it may need some time especially if the scores is intended for a mortgage application. Typically, you’d need time to have a repaired credit score for at least two years. It also needs to be in the upper bracket so you’d get high chances of approval.

- The first thing that needs to be done is to evaluate how badly your credit scores have gotten. Get the free a report to know where you stand. In addition, you can also get reports from institutions if they have denied your application for loan or credit. You can dispute incorrect details and errors in your credit history, and it is the institution’s responsibility to and report these inaccuracies.

- Inventory spending and expenditure. Low credit scores usually mean there is negative impact from your expenses and payment habits. Check how your expenditures going back months to know where your expense leaks are, and adjust your spending habits to correct them.

- Automate payments. People get low credit scores because of habitual late payments. Keep good credit by automating your payments. This way, your expenses and bills will be paid on time, every time during the course of re-building your credit history.

- Don’t apply for new loans. Credit bureaus also look for recent activity in building credit. If you take on new loans while establishing a credit score sufficient for a mortgage loan, they will likely be measured as new debts.

Summary

For first-time home buyers, applying for and getting a mortgage approved seem to be daunting tasks. However, with the right information and details on debt and income ratio, and credit scores, lenders are likely to give the needed amount and will offer convenient and hassle-free transactions from the pre-approval to the closing day.

About the Author

Benjie has been a bookwork for decades. He believes that writing is a form of expression, and that connecting with readers means you’ve expressed yourself correctly. Writing mostly on tech and social media topics, he continues to win over readers across other areas, too – both to inform and engage. His works have appeared in news publications like Christian Today & on business sites like Freelancer.com.

When taking a break from writing, you’ll most likely come across Benjie in a quiet corner of a room browsing an eBook by Robert Kiyosaki or Napoleon Hill, or reading the latest from Tom Clancy or WEB Griffin. In his spare time he enjoys urban trekking & photography.