Debt Investment A Risk-free Way to Obtain Great Tax-free, Risk-adjusted Returns

Paying Debts as Investment for Financial Freedom

Published September 3, 2019 by Benjie Sambas

Financial independence is a topic that many people have yet to discuss. According to experts, most have the erroneous notion that everything related to finance is too complex to understand. However, some have noted that even the simplest of details like paying debts are important to achieve financial goals.

Why People go Into Debt

All people have expenses, and some more than most. However, aside from savings and expenditure, people also allot portions of their income into paying off debts. It’s a common scenario among US households that according to the Federal Reserve Bank of New York, the American household debt hit a record $13.21 trillion in 2018. On average, most of those in the workforce who cover household expenses have high amounts of debt.

| Age | Average Debt | Common Reasons for Debt |

|---|---|---|

| Under 35 | $67,400 | credit card payments, student loans, auto loans, nonessential expenses |

| 35-44 | $133,100 | student loans, personal loans, mortgage payments, auto loans, family expenses |

| 45-54 | $134,600 | student loans, personal loans, mortgage payments, auto loans, family expenses |

| 55-64 | $108,300 | mortgage payments, medical & retirement expenses, lack of savings |

| 65-74 | $66,000 | medical & retirement expenses, credit card debts, lack of savings |

| 75 and up | $34,500 | medical & retirement expenses, lack of savings |

Why are most people going into a debt spiral? Usual reasons range from living in excess of income, to impulse buying through credit cards. However, financial experts say that the top two reasons for people staying stuck with too much debt are financial illiteracy and being unfamiliar with financial freedom.

Not All Debt is Bad

Knowledge-wise, most people want to avoid debts. In finance though, there is the concept of being in “good debt,” where owing money is not detrimental to financial standings. The top reasons for good debt include:

Mortgages

It is uncommon for people to pay straight cash, in full, when purchasing a house. Although the average US prices for houses have risen, home financing is still a good idea. It keeps funds liquid, which can be used for higher-yield investments while locking in fixed rates & fixed monthly loan payments for up to 30 years. Consistent mortgage payments also build equity & positive credit ratings.

Student loans

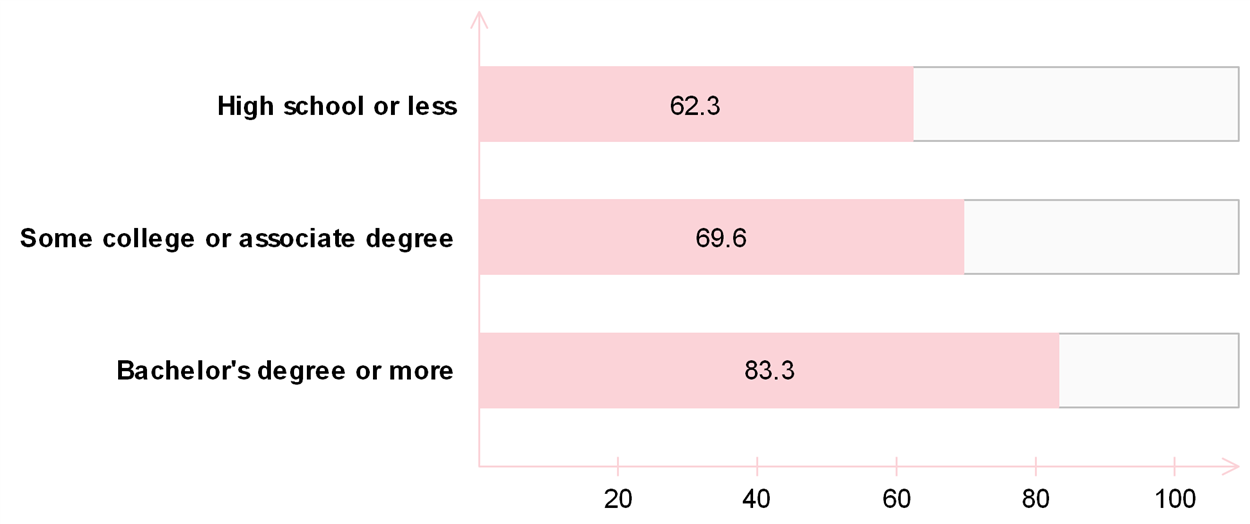

One major advantage of student loans is access to good education, which acts as a credentialing signal & can lead to other career opportunities. Statistics show that the weekly median income for those with bachelor’s degrees is $1,435. Additional education boosts potential income.

Financial Stability based on Education

Business loans

Taking out a loan to open or grow a business has its advantages. Aside from building positive reputation to lenders for consistent payments, using debt for business finances doesn’t interfere with the liquidity of the cash flow. Meanwhile, it is also an advantage over opening the business for investors, since doing so will risk your ownership.

Investors who invest in growing businesses may drive out the founder during periods of weakness. So long as you are not overleveraged on debt and can continue to service debt payments you are not forced to appease outside investors demanding accelerating rates of growth.

Responsible credit card use

Cards are double-edged swords. However, those who are responsible enough and manage to pay their debts off on time get to keep good credit scores. This positive rating helps in building credit reputation. The higher your reputation, the higher the amount that lenders offer should you need another loan. Having positive credit rating also gets you the best interest rates when borrowing.

A simple rule to know when borrowing is good for you: if it adds future value, it’s worth it. If you overshoot your finances or continue to have trouble paying, then it’s bad debt.

People who pay off their credit card bills monthly do not pay interest on their balances & benefit from various rewards points programs which can be used to pay for electronics, flights, or other expenses.

Debt-to-income ratio

Financial expert usually take into account expenditures and income when determining the amount and interest rates for loans. This is where they calculate the debt-to-income ratio (DTI). The DTI is an indicator of financial health. The lower the DTI is, the closer you are to achieving financial freedom. On the other hand, high DTI is a red flag, indicating one may need help in managing their finances.

Why 43% DTI is important

The magic DTI ratio is 43%, since this is the baseline for most lenders. Having lower DTI gives higher chances of qualifying for loans like mortgages. Since DTI accounts all outgoing finances like expenses and payments for outstanding loans, debt payments keep the ratio below the threshold. Most financial advisors recommend keeping DTI at 30% below for guaranteed approvals.

For example, your monthly gross income is $10,000, and all your expenses total $5,000 including the $1,000-monthly for credit cards, student loans, auto loans & personal loans. This means that as long you are paying for the money borrowed, you have 50% DTI. When you’ve finished payments for your loans, your DTI will decrease to 40 percent since your expenses will also be more manageable. This means you gain a sizeable advantage just by paying off debts.

There are helpful apps online (like the above calculator) where it automatically calculates for your DTI if you have complex expenditure.

Financial freedom means “good life”

Most people think that having high income means living the good life. In monetary terms, this means having financial freedom. Aside from income though, there are other factors that experts consider to determine if a person is “living the good life.”

You achieve true financial freedom when you handle your cash flow efficiently. Financial literacy is also part of becoming financially independent, since this means that you can competently manage your spending habits, income and expenses, and other finance-related issues. The right information is important in achieving financial literacy and freedom. However, most may not have the time for complex ideas, methods, and strategies to be financially independent.

How debts help in financial freedom

One of the simpler approaches you can do to start your financial independence is to know how to use debts to your advantage.

First, notice that paying off debts doesn’t mean going debt-free. Being free of debts could be worse than having debt work for you. Although living without debt is a tempting idea, it also means that your cash flow may become stagnant, or yield a low rate of return.

For example, you may avoid being in debt over a $260,000-home since you don’t want to take out a loan. However, your monthly expenses include a $1,355-rent for a two-bedroom. This means that a 30-year mortgage is a win-win situation in the long run, rather than living debt-free.

Debt works against you if it becomes a liability. With effective debt management though, borrowing can become an asset if it helps you build equity or earn more from your labor.

When paying debt equals saving money

Paying off debts can save you more money if it is handled efficiently. Using the example, most people prefer home ownership through mortgages since most housing loans have become flexible & creditors offer compelling interest rates for up to 30-years. Using the example, if you save for at least two years for the 10% down payment on a $260,000-home, the principal & interest portion of a mortgage payment for a fixed rate of 4.2% over 30 years is only $1,144.30. After adding in real estate taxes, homeowners insurance & PMI the monthly expense would jupm to $1,533.46. At first glance this makes a $1,355-monthly rental seem cheaper.

A decade from now the person paying monthly for renting may have experienced about a decade of steady 2% increases. This is where the big difference becomes more obvious.

- They'll have no home equity & they will spend roughly $1,655 on rent monthly.

- The homeowner will have their mortgage payments locked at $1,144 & PMI will no longer be required, lowering their monthly by $97.50. Their loan balance will fall to $185,591 & if their house appreciates at 2% annually their home will be valued at roughly $316,900, giving them $131,309 in equity. Given their initial downpayment this means that after a decade they would build over $100,000 in additional equity.

- You can use an amortization calculator & an inflation calculator to do the above calculations 2 decades or 3 decades in. Rent would go to roughly $2,013 then $2,454. A couple decades from now the homeowner might see rising property taxes & increased home maintenance expenses, but the principal and interest portion of their mortgage payment would still be $1,144.30. Three decades from now they would own the house outright.

When can one use effective debt management in saving more money?

Avoiding late payments

One sound practice in effective debt management is paying on time. Without late payments, there are no extra costs for penalties and delinquency charges. This will save you from additional, non-essential expenses.

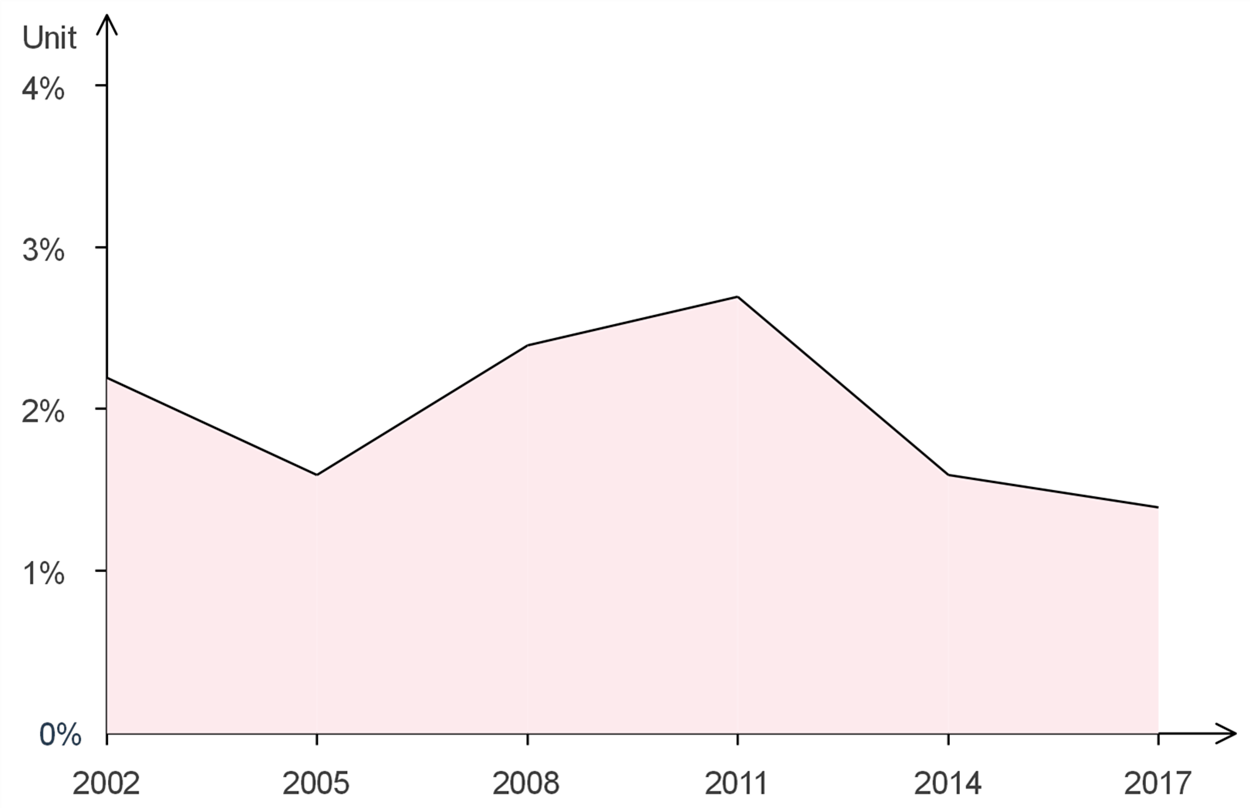

According to the American Bankers Association, more people are avoiding payment delinquencies for their installment loans over the years as part of practicing financial management. James Chessen, ABA’s chief economist, agrees. “Consumers have done a remarkable job of managing their finances over the last several years, and we expect that will continue as the growing economy reinforces their financial footing,” Chessen said.

ABA has defined loan delinquencies as late payments that are 30 days or more overdue.

Installment Loan Delinquencies

“Consumers are supported by a robust economy, and they continue to make judicious decisions when managing their debt levels.”

James Chessen, chief economist, American Bankers Association

Be responsible in paying revolving debts

One of the more common debts people incur are for undisciplined credit card purchases. Credit cards are the most common type of revolving debt, where holders borrow against a set credit limit. If there is balance left after credit card payments, you are charged interests, which can go as high as 16% APR. Credit card interests also add up over time. The less payments you make on your balances, the higher the total amount will be.

You also save more if you pay above the minimum percentage needed, as there are cards that have decreased interest the more you pay above the required payments. You can check how much you can save through apps or online calculators.

Take advantage of installment debts

Contrary to revolving ones, installment debts are loans with fixed amount and predetermined end dates. Examples of this type of debt include secured loans like mortgages and auto loans, or unsecured ones like personal and payday loans. Most financially independent people advise debt consolidation using this type of loan. Usually, advisors say paying off credit card debts with a personal loan is a sound financial practice.

Most personal loans offer lower rates than credit cards. This means that although you’d still be making payments even if the credit card balance has been settled, you’d be paying less amount than if you’ve decided to settle the credit card bills first.

Debts as investment versus saving instruments

Increasing savings through borrowing is an uncommon concept. Usually, people increase their savings through interest-bearing financial instruments. The more common products that give returns through interest rates include bank accounts and products, and other financing options like investments. While being in debt seems the harder route to take, there are certain situations where borrowing is the more profitable option.

Mortgage, or pay in full?

Instead of paying in full, most homeowners choose to finance their second home because of deductible mortgage interests under favorable conditions. According to new IRS rules, the maximum amount of debt eligible for deduction is $1 million prior to 2018. Meanwhile, mortgages made for tax year 2017 and after have deductible interests for a maximum of $750,000-debt. Another condition for this type of savings is that the loan must be secured. The rules have been laid out in a new IRS publication.

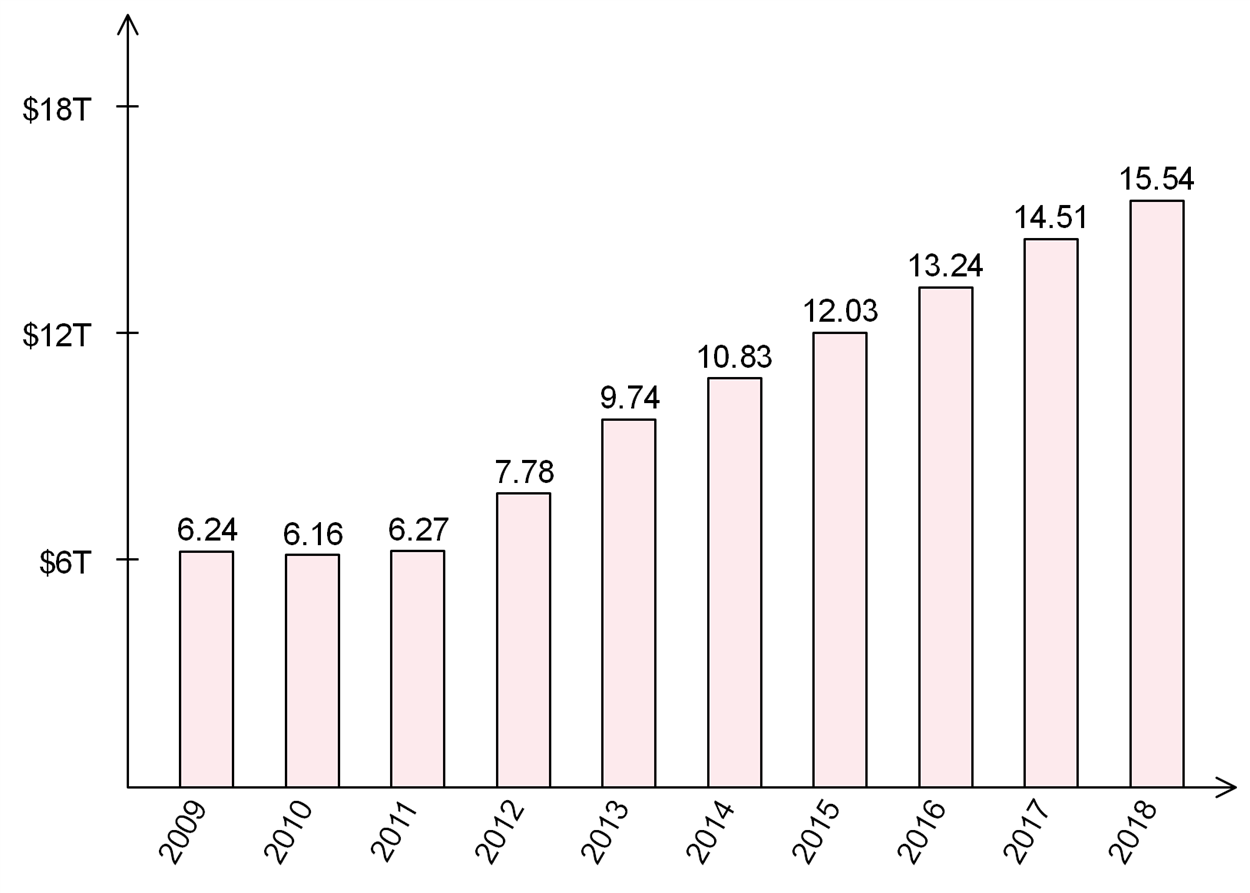

Home equity versus home improvement savings

Most people tend to save up before major remodeling projects. Although this is good practice, there may be a better alternative – home equity loans. While most banks offer at least 2.0% interests for savings accounts, home equity loans, under certain conditions, are tax-deductible, with the amount off-setting the interest returns for a regular savings account.

Aggregate value of homeowner equity in the US

Debt financing over equity

Opening or expanding the business takes capital. One of the more common ways of putting up capital is business equity, where owners open up the company to outside investors. However, there is another option to finance start-ups or expansion. Debt financing like bank loans or revolving lines of credit usually have advantageous tax implications. This translates into savings while still retaining control of the business.

Consolidation versus investments

A typical investment return for some interest-bearing instruments like stocks and CDs, although high, are time-bound. For example, certificates of deposit may accrue up to 2.7% APR, but you sacrifice financial liquidity. Most investment assets are long-term. If your primary objective is to pay off high-interest debts like credit card balances, investments are not a viable option.

On the other hand, consolidating your debts across all accounts is simpler, more fluid, and offers attractive rates. You also gain an added advantage wherein if you pay the same amount instead of the lowered, consolidated rates, you gain more savings.

Complementary methods

Aside from effective management, most financial experts recommend combining debt investments with other approaches to maximize saving.

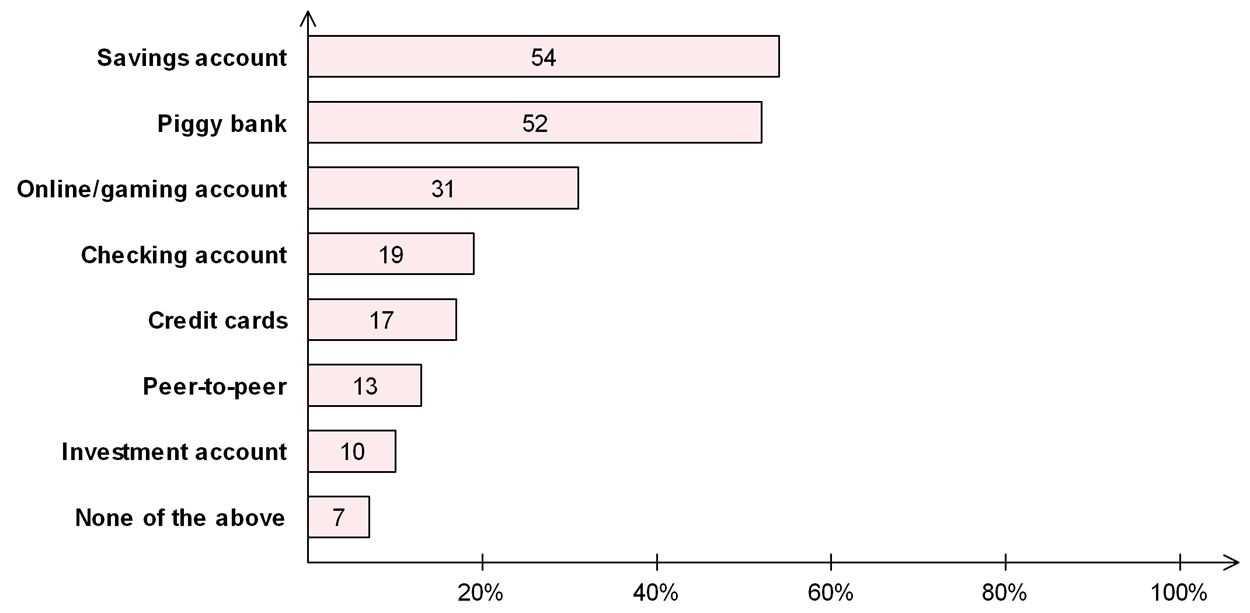

Financial instruments owned by children in the US

- List and evaluate expenditure.

While expenses are a necessity, most expenditures are bloated because of non-essential items and details. Make at least three monthly lists of recent expenses and purchases, and evaluate if the items are basic necessities. Scrap those that turn out to be luxury or impulse buys. - Check spending habits.

The credit card is one of the more powerful financial instruments today. It gives the owner immense spending power. However, this will turn into a pitfall if done irresponsibly. Check spending habits and acquire practice discipline against impulse buying using credit cards. - Use other financial instruments.

Bank accounts and investments have their advantages, so using them as complementary approaches increase savings. Make sure to plan for both short-term and long-term investments to improve cash flow and maintain stable finances.

Summary

While people cannot escape having debts, sound planning and management can turn financial obligations into assets like savings. Making sure that debts don’t interfere with your cash flow and turn into liabilities is an efficient and effective way towards gaining financial freedom.

About the Author

Benjie has been a bookwork for decades. He believes that writing is a form of expression, and that connecting with readers means you’ve expressed yourself correctly. Writing mostly on tech and social media topics, he continues to win over readers across other areas, too – both to inform and engage. His works have appeared in news publications like Christian Today & on business sites like Freelancer.com.

When taking a break from writing, you’ll most likely come across Benjie in a quiet corner of a room browsing an eBook by Robert Kiyosaki or Napoleon Hill, or reading the latest from Tom Clancy or WEB Griffin. In his spare time he enjoys urban trekking & photography.