Pay Off Your Credit Cards Calculate How Long it Will Take

Make Your Credit Card Work for You

Published September 6, 2019 by Benjie Sambas

From being novelty items used by the affluent in its early years, credit cards have now become a foundation of the economy. Financial institutions are now offering these cards as primary product. Meanwhile, credit card usage continues to increase, along with other details associated with it like debt, interest rates, and card-related issues.

Getting your first credit card means taking a step towards financial independence. However, you need to use your card in smart and safe ways in order to fully maximize its advantages.

Credit card fast facts

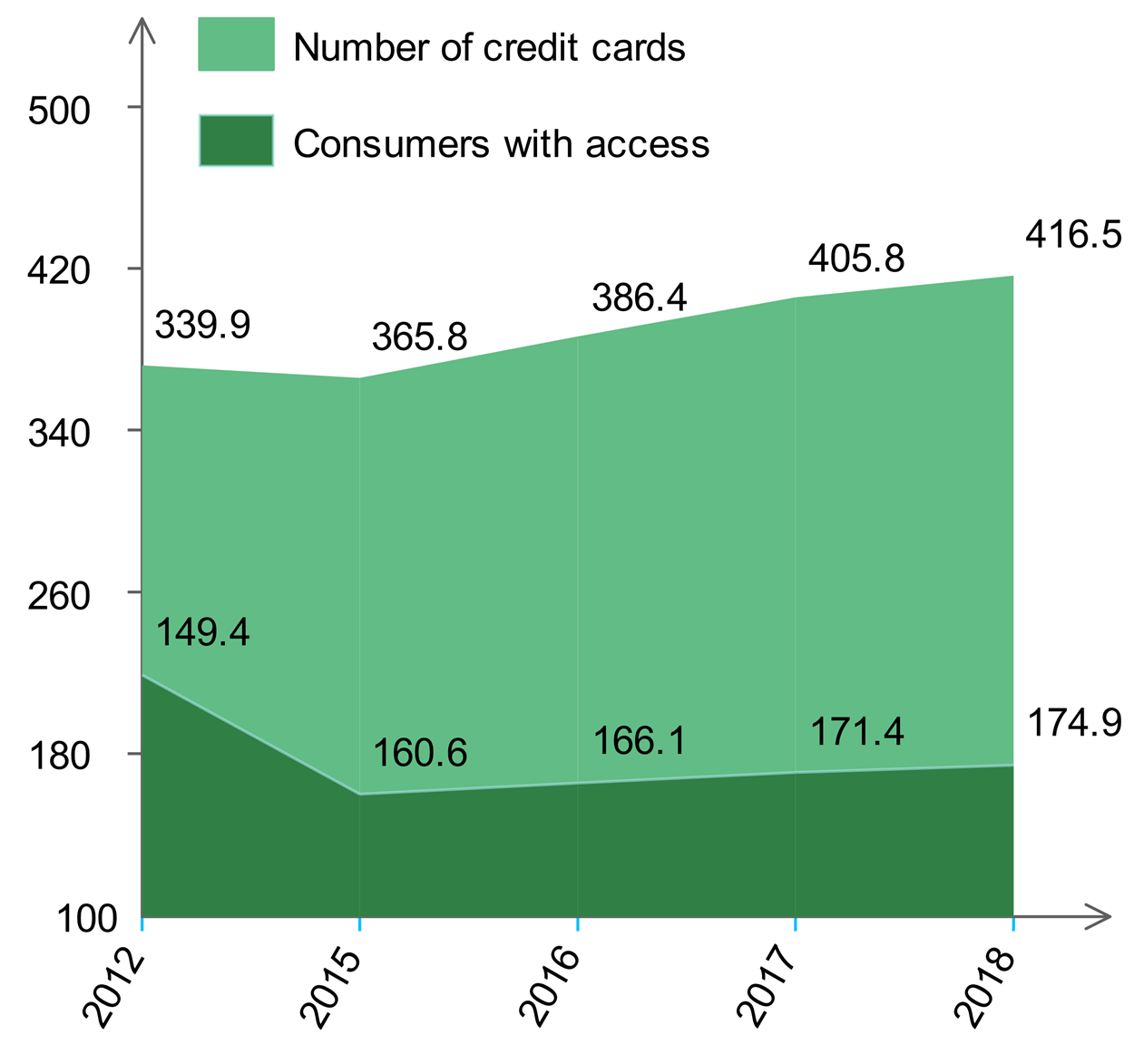

“Pay with plastic” has become a familiar phrase in the US economy, as most purchases are now paid with credit cards. Usage continues to increase that the number of cards will be upwards of the Q1 2018 figures of 416.5 million. Meanwhile, consumers with access to a credit card is also increasing, with the latest numbers at 174.9 million. According to TransUnion, a consumer credit reporting agency, these numbers signify continued reliance on credit cards by consumers and an indicator of continued economic growth.

Number of credit cards versus consumers with access

“Credit cards are a vital part of the consumer credit economy, and their continued good performance bodes well for other credit products such as auto loans and mortgages… the consumer credit market continues to perform well, and we do not see any indicators of concern in the short- or mid-term.”

Matt Komos, vice president of research and consulting, TransUnion

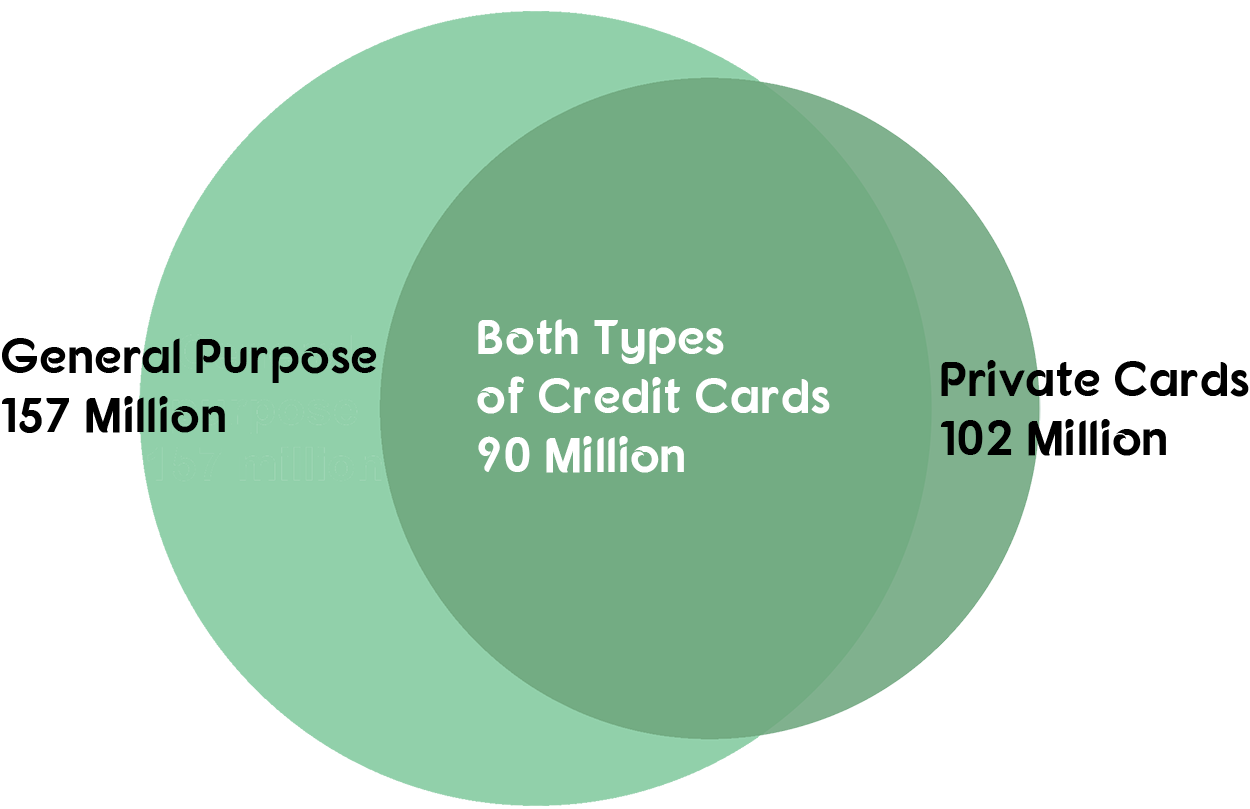

Ownership

Most have already obtained their first credit card even before they graduate, with some even having 2 or more cards at the start of their careers. According to the Consumer Financial Protection Bureau, around 169 million had at least one open credit card in 2017. There are also people who hold both general purpose and private label credit cards.

Card ownership for general purpose and private label cards

General purpose cards are most active and are associated with known bankcard entities like Visa, MasterCard, and American Express. Private label cards, which are also connected with the largest bankcard agencies, are often store-branded ones intended for use in a specific store.

Most of credit card users are in the working sector, as the 25-34 age bracket holds the highest number of credit card ownership. Some minors already own one, although there are laws restricting the use of cards depending on the age. For example, the Credit CARD Act of 2009 bans card approvals for those under 21 unless with an adult co-signer and has solid proof of financial solvency.

Ownership by age

| Age Group | Number of Card Owners |

|---|---|

| 18 to 24 | 67% |

| 25 to 34 | 83% |

| 35 to 49 | 76% |

| 50 upwards | 78% |

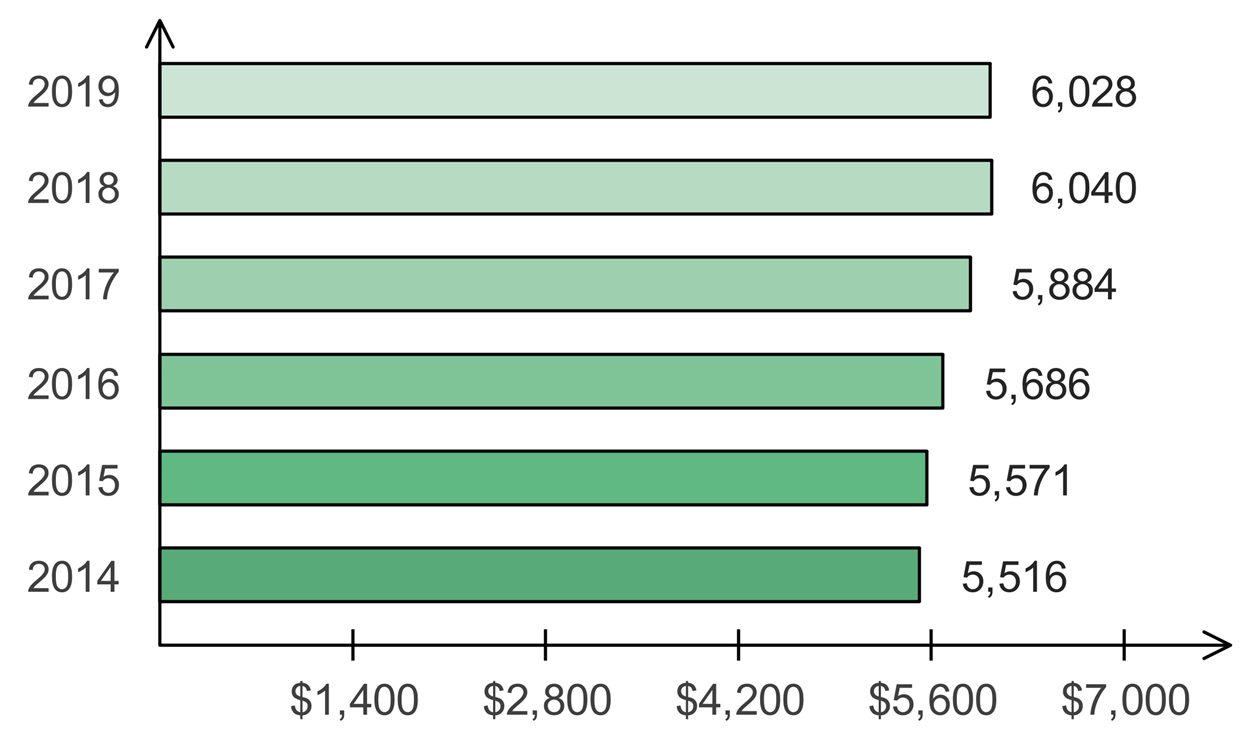

Credit card debt

As a large part of the US economy depends on credit card usage, it also reflects the increasing amount of consumer debt. In the first quarter of 2019, the Federal Reserve reported that the US revolving debt is already $1.06 trillion. A large section of this debt is from credit card purchases, with the average credit card borrower having at least $5,000 in debt in the first quarter of 2019.

Average credit card debt

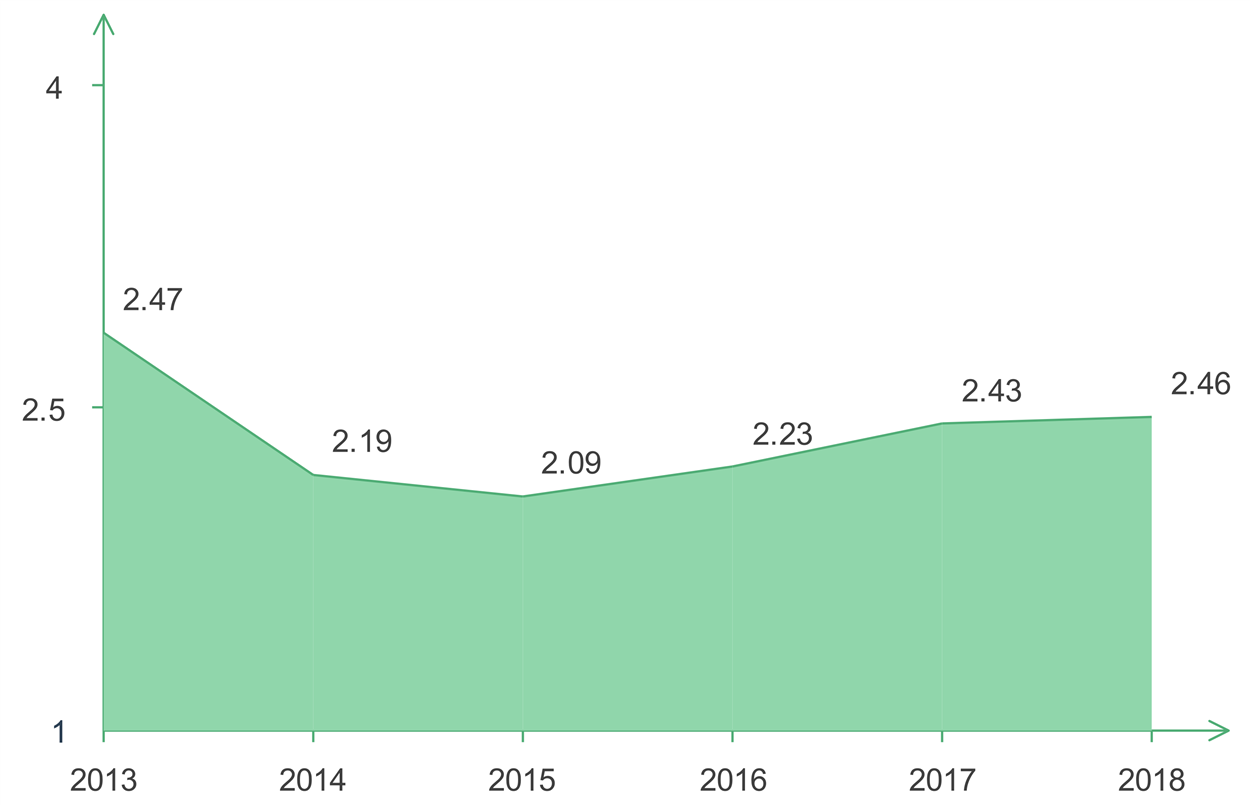

Delinquency rates for credit card payments are also increasing. This is important, since most financial statistics are dependent on details like debt and payment history. Late payments reflect negatively on finance metrics like credit scores and debt-to-income ratio.

Delinquency rate on credit card loans, top 100 banks ranked by assets

Top pros and cons of plastics

Most people prefer credit cards for purchases because they are convenient. With non-cash payments, people only need to pay for what they’ve purchased, without all the difficulties of paying in cash.

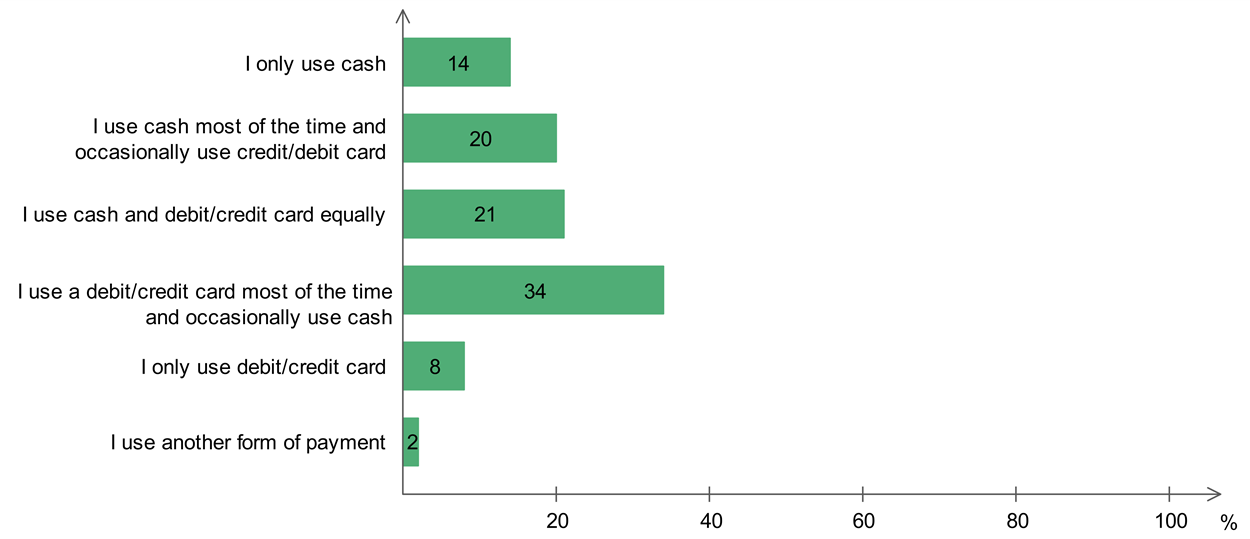

Usage for both credit and debit cards have risen since 2016, with some even owning multiple open accounts.

How people prefer to pay for everyday expenses

Meanwhile, credit card applications continue to increase, even if a Federal Reserve report highlighted that these applications, together with personal loans, receive the highest rates of denial.

Types of credit applied for in 2016

| Type of Credit | Number of Respondents |

|---|---|

| Credit card | 65% |

| Auto loan | 26% |

| Personal general-purpose bank loan | 10% |

| Mortgage for new home | 10% |

| Mortgage refinance | 9% |

| Student loan | 9% |

| Home-equity loan or line of credit | 6% |

| Personal loan from family or friend | 3% |

| Other | 4% |

Aside from convenience, why do credit cards continue to be the most popular type of transaction for most people?

Pro: Credit building

Using credit cards responsibly is one way of building positive credit reputation. Almost all credit bureaus like FICO and VantageScore use credit and payment history as metrics. Using cards for purchases and maintaining regular, scheduled payments count toward better credit scores. This may be one of the reasons why over the years, more people are choosing to pay their card bills in full instead of carrying over balances or incurring penalties for late payments.

Credit card payments behavior

| Payment reason | 2012 | 2015 |

|---|---|---|

| I always pay my credit card in full. | 49% | 52% |

| In some months, I had balances and was charged interests. | 49% | 47% |

| In some months, I only paid the minimum amount. | 34% | 32% |

| In some months, I was charged with late fees for payments. | 16% | 14% |

| In some months, I was charged fees for going over my credit limit. | 8% | 8% |

| In some months, I made cash advances using the card. | 11% | 11% |

Pro: Rewards and cash back

Many card companies offer a rewards program as one of their card features. This may come in the form of cash back, rebates, or loyalty programs. With frequent card swiping, you can add up points which you can use in your finances.

Pro: Security

Credit cards have evolved over the years and have become more secured when compared against other forms of payments like cash. Aside from physical features on the card itself, most companies also have additional layers of security to protect accounts from unintended and fraudulent use. This is particularly important, as people now commonly use plastics to do their online transactions.

Payment type preference for online shopping

| Year | Credit Card | Debit Card | PayPal |

|---|---|---|---|

| 2017 | 48% | 28% | 12% |

| 2016 | 47% | 25% | 12% |

| 2015 | 43% | 30% | 14% |

Payment type preference for online travel sites

| Year | Credit Card | Debit Card | PayPal |

|---|---|---|---|

| 2017 | 47% | 17% | 2% |

| 2016 | 42% | 16% | 4% |

| 2015 | 36% | 17% | 2% |

Protecting data is the main concern for online transactions. Credit cards have always enjoyed robust security, as card companies add new features and systems to protect against credit card issues like identity theft and fraud.

However, although credit cards become increasingly popular because of these advantages, there are also downsides to using them.

Con: Impulse buys are tempting

Since credit card payments are one of the most convenient transactions, most people tend to give in and buy whatever items they think they need. This is one of the reasons why some people dislike credit cards, and also why most card borrowers go into debt.

Top 5 most common impulse buys

| Food / Groceries | 71% |

| Clothing | 53% |

| Household | 33% |

| Takeout | 29% |

| Shoes | 28% |

Aside from the top items bought, the 2018 study by SlickDeals, an online deal community, also said that about one in five purchases is bought impulsively, with 54% of these splurges mostly self-buys.

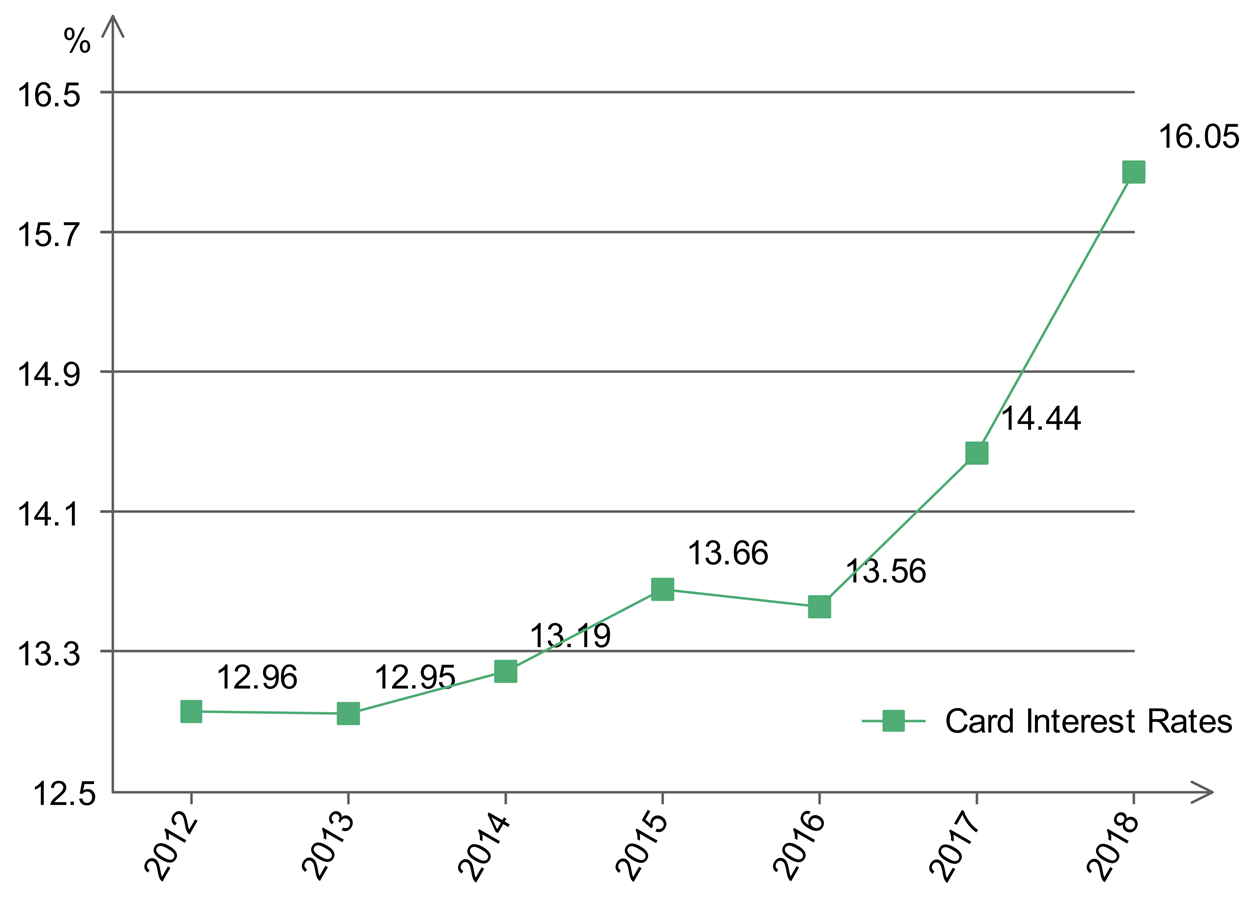

Con: Most cards have high interest

Most credit cards have high interests when compared against other types of financing like cash and bank accounts. Some offer as high as 20% APR. The Federal Reserve mentioned that the average rate for credit cards is at 16.9%, the highest one to date.

In a statement to CNBC, Peter Boockvar, chief investment officer of Bleakley Advisory Group, says that high interest rates may also be a contributing factor why there are high delinquency rates.

“Maybe these very high interest costs are overwhelming people’s ability to pay back. It also coincides with a decline in say, the savings rate and rising gasoline prices and is something we ought to pay attention to.”

Peter Boockvar, chief investment officer, Bleakley Advisory Group

Con: Too many cards equals credit hit

Owning more than one credit card can reflect negatively on your credit score. Since payment histories make significant impact on credit ratings, using many cards can result in overspending. Multiple accounts may also be a red flag to lenders, since they’d wonder why you need so many cards.

Interest rates

Credit cards are now the backbone of everyone’s wallet as people regularly use plastics for their purchases. However, few maximize credit card use and some even go into a debt spiral because of using it. One major factor why people lose out when using their credit cards is lack of comprehension. They can’t fully understand the fine print, especially about interest rates.

Historical credit card interest rates

Basically, interest rates are the service fees collected by card agencies for usage. However, the structure of credit card interest rates is complex, as there are different types and computations for each. This is where confusion sets in.

There are at least two general types of interests that credit card issuers use – fixed and variable interests.

Fixed interests

Usually, the fixed interest rate is the one advertised by agencies as the APR, with the annual rate averaging between 13-20 percent. However, most people think that paying this amount occurs every year, and some even mistake it for annual fees.

APR is added as daily interest on card balances. For example, if your card’s APR is 16%, then your daily interest rate is 0.00044 (APR is divided by 365 days). This interest rate accrues on the daily average balance and the billing period. This is why most financial experts advise people to settle their balances on time, so they pay as minimal interests as possible.

While fixed rates are usually stable, there are instances where the issuer can change the rate if the agency gives the cardholder a 45-day notice, as per the Credit CARD Act. However, this law also states that any new purchases made 14 days after the start of the 45-day notice is subject to the interest rate change without further notice.

Other instances where the issuer can change the fixed rate include late payments (more than 60 days), if the interest rate is tied to an index like the prime rate, and failure to settle/have completed a debt settlement program.

What is the prime rate?

This is the standard rate set by the Federal Reserve and other institutions like the Federal Open Market Committee after analyzing market conditions and the economy. This index is based on the federal funds target figure, deemed to be the rate where economic factors can be maximized. Banks and other agencies like card issuers use these numbers as index for their interest rates.

Variable interests

Further confusing owners, credit cards have additional interests. These different rates depend on services and other charges. The highest APR is the default or penalty APR, which issuers add for late payments or when holders default on credit card terms. There are also different rates when exceeding the credit limits, transferring balances to the next billing period, promotional purchases, or cash advances, among others.

What is a Schumer box?

For those who want to check all the details and maximize their card usage, a summary box is required for card issuers. This is popularly known as Schumer box. This table presents all the pertinent details on credit card usage like interest rates, fees, and other charges. Then-Congressman (now Senator) Charles Schumer introduced legislation requiring card companies to provide complete card information in a standard, easy-to-read format for their clients.

Using your credit card responsibly

When used in smart and secure ways, your credit card is a powerful tool for financial freedom. However, the extreme is also true – irresponsible usage can lead to debts and financial ruin. How can you optimize a credit card to help manage finances responsibly?

- Consider a secured credit card first. If your goal is to build credit history, it is best to use a secured credit card. These cards work much like the “regular” ones, except that card issuers require a deposit to work as collateral. This amount is also set as the credit limit for the card. There are secured credit cards with minimal deposits and limits, so you can use one to build your credit reputation without having to deal with high balances.

- Be thoroughly familiar with the details. Often, people claim that misinformation when confronted with high credit card bills. However, it may be that some owners are not familiar with how their cards work, especially when it comes to interest rates and extra charges. Moreover, credit cards are notorious for having too many details in fine print. Study all the details and get familiar with how your credit card works. Issuers are also required to explain to owners all the details of their accounts through instruments like the Schumer box.

- Save by prioritizing credit card debt payments. Credit cards often have high interest rates when compared with other expenses. It is best to adjust all payment and expense schedules and focus on paying off any balances incurred on credit cards. Making card payments first and on time means that you’ll have zero balance on your statements, avoiding high interest rates and late payment fees.

- Pay extra. Aside from paying on schedule, make the effort of paying above the minimum amount due. While paying it is the easier option to do, paying an extra amount is the best way to quickly build positive credit score. Some card issuers also decrease interest rates based on extra payments made on top of the bill’s minimum.

- Check statements thoroughly. Some overlook listed details on their monthly statements, focusing only on the amount required to pay for the month. Familiarity with monthly statements is important for two things – it lets you know if there are any errors in billing and dispute them, and for unknown entries, get the card company to check for fraud and theft issues.

- Spend below the limit. While responsible use can maximize your finances, going over your credit limit has the opposite effect. It endangers your payment history and credit scores if you don’t pay on time because you went overboard. Additionally, it will likely result in a debt spiral if you can’t pay because of overspending.

- Check for rewards. Most issuers offer a rewards program for their credit cards. Take advantage of this feature and save more through cash backs and rebates. However, be sure to balance chasing rewards with wise spending to avoid binge purchases.

- Avoid impulse buying. While using credit cards is useful in paying for large purchases over time, this convenience is also its pitfall. People who can’t control their spending tend to do impulse buys, especially for items with card payment promos.

- Evaluate spending habits. This is particularly important for people who can’t avoid constant use of their credit cards. Most Americans spend at least $450 a month on impulse buying and binge purchases because of lousy spending habits. Check what you buy, itemize your expenditure, and make sure to pay for what you only need.

- Make rollover payments work for you. Some people take advantage of competition among credit card issuers by making balance transfers, and this is helpful for those with card debt. Compare cards and check out the best rollover rates. You can then transfer the balance of your old debt to the new one. In doing so, you close out the old card with zero balance, while your rollover payments on the new one will not be as high since the rates have changed.

In closing

The credit card has become a powerful tool to manage your finances, but using too much use can spell ruin. Using your card in smart and responsible ways will accumulate positive points towards your finances. The other extreme also holds true – irresponsible usage of the card will expose you to unchecked spending habits and may plunge you into a debt spiral.

About the Author

Benjie has been a bookwork for decades. He believes that writing is a form of expression, and that connecting with readers means you’ve expressed yourself correctly. Writing mostly on tech and social media topics, he continues to win over readers across other areas, too – both to inform and engage. His works have appeared in news publications like Christian Today & on business sites like Freelancer.com.

When taking a break from writing, you’ll most likely come across Benjie in a quiet corner of a room browsing an eBook by Robert Kiyosaki or Napoleon Hill, or reading the latest from Tom Clancy or WEB Griffin. In his spare time he enjoys urban trekking & photography.