Best CD Rates Calculate Interest Earned on Today's Top CDs

Get High Yield Savings with Certificates of Deposit

Published September 2, 2019 by Benjie Sambas

With the rising cost of everyday living, people are looking into all manner of saving up their hard-earned money. Previously, most institutions prefer traditional savings like opening accounts in banks. However, with people being cautious of letting others manage their income for them, most institutions are opening up flexible and accessible savings instruments to engage depositors to save through high-yield, low-risk ventures. One of these is through issuing certificates of deposit (CDs).

What is a CD?

What exactly is a certificate of deposit? A CD is a special type of savings account that you can open in most institutions like banks and credit unions. However, unlike traditional savings where you put your money in a bank account whenever and control how much you want to save, CD accounts hold a fixed amount of money for a fixed period of time. This is one of the unique features of CDs, and is also one of the factors why certificates of deposit give high-yield savings and makes them perfect as long-term savings goal.

When you put up a CD account, you give an institution a fixed amount and you both agree on the term, or a fixed amount of time when the deposit accrues interest. Previously, this feature makes CDs commonly referred to as a type of time deposit. However, since most institutions now offer flexible terms and rates for this type of account – as well as what type of CD to go for – certificates of deposits have become as varied as any other type of savings instruments.

Since CDs have become more complex over the years, it branched out into different types depending on rates and terms, or what institutions handle the savings. In terms of rates, regular savings can have at least 1-2% interest rate. With the APY as one of the factors though, certificates of deposits can go as high as 2.70% and up for some institutions.

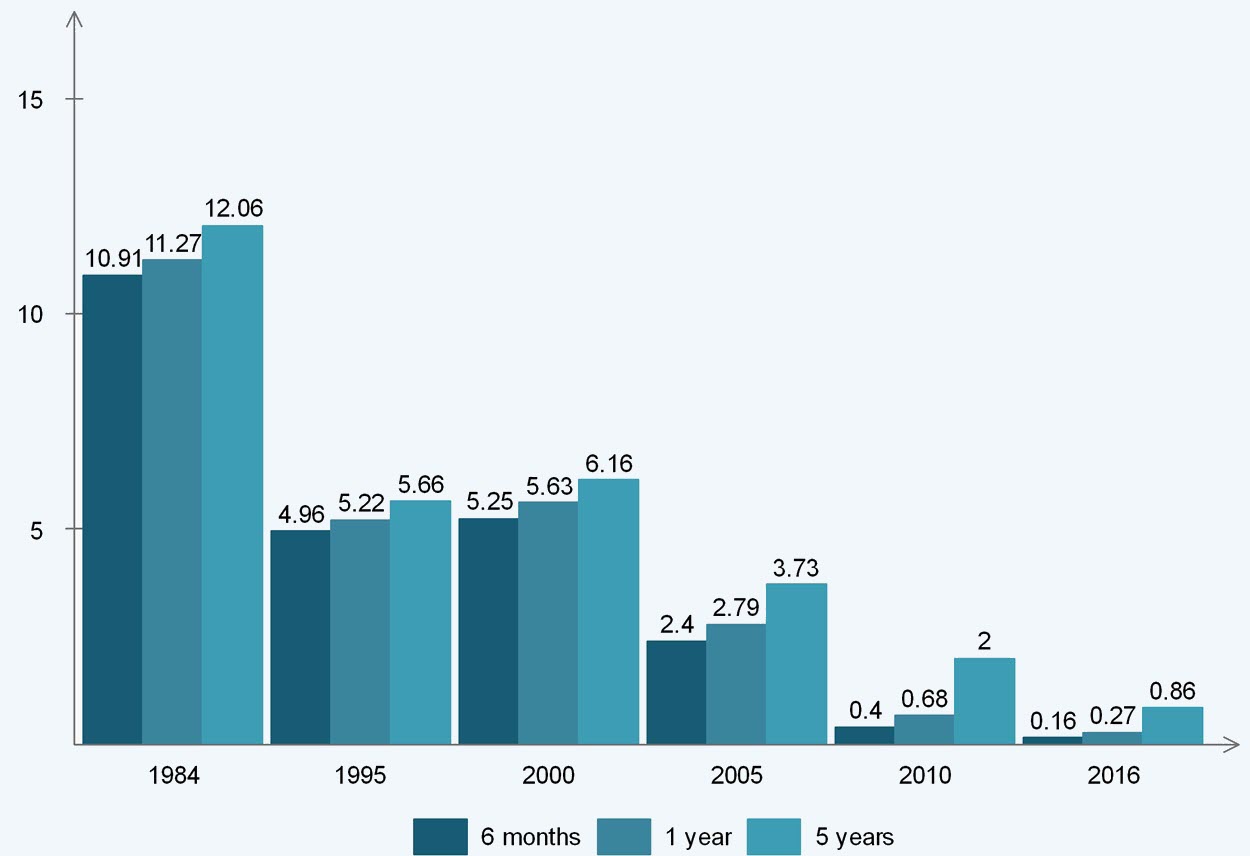

Moreover, it seems that previously, CDs give much higher savings than what depositors can get these days. Savings from today’s certificates of deposit are considered to be on a lower range when compared against previous APY rates. As one of the known high-yield instruments in the market, some observers and collated data reflect that CDs have even reached two-digit APYs and interest rates on its peak, but plummeted – much like other savings instruments – due to the recession.

Historical data on CD interest rates over the years

Certificates of deposits have enjoyed high interest rates previously, even going as high as 12.06% for a 5-year term in1984. However, due to different market factors like recessions, rates continued to slump.

Certificates of deposits have enjoyed high interest rates previously, even going as high as 12.06% for a 5-year term in1984. However, due to different market factors like recessions, rates continued to slump.However, even if their rates have gone down over the years, CDs continue to get high-yield results when compared against other financial instruments, although it varies from the type of entity. Most established mortar-and-brick banks offer lower APYs than online banks or CD brokers.

| Institution | Minimum Deposit Term Required | Minimum Balance for APY | APY |

|---|---|---|---|

| BBVA | 3 years | $500 | 1.90% |

| HSBC | 1 year | $1,000 | 0.90% |

| Marcus by Goldman Sachs | – | $500 | 2.60% |

| Citibank | 2 years | $1,000 | 0.70% |

| Patelco Credit Union | 18 months | $1,000 | 1.60% |

| Chase | 1 year | $1,000 | 0.02% |

| Wells Fargo | 3 months | $2,500 | 0.05% |

In the example above, digital institutions like Marcus by Goldman Sachs are among the entities offering higher rates. These “online banks” have lower overheads when compared with establishment institutions like Citibank, so they are often able to offer rates on top of the rate cap. Meanwhile, these companies also have more latitude when it comes to offering flexible options like no-penalty CD terms.

Why is APY important?

Certificates of deposit offers usually reflect APY, or annual percentage yield, rather than interest rates or annual percentage rates (APR). This is important, since CDs are savings instruments that also compound interest. The more frequent the interest compounds, the faster the deposits will grow since the daily interest adds to the money deposited in the account, with the new total subject to additional interest the following day.

Usually, most instruments like CDs, regular savings, checking, and other accounts compound interests daily. Other compounding interest periods are monthly, quarterly, and annual. To compute for the APY, use the Effective Annual Rate (EAR) formula, or APY = (1 + r/n )n – 1 where r is the stated annual interest rate and n is the number of compounding periods per year. There are also online calculators that automatically compute for the APY.

| Compounded Interest | Value After 36 Months | Interests Earned | APY |

|---|---|---|---|

| Daily | $10,778.81 | $778.81 | 2.531% |

| Monthly | $10,778.00 | $778.00 | 2.529% |

| Quarterly | $10,776.33 | $776.33 | 2.524% |

| Annually | $10,768.91 | $768.91 | 2.500% |

This is how APYs affect the interests gained depending on what compounding interest has been included in the term, for a $10,000-deposit over a 3-year term at fixed 2.5% interest rate.

Types of CDs

As stated, it was previously thought of that earlier details have made CDs to be known as a type of time deposit – fixed amount gaining fixed interest over a period of time. However, as rates and features become more complex, this savings instrument has also branched out into other types.

- Brokered CDs

Aside from banks and other institutions like credit unions, the US Securities and Exchange Commission also lists independent salespeople and brokerage firms among those who can offer CD accounts. These entities are called deposit brokers, and can negotiate with institutions for higher CD rates by offering high volume of depositors. These brokers then offer these negotiated CDs to potential clients. - Liquid CDs

One of the more recent types of certificates of deposit, liquid CDs give you the flexibility of pulling out your funds earlier than the agreed term. Meanwhile, this type usually offers a no-penalty clause so there are no withdrawal charges. However, most liquid CDs offer lower rates than others, since there is no guarantee that you’ll let the deposit grow until it matures. - Step-up CDs

One of the more flexible options when it comes to interest rates, this type of account offers an incremental increase over regular intervals. The increase depends on the term – for long-term CDs, interest rates are usually computed and increased annually. - Equity-linked

A type of long-term CD, this certificate of deposit ties the rate of return to the performance of another instrument, like stock indexes. The principal is protected, since only the rate of return is the variable. However, this type offers higher risk since it may be prone to volatility and other market conditions. Equity-linked CDs are also callable. - Jumbo CDs

Depending on the amount of deposit, most CDs yield high results because the account have high minimum and maintaining balances, often starting at $100,000. The higher the deposits, the higher the returns especially if the deposits are made long-term. Meanwhile, jumbo CDs are also protected by the FDIC.

When to consider CDs

Although certificates of deposit seem be a high-yield option, there are still a number of advantages, as well as downsides, to this type of savings account. Usually, CDs work if you have a large amount of cash which you believe you won’t be needing for a while. Certificates of deposit can be optimized if you make large deposits, and their rates maximized if you opt for long-term accounts without needing an early withdrawal.

However, since you need fixed amount of time in order to get high-yield results, being a long-term account also works against CDs. If you are saving up for an emergency fund, or anything else where you need money in a hurry, you would be better off opening a regular savings account. In CDs, you need a minimum period before you can withdraw your funds, and for long-term accounts, you need to pay penalties for early withdrawal. In addition, some CDs have no protection against fluctuation factors. Brokered certificates of deposits are not insured by the FDIC, while early-withdrawal penalties are also not covered.

Meanwhile, some CDs are also callable – which means institutions can opt to close them out earlier than the agreed term. This is not to be confused with the maturity date, where the deposit nears the end of its term. If you do nothing upon its maturity, your deposit plus interest will automatically be put into another term cycle, which may work against you if the rates have gone down, or if you need the liquidity.

The CD ladder

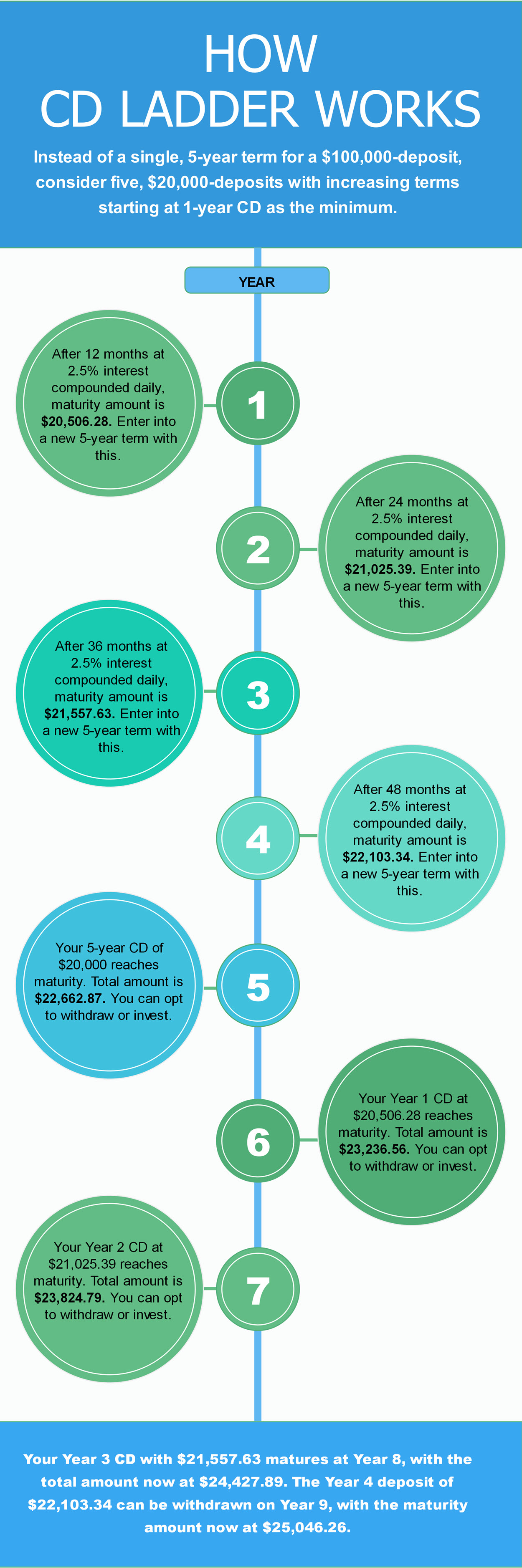

By choosing the right type of CD and leveraging high APY rates, you can maximize yields for your long-term savings. This is where laddering comes in. Some observers have noted that since not being able to tap into the deposit for a long time is a downside for CDs, why not convert it into an advantage instead? What some depositors do is invest proportionally in a number of CDs with different terms.

For example, you have $100,000. Instead of it being deposited into a single CD account with a 5-year term, consider dividing the amount into five, and invest $20,000 into different CDs with increasing terms. If you opted for a 1-year CD as the minimum, you can reinvest the result into a new 5-year CD account after 12 months, the second $20,000 into a new 5-year CD after 24 months, and so on. At the maturity of the original, $20-thousand 5-year CD, you now get to pull out funds annually. This solves the issues connected with long-term accounts and early withdrawals.

With the CD ladder approach, you get the option of withdrawing your funds every year starting from Year 5.

With the CD ladder approach, you get the option of withdrawing your funds every year starting from Year 5.How to start with CDs

The right information is key to maximizing high yields for CDs. Ask your bank or financial institution for their options on certificates of deposits, as most financial instruments like savings, IRAs, and even joint accounts can hold CDs. Also, make sure to clarify with your point person any issues on early withdrawals, fees, and other charges associated with the service. You should also ensure that your CDs, like other savings instruments, are FDIC- or NCUA-insured.

The bottom line

Since they have evolved over the years, certificates of deposits are financial instruments which give high-yield results in savings when they are optimized. There are many options and information available that give you all the details you need in order to make that deposit grow a little more.

About the Author

Benjie has been a bookwork for decades. He believes that writing is a form of expression, and that connecting with readers means you’ve expressed yourself correctly. Writing mostly on tech and social media topics, he continues to win over readers across other areas, too – both to inform and engage. His works have appeared in news publications like Christian Today & on business sites like Freelancer.com.

When taking a break from writing, you’ll most likely come across Benjie in a quiet corner of a room browsing an eBook by Robert Kiyosaki or Napoleon Hill, or reading the latest from Tom Clancy or WEB Griffin. In his spare time he enjoys urban trekking & photography.