Auto Lease Calculator Estimate Your Monthly Vehicle Leasing Payments

Recent Auto Loan Rates

We publish an auto lender review guide to help buyers see current rates from top nationwide lenders.

For your convenience, here is data on what rates looked like across Q1 of 2023 after the Federal Reserve likely completed most of the current hiking cycle.

| Borrower | Credit Score | New | Used |

|---|---|---|---|

| Super Prime | 781 - 850 | 5.18% | 6.79% |

| Prime | 661 - 780 | 6.40% | 8.75% |

| Nonprime | 601 - 660 | 8.86% | 13.28% |

| Subprime | 501 - 600 | 11.53% | 18.55% |

| Deep Subprime | 300 - 500 | 14.08% | 21.32% |

Source: Experian 2023 Q1 data

Here were what rates looked like in Q2 of 2022.

| Borrower | Credit Score | New | Used |

|---|---|---|---|

| Super Prime | 781 - 850 | 2.96% | 3.68% |

| Prime | 661 - 780 | 4.03% | 5.53% |

| Nonprime | 601 - 660 | 6.57% | 10.33% |

| Subprime | 501 - 600 | 9.75% | 16.85% |

| Deep Subprime | 300 - 500 | 12.84% | 20.43% |

Source: Experian 2022 Q2 data, published in August of 2022

For historical comparison, here is what the data looked like in Q1 of 2020 as the COVID-19 crisis spread across the United States.

| Borrower | Credit Score | New | Used |

|---|---|---|---|

| Super Prime | 720 or higher | 3.65% | 4.29% |

| Prime | 660 - 719 | 4.68% | 6.04% |

| Nonprime | 620 - 659 | 7.65% | 11.26% |

| Subprime | 580 - 619 | 11.92% | 17.74% |

| Deep Subprime | 579 or lower | 14.39% | 20.45% |

Source: Experian 2020 Q1 data, published on August 16, 2020

Across the industry, on average automotive dealers make more money selling loans at inflated rates than they make from selling cars. Before you sign a loan agreement with a dealership you should contact a community credit union or bank and see how they compare. You can often save thousands of dollars by getting a quote from a trusted financial institution instead of going with the hard sell financing you will get at an auto dealership.

If our site helped you save time or money, please get your accessories like cell phone chargers, mounts, radar detectors and other such goodies from Amazon.com through our affiliate link to help support our site. Thank you!

Auto Leasing Basics

For a great many drivers, the most important part of their car is that it be new, and that it be as fancy as they can afford. For these people and others, leasing a car is a very attractive option. Leasing opens up more vehicular options than one would normally have, and often lets an individual cycle their ride with greater frequency than they could if they bought; while only 20% of cars on the road are leases, that number jumps quickly to a full 50% of all luxury cars with a driver behind the wheel.

That said, leasing is different than purchasing in several important ways, and it is vital that you understand the rules and regulations of leasing before making a decision on your new ride.

Leasing Basics

In many ways, the process of leasing a car is very similar to buying. You will shop around for a car you like and a dealership offering you a good deal on it. You will sign a contract with all the facts and figures associated with the lease. You will ultimately drive your car off the lot, hopefully with a wide smile across your face.

The core difference with a lease is that you are not making payments toward owning that car: you are simply paying to rent the car. At the end of the lease, you have no equity in the vehicle, and must return it to the dealer. For this reason, in most cases, a lease will result in a higher price being paid over the same period.

Terminology

Most terminology used in the process of car buying can be directly translated to the leasing world, but this is not always the case. There are also many varieties of fees that may be unfamiliar to those who have not leased before. Some important words to know are below.

- Acquisition Fee: A fee charged by the leasing company to handle a lease. This is usually nonnegotiable. Sometimes you will pay this fee upfront when leasing; other times it is including the capitalized cost and so becomes a “hidden” fee.

- Capitalized Cost: The price of the vehicle as used for the leasing agreement to determine payments. This is generally the same as the price if you were to buy the car, though some fees may be included in the capitalized cost.

- Capitalized Cost Reduction: Reduces the capitalized cost, usually resulting in lower monthly lease payments, though for customers with lesser credit ratings a larger capitalized cost reduction payment may be required. It is roughly equivalent to a down payment on a purchased vehicle. Trade-ins can count toward a CCR, as well as some special deals offered by the dealer, known as Dealer Participation.

- Closed-End Lease: A variety of lease that declares the residual value of the vehicle in the leasing contract. This avoids an issue where the customer would have to pay an additional fee if the depreciation of the car ends up higher than expected over the lease period. Most leases are of this type.

- Depreciation: The amount of value the vehicle loses over time – in this case, the life of the lease. The capitalized cost minus depreciation equals the residual value of the car. Higher depreciation will result in higher lease payments, so choosing a vehicle with historically low depreciation can result in a more affordable lease.

- Disposition Fee: A fee levied upon return of the vehicle at the end of a lease, used to prepare the vehicle for resale.

- Early Termination Fee: A fee charged the customer if he or she ends the lease prematurely. Vehicles lose substantial value as soon as they are driven off the lot, and the rate of loss slows afterward; but this depreciation is applied evenly over the whole period of the lease in the contract. Returning a leased car early would force the dealer to absorb most of the depreciation without recouping it from lease payments. The early termination fee, which is usually rather large, discourages this behavior.

- End-of-Lease Purchase Price: An amount, usually stated in the leasing contract, that the customer can buy their leased car for if they choose to at the conclusion of the lease period. Most often closely tied to the residual value, if they are not identical. A customer who leases a car then purchases it at the end of the lease will usually end up paying slightly more than if they bought the car outright.

- Excess Mileage Charge: Most leases come with limits on how many miles you can put on them, usually around 15,000 miles per year. Going over this amount will result in a charge per mile when the car is returned. Since this charge is usually high, if you anticipate needing more miles, you can often get a much better rate negotiating before going over.

- Excess Wear-and-Tear Charge: A fee the customer pays at the end of the lease term if the car is not returned in expected (usually excellent) condition. Scratches, dents, and damaged upholstery are some things that could cause a wear-and-tear charge. This charge is often more than you would pay getting repairs done yourself, so doing so before the end of the lease term is usually advised.

- Lease Term: The length of time you agree to pay a monthly payment to the leasing company in return for renting the car. Most leases have a two- or three-year duration, but leases from six months to sixty months are sometimes available.

- Lessee: The individual leasing the car from the dealer for the stated period.

- Lessor: The company or dealer leasing the car to a customer in exchange for payment.

- Residual Value: The amount the car is expected to be worth at the end of the lease term. Capitalized cost minus depreciation equals the residual value. This amount is usually equivalent to the resale value of the car if instead you had purchased it and attempted to sell it or trade it in, given the same period. A higher residual value means less paid to lease the car overall, so it is advised you lease a vehicle with a traditionally high residual value. Sometimes automobile manufacturers will have promotional deals where a special RV, usually higher than it would be otherwise, is used to negotiate the lease.

- Security Deposit: Just like a security deposit you put down on a rental property, an amount you pay upfront when leasing a car that is usually refunded when the vehicle is returned in good condition.

- Subvented Lease: A lease with more favorable terms than a standard lease due to some intervention by the dealer or manufacturer. Most often a manufacturer will guarantee a higher-than-normal residual value on the vehicle for calculating the lease payments. Sometimes a low interest rate or capitalized cost reduction is used instead. Usually manufacturers will subsidize leases on particular models that are not selling as well as expected in an effort to get more of them on the road.

The Best Candidates for Leasing

The best candidate for choosing to lease a vehicle over buying it is a business that requires a company car but does not use it especially heavily. In the majority of cases, costs for a business vehicle can be deducted as a business expense on the company taxes every year. This minimizes the price differences between leasing and buying while securing the benefits leasing has for the business.

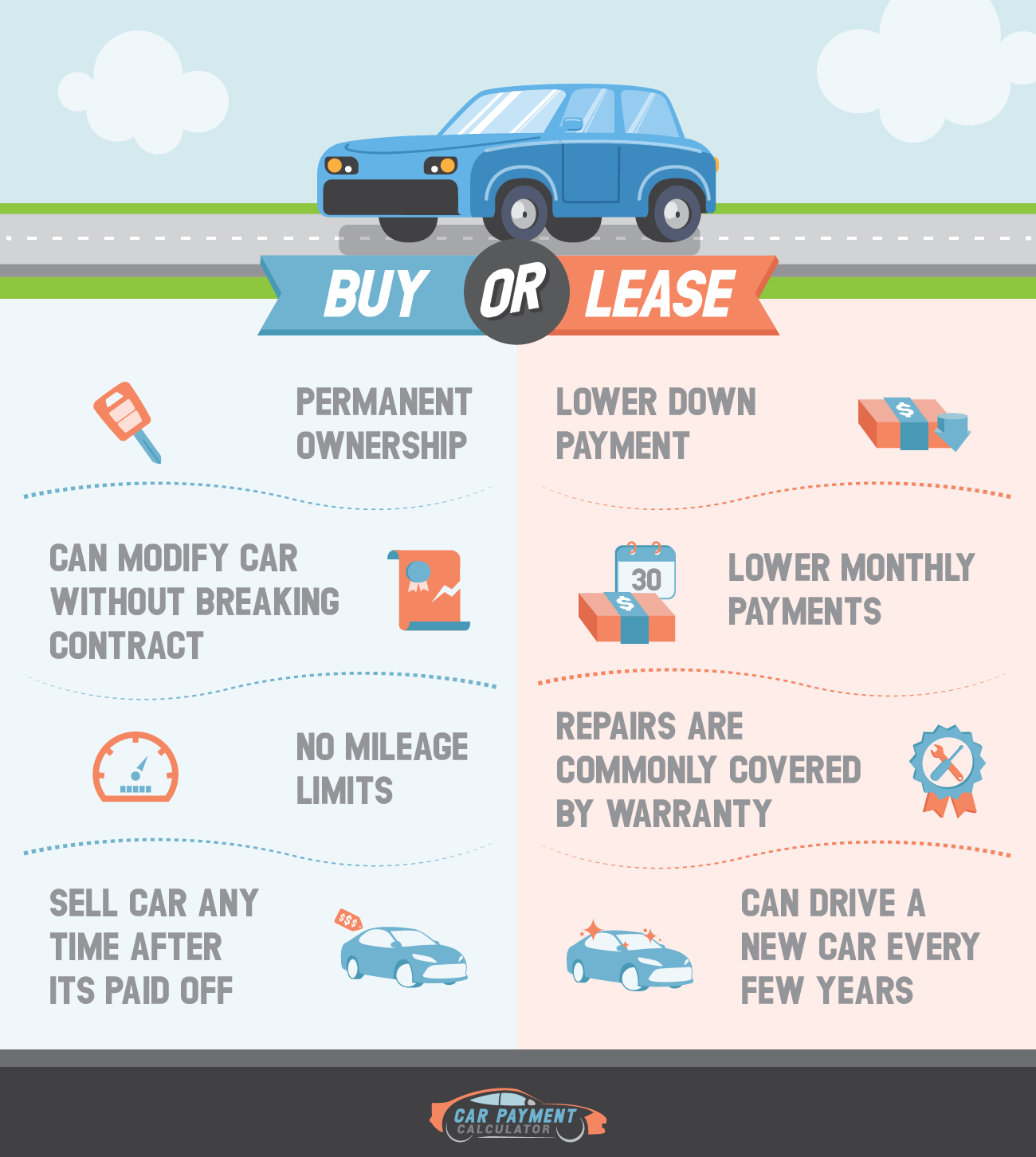

Financially, leasing is not as hard on a customer’s pocketbook. A leasing capitalized cost reduction is usually substantially less than a down payment on a purchase of the same vehicle (given that the leasing term and the loan term are equal duration). Monthly payments are also often quite a bit lower in a lease agreement compared to an equal-length loan, freeing up more cash for the customer on a month-to-month basis.

If a motorist fully intends to switch out his car every two or three years, rolling from lease to lease might be simpler than going through the process of buying, paying off, and selling an owned car every cycle. Since the customer never makes substantial use of the equity they have in the purchased vehicle, the difference in out-of-pocket expense in a lease can be a bright spot. For both motorists and businesses, the benefits of driving a new car off the lot every two or three years can also outweigh the higher costs of leasing, including reduced maintenance required and the aesthetic and emotional benefits of having a new ride.

The Worst Candidates for Leasing

Most crucially, all else equal by the end of the contract, a lease will always cost more than a loan of equal duration once the residual value of the vehicle is taken into account. While a lessee will have taken substantially less money out of their own wallet during the full course of the agreement, the buyer will end up with a vehicle they own completely and can sell or trade in at their leisure, usually netting out an additional $1,000 to $2,000 if the vehicle is sold at full expected residual value as soon as loan repayment ends.

If the loan repayment period is longer than the lease contract (most lease contracts are 24 or 36 months; most loan repayments on vehicle purchases are 48 or 60 months), the overall financial picture does converge, since the buyer will end up paying additional interest on the loan over that longer duration. While this rarely eliminates the financial advantage of buying, it does minimize it, making non-financial concerns between leasing and buying more important.

The fact that you do not own the car you drive off the lot makes for a number of differences between buying and leasing that can strongly influence decisions. Anyone who tends to put a lot of strain on the car is probably better off buying; else they risk being charged with a hefty wear-and-tear fee when they return the leased vehicle. Any damage you incur on your own vehicle, on the other hand, can be dealt with at your own leisure to whatever degree you are satisfied with.

Buying remains the better choice if you intend to drive the car excessively, as even if you negotiate for more than the standard 15,000 miles per year allowed on most leasing contracts, the ultimate financial difference between leasing and buying will only grow the more you drive. If you fail to negotiate these increases but still go over your mileage limit, the fee – usually between 15 and 25 cents per mile – can add up very quickly.

Anyone unsure about their financial situation a few years down the line is advised to shy away from leasing. A purchased car can be resold at the owner’s leisure, as long as the remainder owed on the vehicle is paid off with part of the proceeds. A lessee has less freedom. The lease contract is binding for the full duration, and canceling early almost always results in a very hefty early termination fee. A lessee thus has far fewer options in the event of a financial catastrophe.

The Mechanics of Leasing

At the end of the day, the main benefit of leasing is that you are not financing the entire cost of the vehicle. Instead, you are essentially paying for the depreciation of the vehicle over the period you lease it, plus interest, plus any applicable fees (some of which are nonnegotiable, and some which may result from improper care of the vehicle). There are four primary considerations when evaluating a lease agreement:

- Initial payment, including the capitalized cost reduction (a lease “down payment”) and any fees

- The amount of your monthly payment for the duration of the lease term

- The total length of the lease term

- Any applicable fees at the end of the term

The monthly payment is where most of the cost of the lease is tied up, and is based on two main factors: the capitalized cost and the residual value. Capitalized cost is usually very close to the price of the car just as if you were buying it. Residual value is the amount the car is worth at the end of the lease term. The difference is financed at a particular rate of interest, usually known as the lease rate, to determine your monthly payment. The interest rate depends strongly on your credit rating and can dramatically affect the overall cost of a lease; in general, the highly appealing rates seen in car advertisements are available only to individuals with spotless credit ratings.

Monthly payments can also be reduced with a capitalized cost reduction. This is similar to a down payment in that it is a larger sum of money paid up front that reduces the monthly payment (since the difference between the capitalized cost and the residual value is smaller). Whether a CCR is required depends on the individual lease, the dealer or leasing company, and your credit rating. In some situations, a CCR may not be required at all. Dealer participation is a reasonably common type of lease promotion that acts as a CCR, improving lease terms.

The customer can also reduce the monthly payment by attacking the other end of the equation: the residual value. This figure is estimated and published for every make and model car by several companies (such as Kelley Blue Book), sometimes as often as every two weeks. The customer has no direct control over this figure, but he or she can choose to lease a car that has a high residual value, which means better lease terms over a car with a low residual value. Sometimes a manufacturer, wishing to promote a particular model, will offer a higher residual value for a lease than a car would receive normally, improving lease terms.

Fees are the smallest part of the equation, but they can make for a very unpleasant surprise if ignored entirely. Most leases are subject to a nonnegotiable acquisition fee at the outset of the contract. Sometimes this fee must be paid up front, in cash; other times it is rolled into the capitalization cost and not itemized, making it a hidden fee. A disposition fee is similar but paid at the end of a lease, used to pay for returning the car to sellable condition for the dealer. Early termination fees only come into play if the lessee attempts to end the contract early, and are usually very punishing.

Other fees you might pay at the end of the term are conditional upon treatment of the car. Most leases allow mileage of about 15,000 miles per year, with every mile over that costing an additional 15 cents or more per mile at the end of the lease term. The wear-and-tear fee for any damage to the vehicle can also bump the final price.

Above all, be sure to read the lease contract closely and be familiar with all the costs associated with the lease before signing anything.

Lease Buyout Options

Most lease contracts will include an option to buy the vehicle at the end of the term, after a certain amount of time has passed, or even at any point during the lease period. The price for this is usually predetermined and stated in the contract, and closely tied to the expected residual value of the vehicle at the time the contract was written.

If considering a lease-end buyout, think of it as any other used car purchase. One distinct advantage is that if the lessee is considering a buyout, she likely already knows that she enjoys driving the car, and she is familiar with the full extent of its history and condition. Most of the time, the buyout price is negotiable, though some lease companies will have what is known as “residual insurance.” Residual insurance guarantees the lessor the difference between the residual value and the wholesale price of a returned car, meaning they have no incentive to sell it to you below the residual value. You have no way of knowing if a company will negotiate unless you try.

Early lease buyouts are more complicated and often more costly than one might expect. Since depreciation is greater than the monthly payments for much of the lease period, what is owed on a lease may be significantly higher than the remaining duration would suggest. The complicated recalculations to determine the adjusted buyout price also apply much of the lease payments already made to fees and other charges, keeping the amount owed on the lease high. For this reason, it is usually beneficial to wait until the lease end to buy it out.

It is worth noting that conditional charges, such as excess mileage and wear-and-tear, are ignored if the lease is bought out.

Lease-Like Financing

In recent years, companies have started offering “lease-like” financing options that are promoted as having benefits of both purchases and leases. Often, these deals could be better described as having the drawbacks of both purchases and leases.

The vast majority of financing options advertised as lease-like are actually a standard variety of loan known as a “balloon” loan. The customer is loaned money just as with any other loan, which is then used to purchase the car. The payments on this loan are significantly lower than a normal car loan – normally very close to a traditional lease payment.

These balloon loans are often across longer periods than a standard lease, up to 60 or 72 months, so the customer ends up paying more for the car in the form of interest. At the conclusion of the period, the customer is presented with an option: return the car, or make one large payment (known as the balloon payment) to cover the entire remainder of the unpaid portion of the loan at once.

The catch is that the balloon payment is almost always less than the car is worth, so if the purchaser does not keep the car, he is essentially handing the dealer his equity.

The long loan duration and very low payments mean the buyer will pay significantly more in interest over the life of the loan than with a normal purchase – similar to the extra costs incurred by leasing. The long duration again coupled with the fact that the balloon payment structure strongly encourages buying at the end means the customer is not able to easily acquire a new car, stay in warranty, or avoid maintenance – similar to a purchase. While they may look good on the surface, lease-like financing deals are very rarely good for the customer in the end.

Conclusion

While leasing has fallen slightly out of favor compared to the 1990s and dealers do not have quite as many special promotions available to reduce the costs, it nonetheless remains a viable alternative to purchasing as long as the buyer knows what to expect. As with any major decision, carefully reading through the contract and understanding all the fees, payments, and interest associated can help the prospective lessee come to a reasoned decision.