Compare Fixed, ARM & I-O Home Loans

Choosing Fixed or Adjustable Rates for First-time Housing Loans

Published October 8, 2019 by Benjie Sambas

As a first-time buyer, one needs to carefully explore all options to choose the best type of loan that optimizes the borrower’s finances. Getting the right loan is the ideal situation for all. The lender risks as little as possible, while borrowers get their first home without any unfavorable surprises.

However, choosing the best mortgage loan is not that simple. There are some concepts that borrowers need to be familiar with. They should explore these ideas thoroughly to secure loans with beneficial terms.

Mortgage facts

Instead of paying in full, financing is the most common method of acquiring a house for first-time buyers. Although owning a home outright by paying in cash is a fine idea, it’s highly impractical. Borrowers will need to be unbending in their budget, or else live miserly, to save enough and get the house for its full purchase price. They also need to do this in as little time as possible.

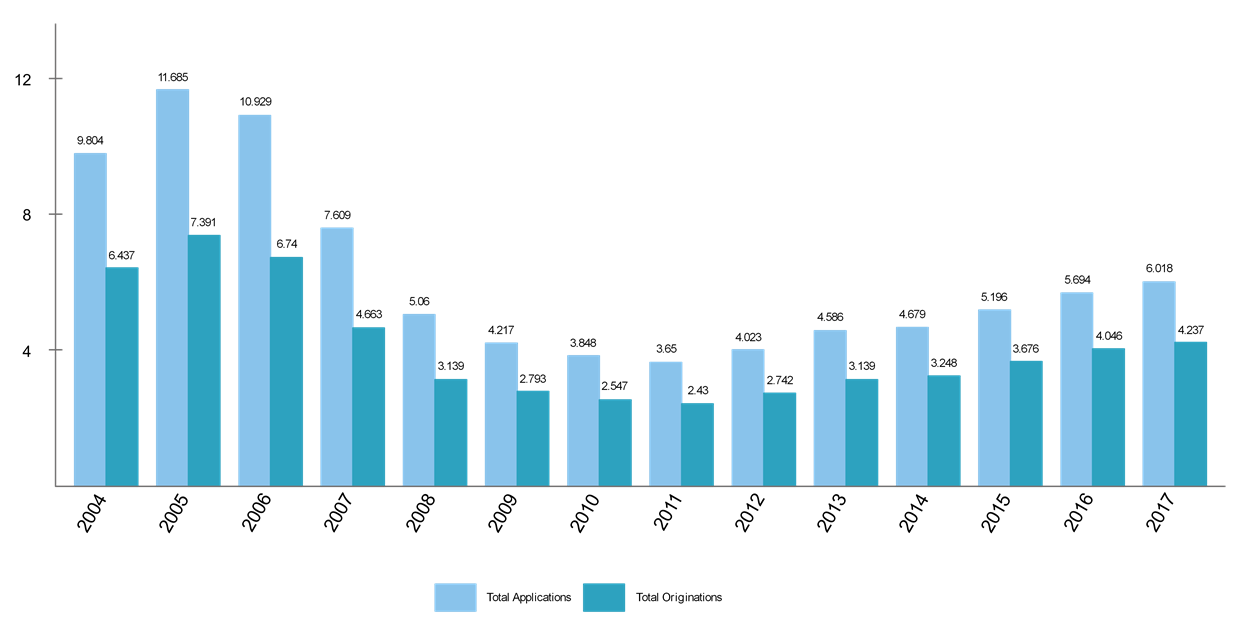

Housing loans have become the popular method of purchasing a home, especially for first-time owners. In 2017, the applications for purchase loans have totaled at least six million. However, these figures indicate that the industry is still in recovery after the downturn years. Before the recession, numbers have totaled at least 10 million applications.

Applications and origination from 2004-2017, in millions

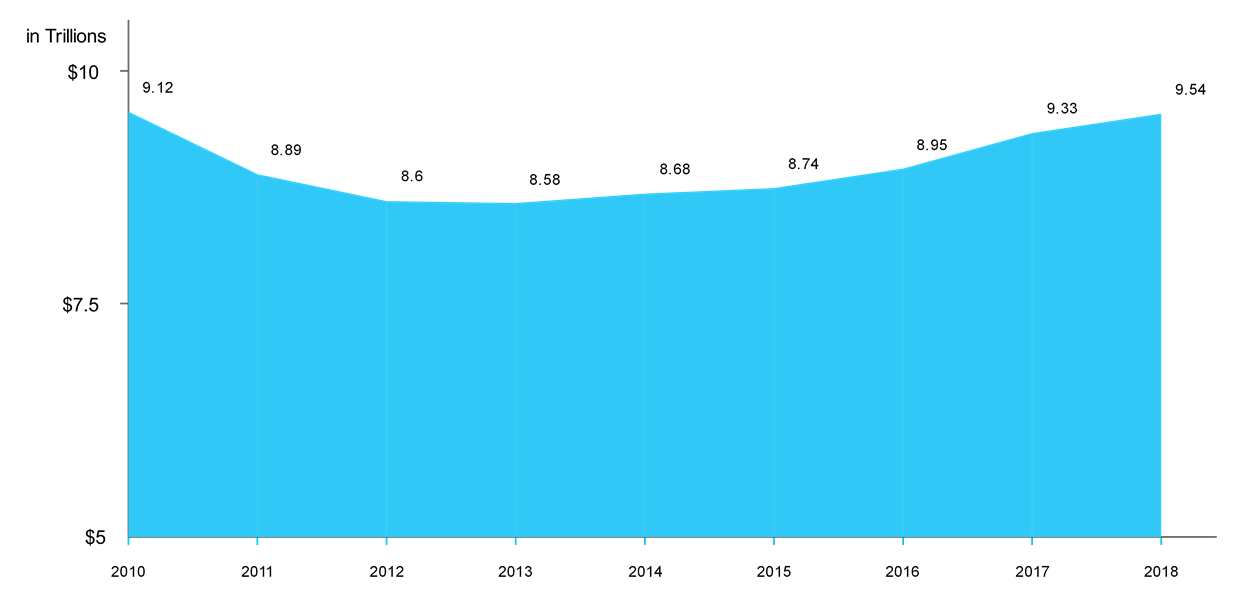

The housing market continues to recover, and a large portion of the industry share is from mortgages. In 2019, the total outstanding mortgage debt is at $10.9 trillion. Other house loan-related details like equities and interest rates are also on a positive turn.

Total outstanding housing debt, 2010-2018

Meanwhile, not all applications get approved, since there is a screening process. There are a number of requirements needed before the request is underwritten and approved.

Pre-approvals and loan purchases, in millions

| Purchased loans | Requests for pre-approval | Approved but not acted on | Denied requests | |

|---|---|---|---|---|

| 2004 | 5.142 | 1.068 | .16 | .171 |

| 2005 | 5.868 | 1.260 | .166 | .231 |

| 2006 | 6.236 | 1.175 | .189 | .222 |

| 2007 | 4.821 | 1.065 | .197 | .235 |

| 2008 | 2.935 | .735 | .099 | .177 |

| 2009 | 4.301 | .559 | .061 | .155 |

| 2010 | 3.231 | .440 | .053 | .117 |

| 2011 | 2.939 | .429 | .055 | .130 |

| 2012 | 3.163 | .474 | .064 | .149 |

| 2013 | 2.788 | .474 | .069 | .123 |

| 2014 | 1.8 | .496 | .064 | .125 |

| 2015 | 2.126 | .531 | .063 | .115 |

| 2016 | 2.232 | .514 | .060 | .115 |

| 2017 | 2.087 | .481 | .036 | .107 |

This is where information about housing loans is helpful. The more details borrowers are familiar with, the higher the possibility of the lender granting their loan.

Understanding interest rates

Aside from knowing how long to pay off the loan, another important detail in securing a mortgage is the additional interest the borrower needs to pay. The lender sets the interest based on many factors. The interest rate also affects the loan term and total payments for the loan.

Rate or APR?

Often used interchangeably, the interest rate and the APR of a housing loan are two different things.

The interest rate is the “service fee” that lenders charge the borrower for the loan, with the rate applied on the principal. The total interest amount adds to the loan term and folded into the monthly payments.

The APR is the annual percentage rate, which is a metrics for lenders and borrowers to get a general sense of how much the mortgage will cost. The APR includes the interest rate, points, broker fees, and other charges added to secure the loan.

The APR is higher than the interest rate, but it is also expressed as a percentage. This is where the confusion stems from. If the lender estimates the payments using the interest rate, the monthly payment amount will definitely increase. The computed amount is only for the principal plus the interest, with no add-ons and other loan costs.

Loan types based on interest rates

The type of loan to apply for depends on the interest rate as structured and applied to the principal. While there are many types of housing loans, the most popular ones include fixed-rate loans and adjustable-rate mortgages.

Fixed-rate mortgages (FRM)

FRM is popular with first-time loan takers because it’s a simple setup. The interest rate applies to the principal, and the total amount divides into regular payments for the terms that the borrower and lender agree on. The monthly payment on both principal and interest remains the same throughout the duration of the loan. Only add-ons like insurance and taxes change the monthly amortizations.

One distinct advantage of fixed-rate mortgages is stability and security. Outside of add-on charges, the payment amounts mostly remain stable. The loan is also secured against inflation, since interest rates get locked in and remain the same throughout the duration of the loan.

The only time that monthly loan payments will significantly change is when the loan defaults or when the borrower gets a refinance. Defaulting may make the lender get the services of a collector and will add new fees on top of the loan payments. Refinancing restructures the loan, with better terms for the outstanding balance.

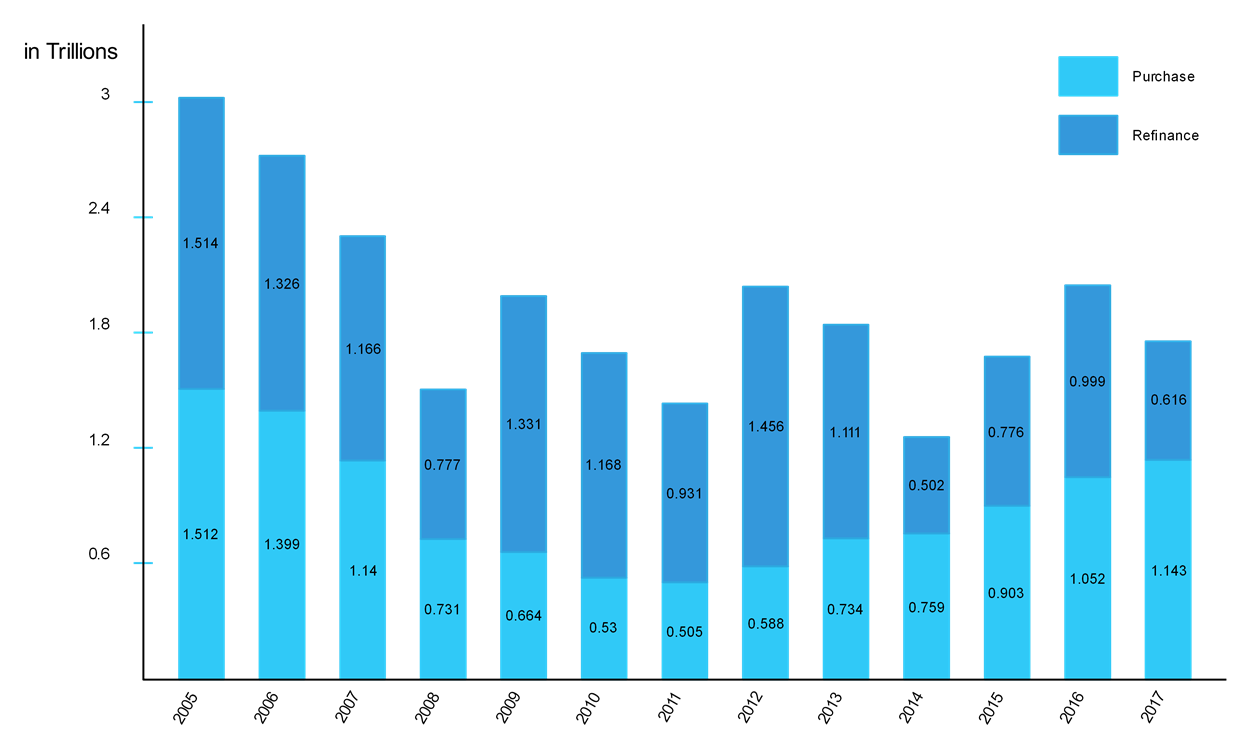

Mortgage origination, 2005-2017

Since fixed-term mortgages have their agreed-on rates spread throughout the duration of the loan, one detail that affects the monthly payment amounts is the loan term. The lender and borrower agrees on how long to pay for loan. The most recognized terms are 15- and 30-year loans. According to loan guarantor Freddie Mac, almost 90% of homebuyers choose a 30-year term when applying for a mortgage.

Lenders may also present other terms depending on different metrics, mostly the financial capacity of the borrower.

Comparing different loan terms

| 10-Year | 15-Year | 20-Year | 25-Year | 30-Year | |

|---|---|---|---|---|---|

| Interest rate | 3.6% | 4.2% | 4.7% | 5.1% | 5.8 |

| Monthly payment | $1,950 | $1,500 | $1,287 | $1,181 | $1,174 |

| Total interest | $33,968 | $69,910 | $108,878 | $154,259 | $222,462 |

| Total payments | $233,968 | $269,910 | $308,878 | $354,259 | $422,462 |

Lenders may offer different terms. Note that on a $200,000 loan, longer-term options offer minimal monthly payments. However, interest rates increase for longer loan period. A 30-year term can total more than double the principal amount.

Graduated payment mortgage (GPM)

Aside from the different loan terms offered by lenders, there are some specially-structured FRMs that may fit a borrower’s financial profile. A graduated payment mortgage is an example. Although the interest rates remain fixed, it is not spread over the loan duration, like a traditional FRM. Instead, lenders offer lower interest rates at the initial years, then gradually increases the rates.

FHA loans have this type of structure, especially for first-time homebuyers who can’t come up with a large down payment. GPM loans backed by the FHA typically finances up to 96.5% of the home’s value.

This type of FRM is different from adjustable-rate mortgages. GPMs start from a much lower base for monthly payments, and adjusts the amounts gradually until reaching the full monthly payment amount.

Adjustable-rate mortgages (ARMs)

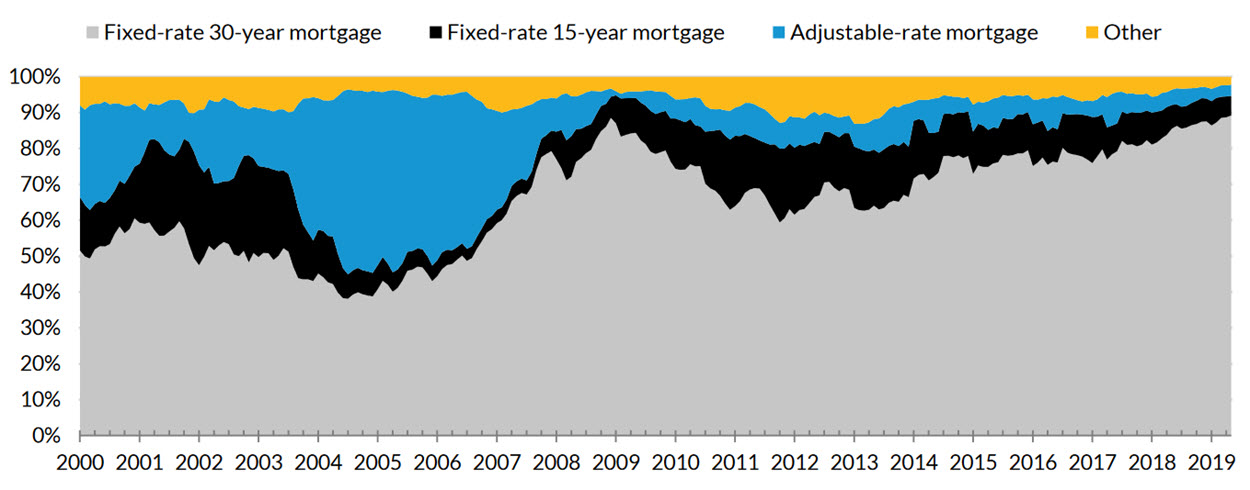

ARMs became common pre-recession. Before 2007, most lenders are offering adjustable rates programs to clients, including those who were not financially-qualified to be house owners. Most applied because of the teaser rates. These are the initial rates paid during the introductory period, and is regularly less than FRM rates. According to the New York Fed, the ARMs share for loan origination even reached peaks of 60-70% of all loans in 1994.

Post-recession, safeguards went up, and the average volume of ARM loans dropped to single digits compared to fixed-rate mortgage origination during the recovery years.

Product composition, mortgage origination

What are ARMs, and how do these mortgage options compare with fixed interest rates?

Adjustable-rate mortgages derive their rates differently than FRMs. Even at the same 30-year duration, ARMs get their rates adjusted, most often annually. Although fixed-rate mortgages take up much of the housing industry, sponsors like FHA still guarantee ARM loans, with different structure and payment terms.

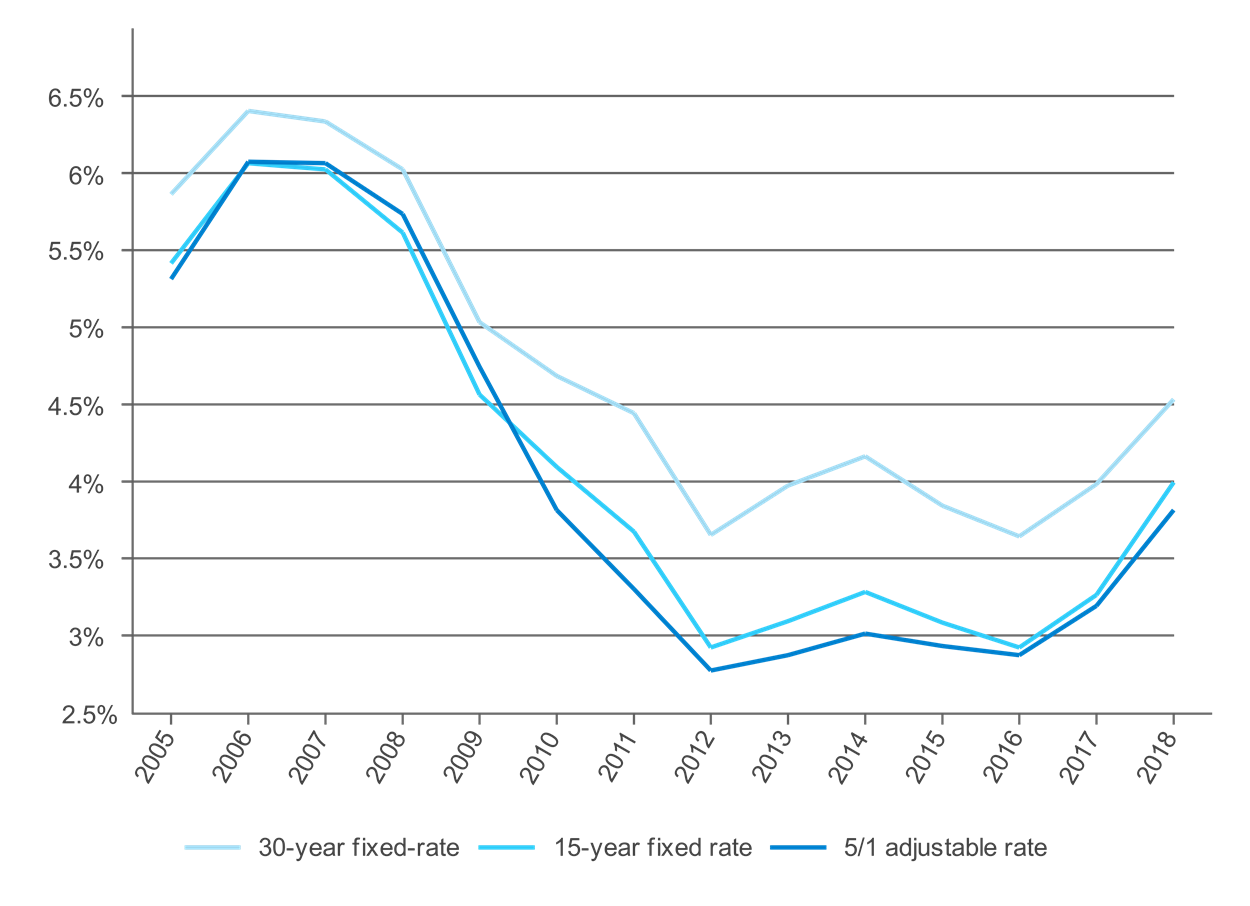

Mortgage interest rates over the years

In an FHA traditional ARM loan, the rates get adjusted immediately after a year, structured as 1/1. This means that the first year (x/1) serves as the introductory period, with lower interest rates than the standard. After a year (1/x), the loan enters into a reset date, where the rates get adjusted based on a new ARM rate. After another year, the loan enters into an adjustment date, when the rates get recomputed and the new payment amount applied. The adjustment dates occur every period agreed upon on the duration of the loan. An ARM loan is usually a 30-year term.

Aside from the traditional 1/1 ARM, there are other loan terms called hybrid ARMs. These type of loans offer longer introductory periods. Some also enforce different adjustment periods other than an annual one. However, these types are uncommon, so most ARM terms are on an x/1 adjustment option.

Popular hybrid ARMS include 3/1, 5/1, and 7/1 terms. There is also a longer 10/1 hybrid ARM.

One of the main advantages of ARMs is flexibility in both structures and rates. The introductory periods often offer lower interest rates than FRMs, which makes for manageable monthly payments. Low payments are particularly appealing to first-time homebuyers. Meanwhile, low interest rates, especially in the opening years of the loan, is an ideal scheme for those without the ready finance for a huge down payment.

Since ARM rates are not fixed, lenders use another set of metrics to derive the prevailing rates for ARM loan. ARM interest rates get computed using the index and the margin.

Index and margin

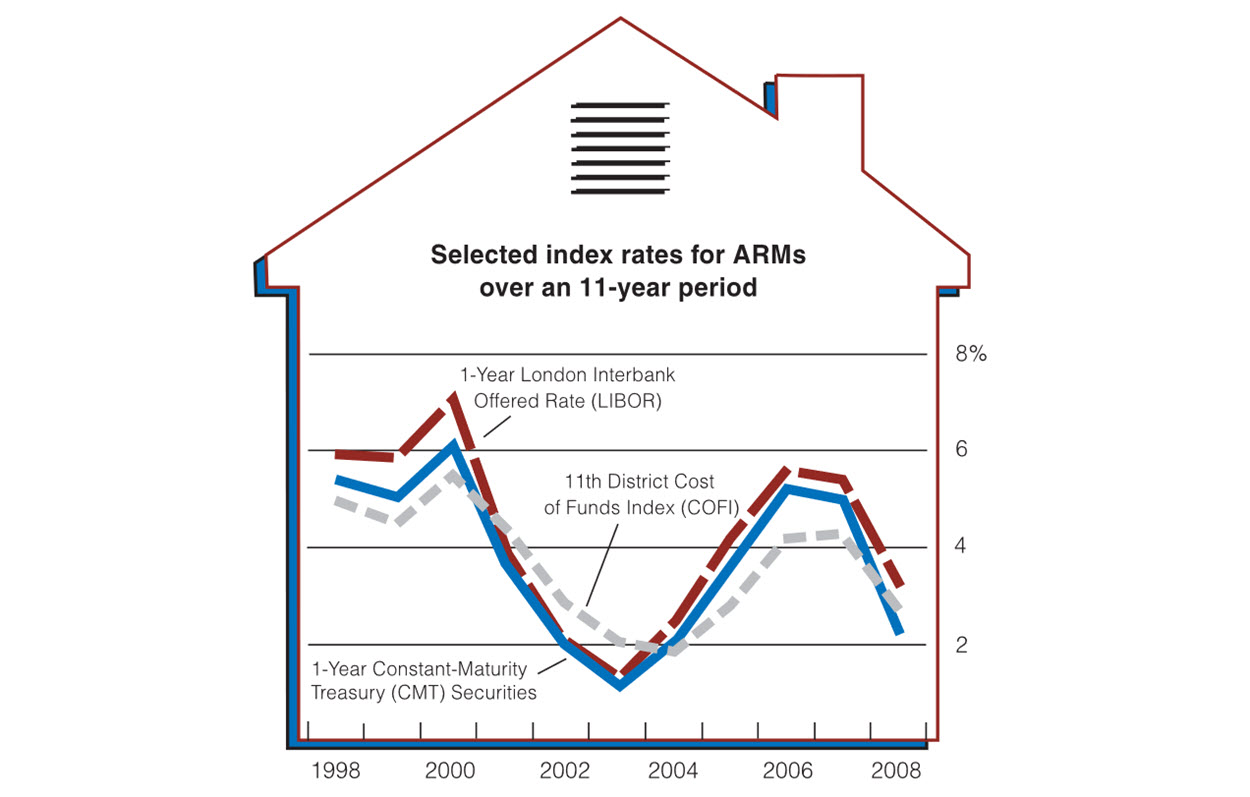

The index is the benchmark rate which lenders use for ARM rates. This may vary from lender to lender. A popular index that institutions use is the one-year LIBOR, or London Inter-Bank Offer Rate. Other indexes that lenders use include the 11th District Cost of Funds Index (COFI), Constant Maturity Treasury (CMT), and the prime rate. Meanwhile, there are some proponents of a new index for hybrid ARMs. Advocates are proposing a new index based on the Secured Overnight Financing Rate (SOFR). Supposedly, this new index will become a standard in 2021.

Popular indexes for ARM rates

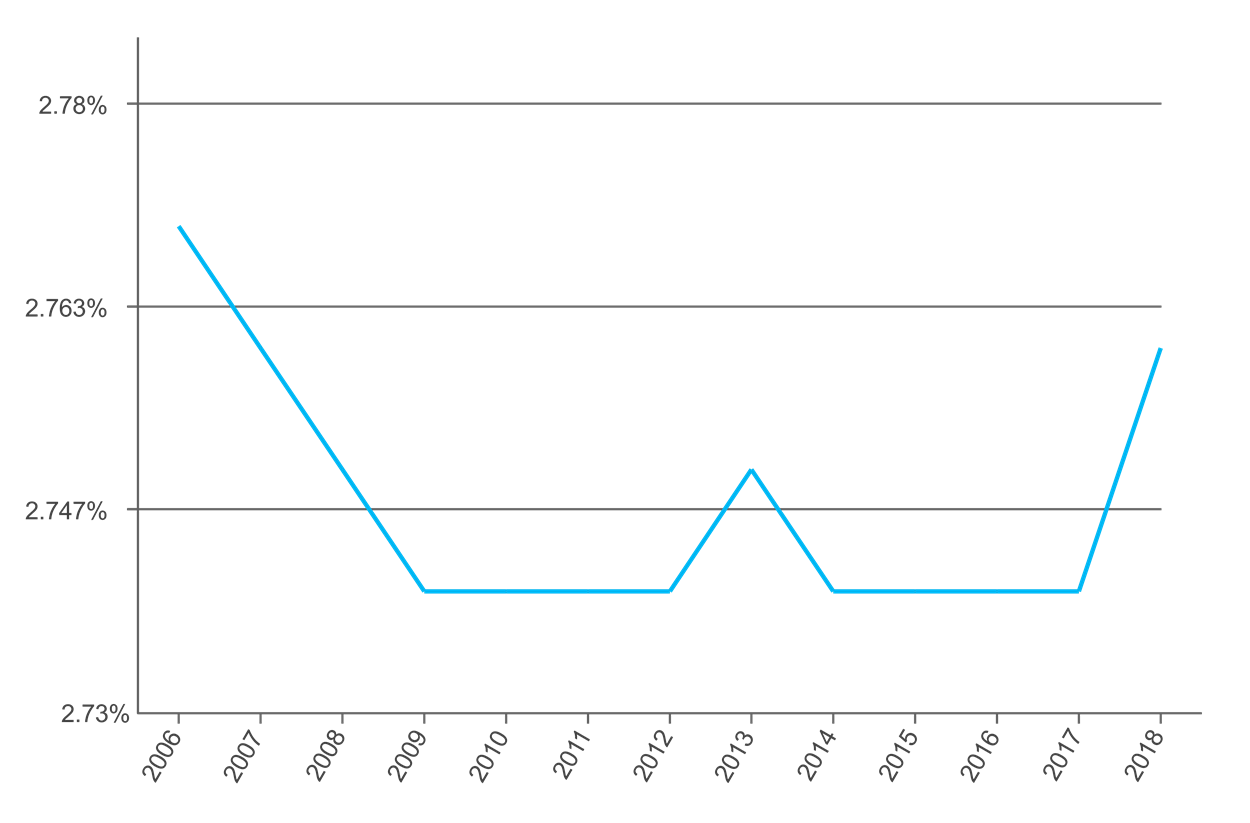

The margin gets added to the index to come up with the fully indexed rate. While the index is a variable component of the ARM rate, a margin remains fixed until the loan’s closing. However, this is still an advantage. Usually, lenders give a lower margin to high-credit applicants. This means that those with high credit scores with ARM loan applications can expect lower monthly payments after the teaser period.

Average margin for ARM loans, 2006-2018

Interest caps

Although ARM rates change, there is a limit to how much lenders can adjust the numbers. There are three known interest rate limits in ARM loans.

- The initial adjustment cap is the limit to the interest rate for the first adjustment. This means the limit applies just after the reset date. Generally, the adjustment cap is set between two to five points higher than the initial interest rate.

- The annual interest rate limit is the cap for the fully indexed rates which follows after the initial adjustment. Typically set at two points higher.

- The life-of-loan rate cap is the limit set by the lender in total all throughout the duration of the loan. For example, if the lifetime rate cap is set at 5%, and the initial rate is at 3%, it means that the maximum interest rate a lender can impose on a 30-year term is 8%.

Questions to ask

Choosing between fixed-rate or adjustable-rate mortgage can be a daunting task. As first-time homebuyers, getting a loan can be the biggest investment you make, or the heaviest debt you need to manage.

Like most financial instruments, both mortgage rates structures have their own upsides and downsides, and each can be the best fit to finance the home that you want. You need to thoroughly assess yourself if you can push through and commit to having a loan.

What’s my financial situation like?

There are available official reports that can gauge what type of loan suits you best. However, a self-examination won’t hurt. Check credit scores, DTI, and other financial metrics so you can to have an idea on the loan terms, payments, and loan type that will be the best fit.

How long do I plan to stay?

Most ARM advocates say that borrowers who don’t have long-term plans to stay in their houses can apply for adjustable rates. The teaser period allows them to pay less than when getting a fixed-rate term.

What’s my financial capacity?

Getting a 15- or 30-year fixed-rate loan is a safe choice for those who want stability and security. As a simple setup, FRMs don’t have surprises when it comes to price changes. For those with cash reserves, aside from a shorter-term FRM, a hybrid ARM is another practical option.

Although ARM loans have higher interest rates after adjustment, ample cash reserves or an above-average income can cover them. This is the same with short-term fixed-rate loans, as monthly amortizations are higher due to the shorter duration.

However, another advantage of ARM is the flexibility of its rates. Lower rates mean payments can decrease especially in today’s wave pattern on indexes and margins. This is an advantage over fixed rates which are already locked in for the duration of the loan.

Can I afford significant increases?

ARM loans offer low interest rates on their introductory period. Once the reset date happens, interest rates may go at least twice as high. Check the Loan Estimate to get an idea of how monthly payments will change throughout the loan. Meanwhile, if borrowers prefer to pay regular amounts over a longer period, a fixed-rate loan is the best fit.

What’s my end goal?

Some first-time homebuyers get a loan not because they wanted to own a house. Rather, they want to invest. Real estate appreciates over time. FRM is the best choice for first-time borrowers who want to invest on a house they can call their own. However, those who want to invest can take advantage of lower ARM rates. This is a huge advantage especially for high-priced locations, since lower rates can mean high returns.

The next steps

Choosing the type of loan based on their interest rates is only a small part of the mortgage process. Whether selecting fixed-rate loans or hybrid ARMs, both first-time borrower and lender have much to discuss before closing the loan agreement.