How Much Will You Have Saved for Retirement? Set Your Goals & Plan Accordingly

Increase Savings With Maximized Retirement Plans

Published September 26, 2019 by Benjie Sambas

People who have worked hard throughout their life are looking forward to the day they retire. However, different factors over the years made retirement planning a must. Although most people expect to retire at 65 or 70, there are some who have already retired early. These early retirees have managed to put up a decent nest egg for their retirement funds.

Nowadays, the concept of retirement planning has changed. People can now prepare for post-work years at any stage in their lives.

Expectations on retirement

The most common notion about retirement is that people stop working when they reach 60 years or older. This is the general thought, since most countries has a standard retirement age, usually from late 60's and upwards. However, there are some who still continue to work well into their 70's. According to the Employee Benefit Research Institute, the median age that retirees said they have stopped working is 62. This is a long shot from active workers who have expected to retire at 70.

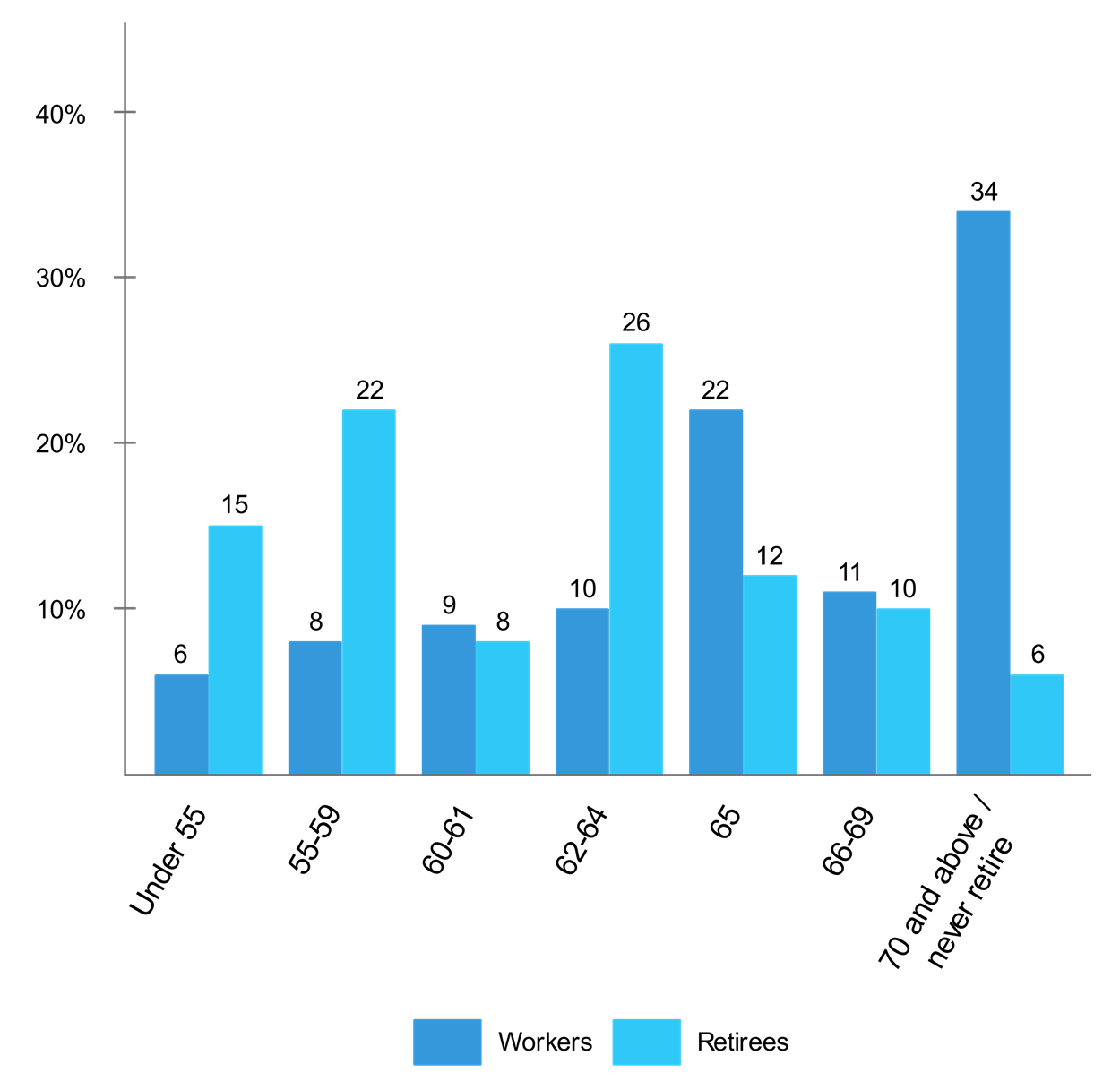

Workers' expected retirement age versus actual retirement age

Most workers are expecting to retire at 70 and above, and some said they won't stop working. However, most have retired at age 65. (Employee Benefit Research Institute)

Most workers are expecting to retire at 70 and above, and some said they won't stop working. However, most have retired at age 65. (Employee Benefit Research Institute)Meanwhile, in case of retirement expectations, there are still those who have put in their retirement later than planned. There are also others who have continued working even if they are already of retirement age.

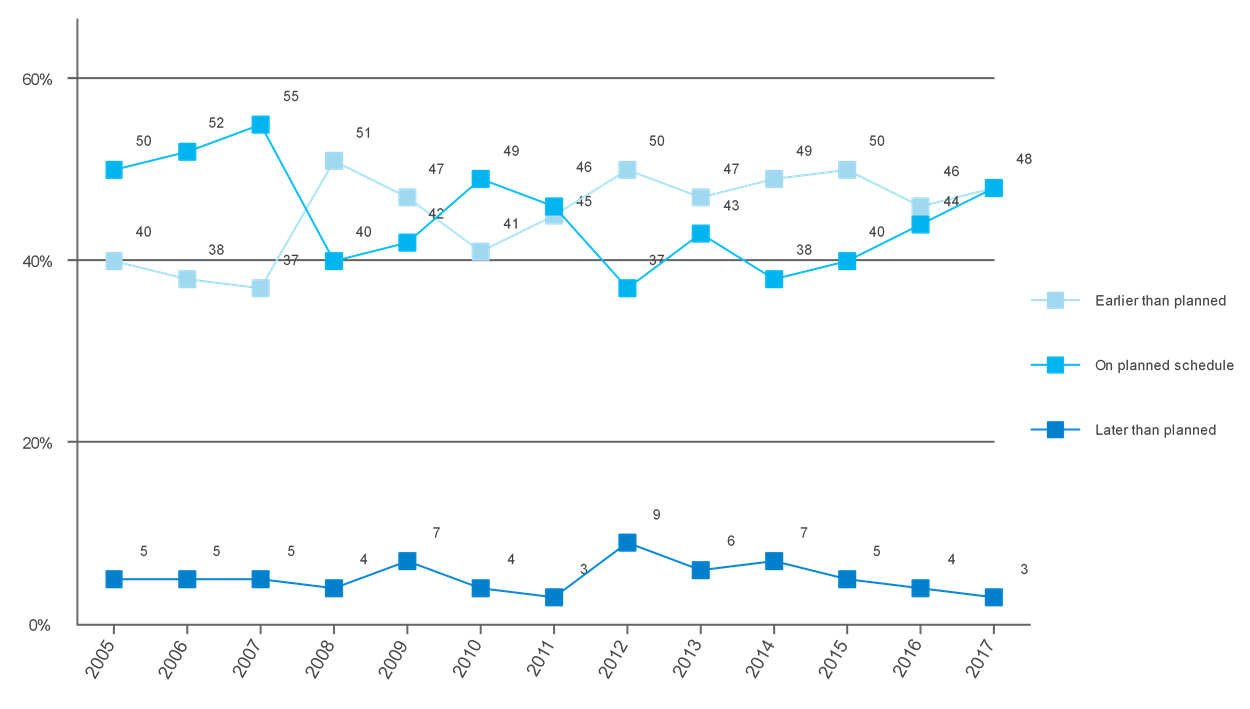

Retirement age expectations

While most employees usually retire on the age that they have planned to, there are still some who worked past their desired retirement age. (EBRI)

While most employees usually retire on the age that they have planned to, there are still some who worked past their desired retirement age. (EBRI)Post-retirement work expectations

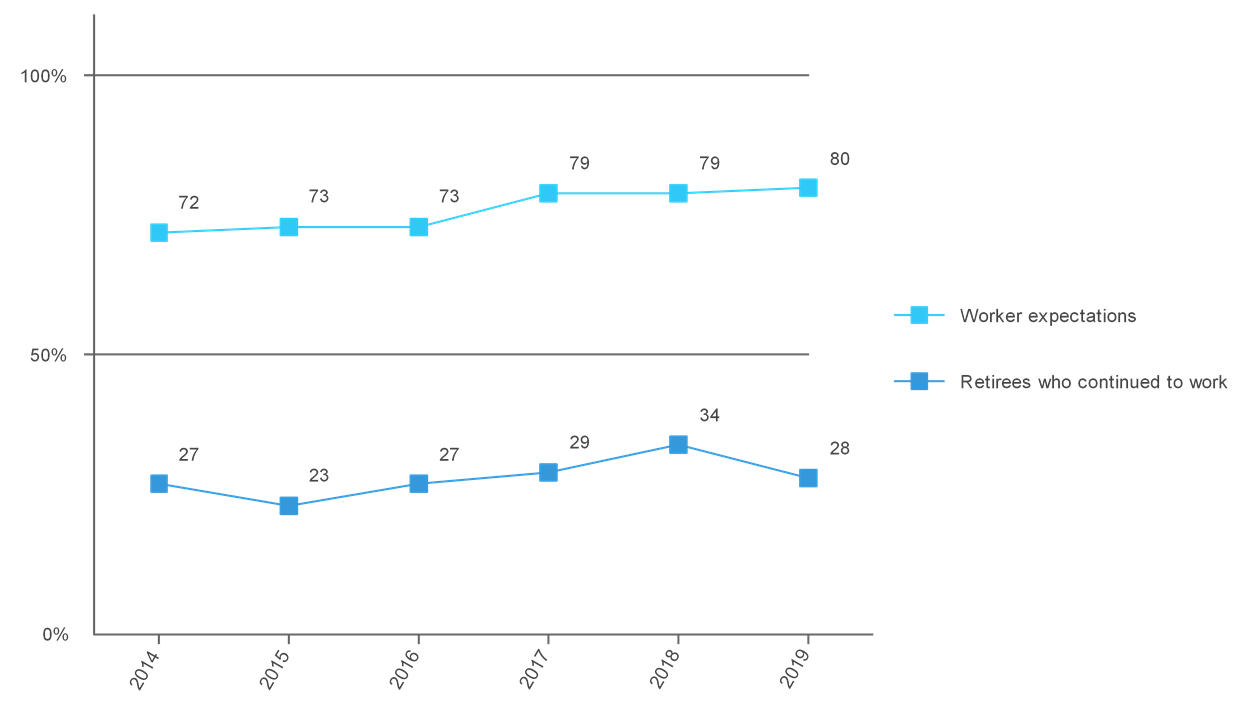

A high number of employees have expected to work past their retirement age. However, only few do so. (EBRI)

A high number of employees have expected to work past their retirement age. However, only few do so. (EBRI)Those who continued working in their retirement age say they need to stay active. However, there are those who continued working because of the same reason for active workers who retired later than planned. According to them, they need to work additional years because they are not confident about their retirement savings.

Working past retirement

Financial security is a big factor when one decides to opt for retirement. However, most employees differ on where to get this post-retirement income. According to the survey conducted by EBRI, employees think that continued working can build a decent nest egg. However, few of them work past retirement. Instead, both active workers and retirees expect income from Social Security.

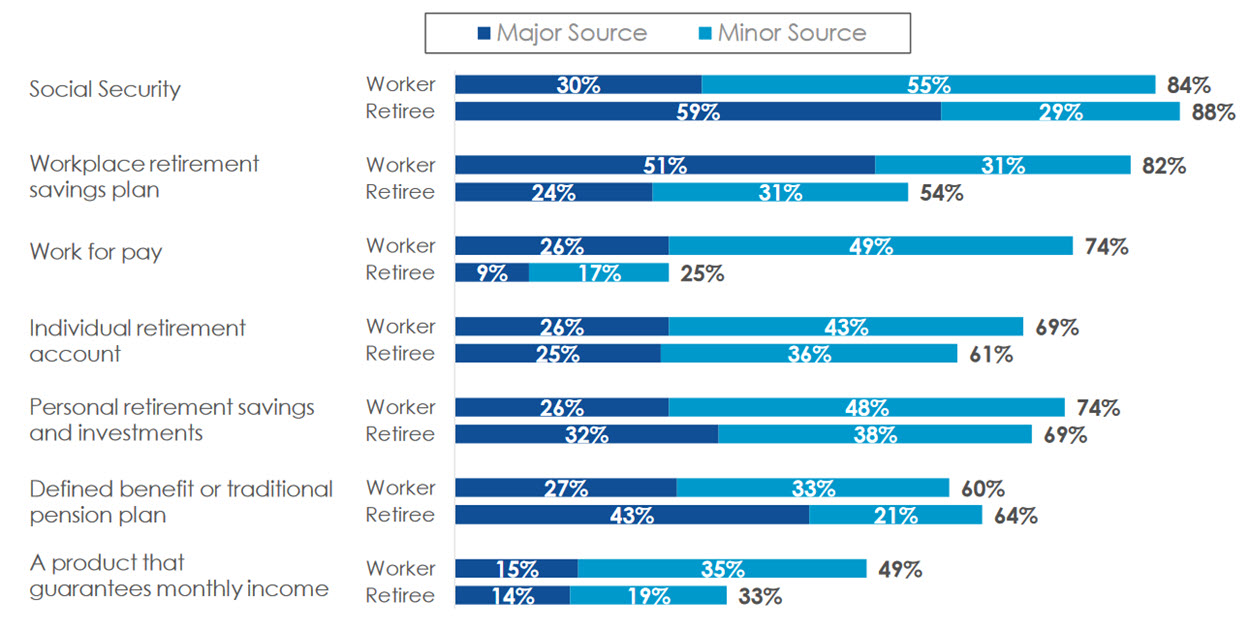

Worker and retiree expectations on post-retirement income

While most workers expect a retirement savings plan to be a major source of post-retirement income, most of them rely on Social Security when they stop work. (EBRI)

While most workers expect a retirement savings plan to be a major source of post-retirement income, most of them rely on Social Security when they stop work. (EBRI)This gap in understanding is risky. The type of thinking diminishes post-retirement financial capacity, according to Craig Copeland, EBRI senior research associate. “Three-quarters of workers believe work for pay will be a source of income in retirement and only a quarter of retirees actually receive income from work,” said Copeland.

“It is risky for workers to assume they will be able to work into retirement when, for so many retirees, this has not been the case. I understand there's a strong desire for income stability, but for many, continuing to receive a regular paycheck from work may not be the solution.”

Craig Copeland, EBRI

The best time to prepare for retirement

What's the best age to prepare for retirement? With different factors like income, inflation, and others, this question has shifted to, “What's my retirement plan look like?”

Why people neglect planning

In reality, there are obstacles to starting a retirement plan early. In a study by the TransAmerica Center for Retirement Studies, at least a quarter of young workers are expecting to support the family post-retirement. Those in their 20's are saying that they will need to support aging parents, and the expectations decrease as people age.

Expectations on financial supporting post-retirement

| All ages | 20's | 30's | 40's | 50's | 60's + | |

|---|---|---|---|---|---|---|

| Do you expect to provide financial support to someone even when you retire? | 25% | 40% | 34% | 21% | 16% | 14% |

| Yes – to aging parents | 15% | 28% | 22% | 13% | 5% | 3% |

| Yes – to other family members excluding spouse/partner |

14% | 19% | 15% | 13% | 12% | 12% |

| No | 55% | 37% | 41% | 58% | 68% | 74% |

| Not sure | 20% | 23% | 25% | 21% | 16% | 12% |

The expectations to provide someone financial support post-retirement drops dramatically with age. (TransAmerica Center for Retirement Studies)

Combined with other factors like starting a family, paying off debt, and other financial obligations, preparing for retirement doesn't become a higher priority until the late 30's or early 40's.

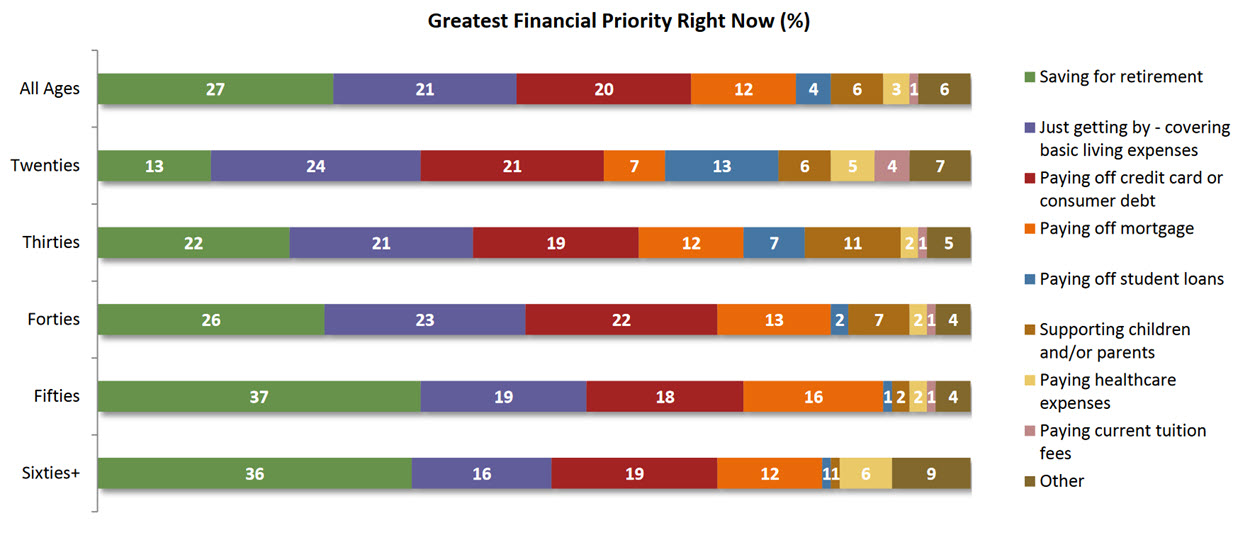

Expected financial obligations across age groups

The concept of an early start in saving for retirement has yet to be common among age groups, particularly with those in their 20's. (TCRS)

The concept of an early start in saving for retirement has yet to be common among age groups, particularly with those in their 20's. (TCRS)Prepare early for retirement

Financial experts recommend starting retirement savings early. Some retirees live comfortably because they've started building their retirement plans well before their 40's.

Having a decent nest egg is important. In the information handout by the Department of Labor, it is mentioned that retirement is expensive. A comfortable post-working fund requires at least 70 to 90 percent of pre-retirement income for comfortable living. Meanwhile, the agency also recommends starting early.

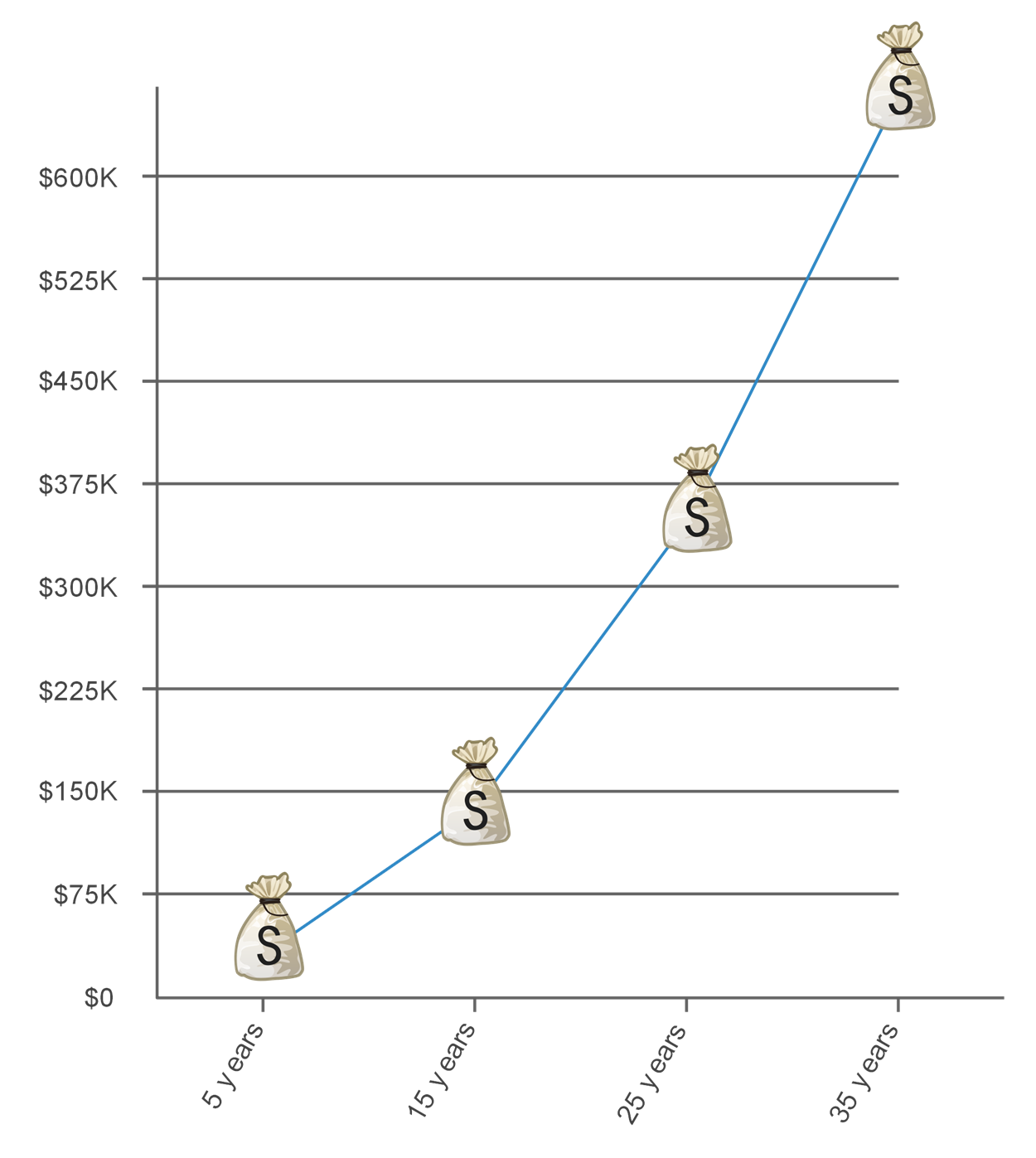

Why an early start is the best option in retirement planning

A chart of why an early start is the best option in retirement planning. For example, on a 7% annual interest, saving $5,500 each year will grow savings to $760,303 after 35 years. (Department of Labor)

A chart of why an early start is the best option in retirement planning. For example, on a 7% annual interest, saving $5,500 each year will grow savings to $760,303 after 35 years. (Department of Labor)With the right information and proper planning, building a decent nest egg to live comfortably in retirement is definitely possible.

Common retirement plans

Aside from the mandatory Social Security program, there are also different retirement plans that employees can participate in so they can build their post-work funds as early as possible. The most common ones include retirement savings plans such as a 401(k) or IRAs.

DCs versus DBs in retirement plans

401(k) and IRAs are also known as defined-contribution (DC) plans, where the employee is the primary participant for funding the program. Most often, employers match the contributions to a certain amount. One advantage of DCs is their flexibility in funding and vesting, or the time when the funds will become available. With a DC program, the employee can opt for the contributions to be automatically deducted from their pre-tax salary. Meanwhile, they can also opt to roll-over their contributions to a new plan in another company, or enroll the funds in an IRA, when they leave their current organization.

Defined-benefit programs are mostly pension plans set up by the company for their employees. Retirement benefits are based on a number of company-related factors like number of years in the company, salary, performance metrics, and other details. As the primary participant, the employer funds the plan through company-approved instruments. Since a DB plan is based on an employee's tenure, workers need to be with the company for a long time before taking advantage of the plan.

This inflexibility, as well as added advantages of DC plans, have made DBs almost obsolete.

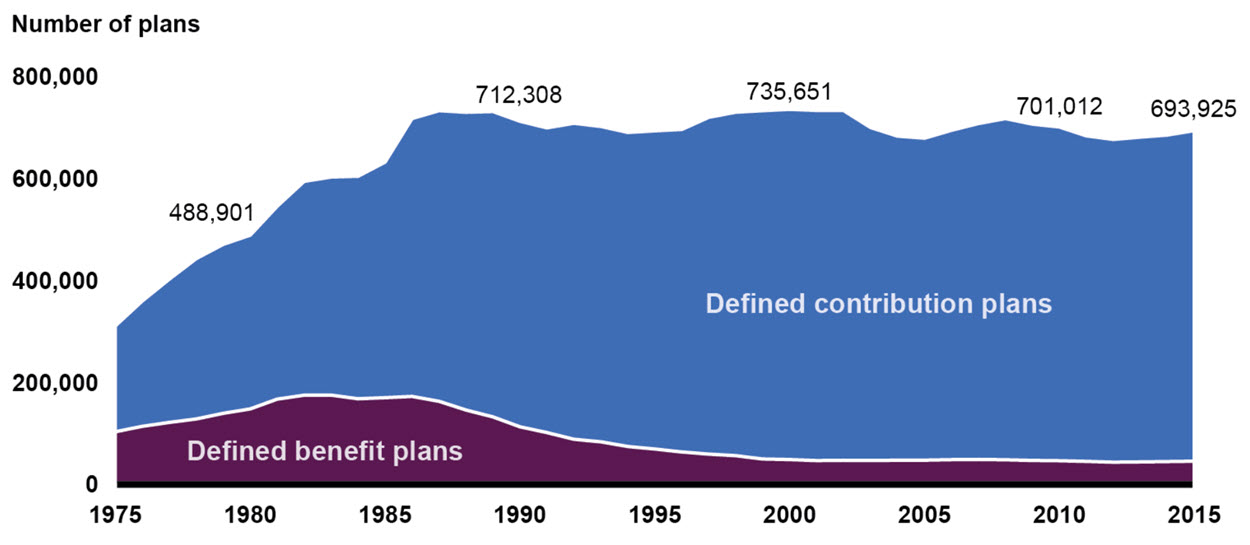

Defined contribution plans versus defined benefit plans over the years

While there are still DC plans being offered, defined contribution plans have been the more regular retirement plan to be offered to workers. (US Government Accountability Office)

While there are still DC plans being offered, defined contribution plans have been the more regular retirement plan to be offered to workers. (US Government Accountability Office)Why are DCs more commonly known than defined benefit plans? Aside from flexibility in contributing and vesting, defined contribution programs also offer other important advantages to the participant.

- Higher income potential. As the primary participant, the employee can choose the instruments where the funds will be invested. With the right call, the rewards are greater than the returns from a DB, especially if the employee is with the company for only a short time.

- Transferability of funds. A DC plan is flexible enough that most plans have roll-over options. This means that you can transfer funds when you change employers. The funds can also be rolled over into other plans, like transferring a 401(k) to an IRA.

- Worker decision. This is the biggest advantage of DC plans. As the primary participant, the employee retains control over the program. Decisions like how much contribution to make and where to invest the funds are with the participant. If you have an eye for high-yield investments, having a DC program will be a good preparation for having decent retirement funds.

401(k)

One of the most common retirement savings instrument is a 401(k). Mostly, people prefer this program since their employers often offer matching contributions, essentially doubling the funds. Since the program is a defined contribution plan, the flexibility it offers as an employee benefit is also an advantage. Most employees can roll-over their 401(k) when they change employers, and they can also transfer the funds into other investment vehicles.

There are at least two types of 401(k) plans. In a traditional setup, the participant contributes pretax income into the plan, with matching contributions from the employer. The funds and investment gains are tax deferred until they are withdrawn. Meanwhile, a Roth 401(k) gets its funds from after-tax dollars. This means that gains and returns from the plan are non-taxable income, especially if the account remains active for at least five years.

401(k) plans are also known as a retirement program with high contribution limits. In 2019, 401(k) contributions maxes out at $19,000. However, those aged 50 and above get a catch-up contribution, pushing the maximum to $25,000.

401(k) plans are mostly offered by for-profit companies. Non-profit organization have similar type of programs, like 403(b) for nonprofit and educators, and 457(b) for government workers.

IRAs

The biggest advantage of individual retirement accounts (IRAs) is their flexibility when it comes to investments. Since full control of the plan is with the participant (the employee), funds can be divested to different instruments like stocks, bonds, mutual funds, and others. IRAs can still be maintained when the employee has a maxed-out 401(k). In addition, taxpayers with IRAs in place of 401(k) can use their contributions as deductions in income tax returns. These advantages allow the plan holder to maximize the retirement savings.

Much like 401(k), there is also a Roth IRA as an alternative to the traditional setup. Again, this plan is funded with after-tax contributions, so savings remain tax-free. Meanwhile, an added advantage for Roth IRA is a no-penalty term for early distribution, provided that the plan is set up for at least five years since the first contribution.

Maximum contributions for IRA amount to $6,000 in 2019, with a catch-up contribution of $1,000 for those aged 50 and above.

Special 401(k) and IRAs

Most of the DC plans are for workers of medium to big enterprises. However, even as a part of a small company or as self-employed individual, you can still start setting up a retirement plan. There are specialized programs that are made to build decent retirement funds depending on the type of work.

Sole proprietors can set up a Solo 401(k) plan. In this program, the individual is both the employer and the employee, and can contribute up to $19,000, or $25,000 for aged 50 and above. This plan can also be done by self-employed individuals.

Another program used by the self-employed or a micro business owner is the SEP IRA, a simplified employee pension plan. As the employer, the individual can match up to 25% of the income or up to $56,000 (2019). If the micro business owner has employees, the plan should also be offered to those who meet the requirements.

Businesses with fewer than 100 employees can avail of a SIMPLE IRA plan, matching contributions for up to $13,000 in 2019. Catch-up contributions for 50 years old and above add $3,000 more to the max amount.

Health savings accounts

Although opening an account is not uncommon, an HSA is not something that most people associate with retirement savings. However, from a tax-benefit POV, a health savings account can be a great help when combined with a retirement plan. HAS contributions and gains are not taxed. The funds from the account can also be withdrawn tax-free when tagged as medical expenses. As an employer-sponsored program, matching contributions to an HSA means the funds grow in as little time as possible.

How will an HSA contribute to maximizing your retirement funds? Having a separate health savings account means that you won't need to take a hardship loan or early distribution from retirement plans for medical emergencies. Healthcare issues are the more common expenses for retirees.

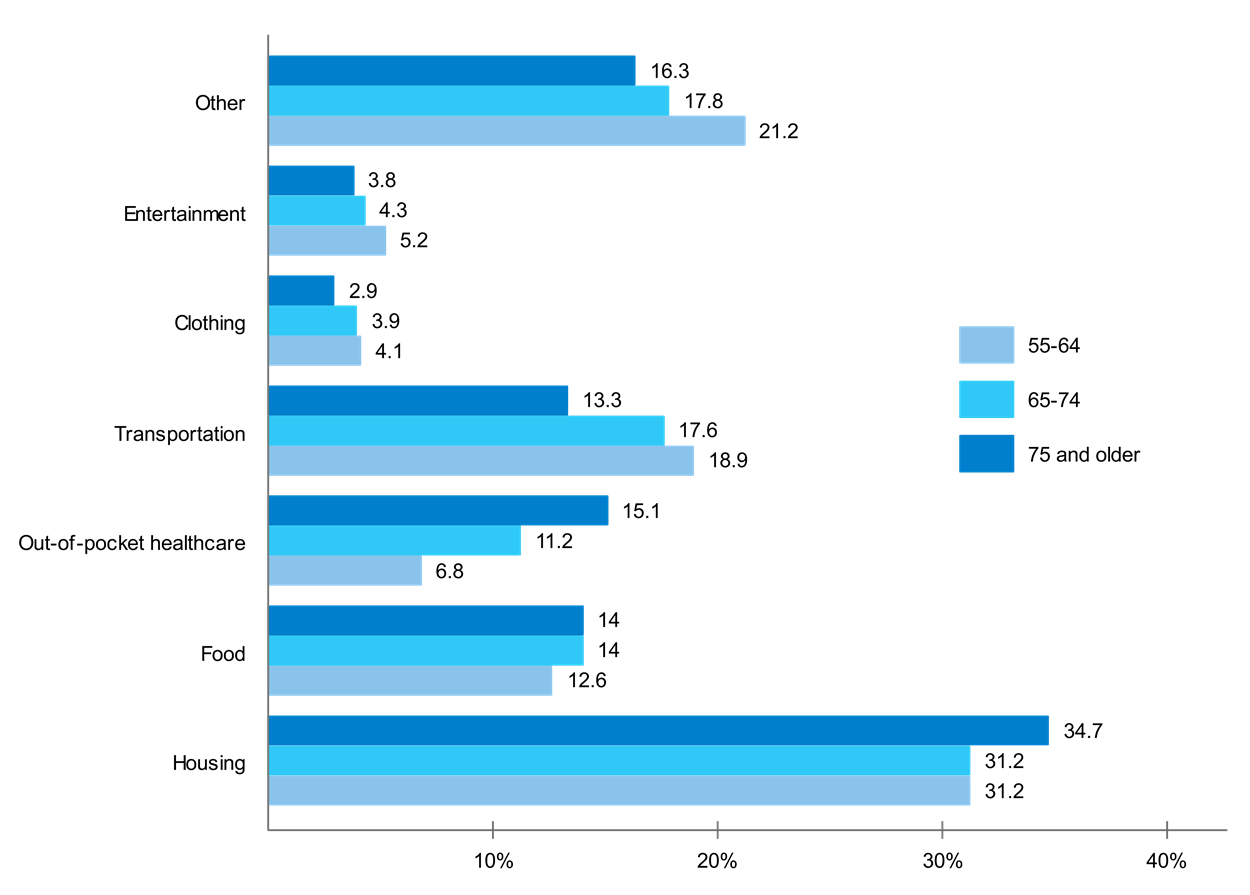

Percentage allocated to expenditure, by age groups

Housing, food, and out-of-pocket healthcare are the most common obligations that get expensive as people age. (Social Security Administration)

Housing, food, and out-of-pocket healthcare are the most common obligations that get expensive as people age. (Social Security Administration)Contribution rules

Experts recommend an early start to be the best option when planning for retirement. However, different plans still have their own set of regulations when it comes to contributions and withdrawals. Most are already familiar with contribution limits for some known retirement plans. For example, (401)k and IRA max contributions get regular adjustments. The max contributions are also higher for those aged 50 and above.

Max contributions for common retirement plans

| 401(k) and others (403, 457) | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|

| Annual deferral limit | $18,000 | $18,000 ($24,000 for aged 50 and above) | $18,500 | $19,000 |

| Catch-up contribution limit | $6,000 | $6,000 | $6,000 | $6,000 |

| Overall contribution limit | $53,000 | $54,000 | $55,000 | $56,000 |

Annual deferral limit for these plans can also equal 100% of salary, whichever is less.

Meanwhile, 403 plans use the current value of benefits as alternative for max contributions and the number of years in service for catch-up.

| IRAs | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|

| Annual contribution limit | $5,500 ($6,500 aged 50 and above) |

$5,500 ($6,500 for aged 50 and above) |

$5,500 ($6,500 for aged 50 and above) |

$6,000 ($7,000 for aged 50 and above) |

| Catch-up contribution limit | $1,000 | $1,000 | $1,000 | $1,000 |

| SEP Plans | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|

| Overall contribution limit | $53,000 | $54,000 | $55,000 | $56,000 |

SEP plan contributions can also equal 25% of salary or compensation, whichever is less.

| SIMPLE Plans | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|

| Annual contribution limit | $12,500 | $12,500 ($15,500 for aged 50 and above) |

$12,500 ($15,500 for aged 50 and above) |

$13,000 ($16,000 for aged 50 and above) |

| Catch-up contribution limit | $3,000 | $3,000 | $3,000 | $3,000 |

The annual contribution limit can also equal 100% of account holder's salary, whichever is less.

Excess deferrals

Maxed out plans can still go over the limit. These contributions are excess deferrals. The employer or plan administrator should be aware if contributions are already above the limit, and plan holders should request withdrawal. Excess deferrals should be withdrawn before April 15 of the following year to be filed as non-taxable income. If withdrawn after the date, it can be double-taxed and may even be listed as an early withdrawal. This means there will be penalties.

Early withdrawals

Withdrawals from retirement plans are called distributions. Whichever plans you are saving into, early distributions are usually those that are made before the plan holder is 65 years of age. This is the normal retirement age for most. However, some plans may have an earlier retirement age. For example, IRAs consider any distributions to be early withdrawals if made by 59½. The early distribution age should be clarified with the plan administrator.

Normally, early distributions are taxed with an additional 10% of the withdrawal amount. However, the IRS grants exceptions to this early distribution rule.

Required minimum distributions (RMDs)

The government also doesn't allow retirement funds to sit indefinitely. To commit plan holders into withdrawing regularly, required minimum distributions or RMDs have been set. These are the amounts required to be withdrawn from the account annually. The IRS has set some terms on RMDs once the account holder reaches 70½. Upon reaching the age, the first RMD should be withdrawn until April 1 of the subsequent year after turning 70½. All follow-up RMDs are then withdrawn by December 31 of every year. Every year, the RMD changes, and the IRS has set up a sample worksheet to determine the current year's required minimum distributions.

Failure to withdraw RMDs, or less than the required amount, will incur a 50% excise tax on the RMD balance. Generally, both DBs and defined-contribution plans have the same RMD rules.

Maximize retirement plans

Generally, retirement plans are the main source for post-retirement income. However, most have started late and have yet to realize their target incomes before they retire. Aside from starting early, how can you maximize your retirement plans and increase savings to get your post-retirement income goal?

Avoid penalties.

The most common misconception for people is they can withdraw from their retirement funds once they reach 60. However, some plans have rules on the “right” retirement age. This means there are early withdrawal penalties that become added expenses and gets a portion of the account which could've been additional savings.

Maximize employer match.

For employer-matching plans, talk to the management or the plan administrator. Discuss what the maximum contribution they can match. Maximizing contributions will let you save up for retirement faster. It will build a decent egg nest much earlier than expected.

Be familiar with the fine print.

For example, most 401(k) plans send a disclosure statement annually. Make sure to familiarize yourself with the details of the account. Most statements include annual expense gross ratio, certain actions that incur penalties, and may also include fine print on fees and charges otherwise hidden.

Remember that vesting is important.

While roll-overs are available to some employer-sponsored plans, a vesting schedule is usually included in the option. Make sure to check that you are eligible in vesting before you decide to transfer work. This way, employer contributions can are also rolled over into a new plan.

Make direct roll-overs.

If possible, transfer all the accounts from a 401(k) into a new plan directly to avoid unnecessary expenses. For example, a check transfer will incur a 20% income tax withheld. If all the amounts, including the withheld 20%, are not funded in the new account within 60 days, it will be considered a distribution and may even incur additional fees like early withdrawal penalties.

Remember that RMDs are important.

Those nearing 70 should remember that required minimum distributions will apply soon. Failure to withdraw RMDs, or getting less than the required amount, will incur heavy penalties. Missing a required distribution is fined 50% of the RMD, plus the regular income tax that is applicable.

Retire comfortably

An early start is the best way to prepare for retirement. Making sure that a plan is optimized will have plan holders reach their target goals for post-retirement income as early as possible. With the right mindset, an above-average nest egg to finance your golden years is not impossible.

About the Author

Benjie has been a bookwork for decades. He believes that writing is a form of expression, and that connecting with readers means you’ve expressed yourself correctly. Writing mostly on tech and social media topics, he continues to win over readers across other areas, too – both to inform and engage. His works have appeared in news publications like Christian Today & on business sites like Freelancer.com.

When taking a break from writing, you’ll most likely come across Benjie in a quiet corner of a room browsing an eBook by Robert Kiyosaki or Napoleon Hill, or reading the latest from Tom Clancy or WEB Griffin. In his spare time he enjoys urban trekking & photography.